내가 좋아할 만한 콘텐츠

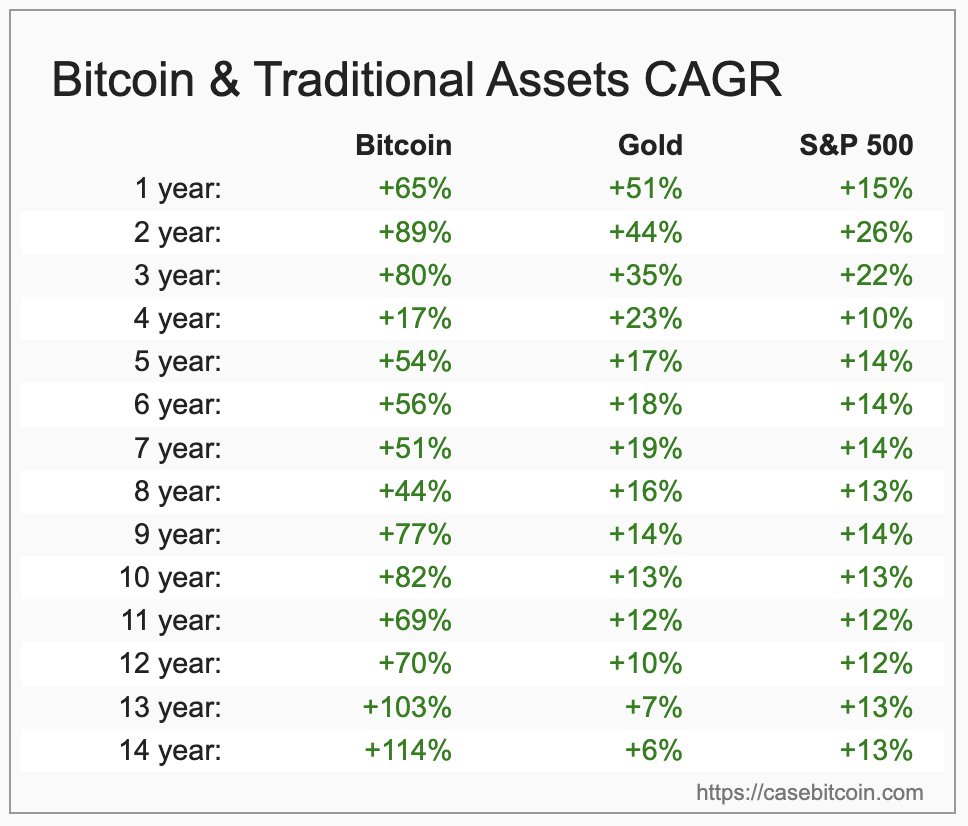

Look, the strategy is really simple. Keep DCA-ing into #Bitcoin. That's it. Seriously, you can stop reading here.

Do BTCTCs need an operating business that leverages their BTC stack? Long run, that is the end game. There are some possibilities for doing this today. Though it should be remembered that the whole point of not only deploying free cash, but levering up to buy bitcoin is the…

If you borrow to buy bitcoin, you pay 0% to 10% interest to buy an asset that has >50% CAGR over most recent timeframes. If you deploy bitcoin to earn 5% yield, the borrower needs to have a use case returning >50% + 5%.

Interesting how reflexivity became a direct part of the thesis of the third-largest US bank.

MSTR initiated BUY at Citi. $485 price target (64% upside) implies 25-35% mNAV premium, "in line with stock’s historical 2.5x-3.5x Bitcoin Yield multiple assuming continued positive momentum for Bitcoin." "We acknowledge the degree of circular reference. A higher MSTR relative…

There is no asset as excellent as Bitcoin. There is no company that holds as much Bitcoin as H100 in the Nordics.

ビットコインほど優れた資産は存在しません。日本でメタプラネットほどビットコインを保有している企業もありません。

The road to bitcoin adoption is a longer, more circuitous route for some than others. I think it's important to welcome people into the fold. In general, when someone comes over to your side after a contentious disagreement, gracefully take the win and reaffirm their decision.

Welcome to team orange, @GuyTalksFinance.

It’s never too late to admit you might be wrong on something. Sometimes once you see something you can’t unsee it — then there’s no going back.

Printer is coming.

QT is dead. QE is next. RRP is empty. Bank reserves <10% of GDP. SOFR > EFFR. 2019 repo playbook—only bigger. This ends with QE → YCC. Own what can’t be printed: Bitcoin and gold. Awesome newsletter from @jameslavish this morning.

H100 Update ($H100 $GS9 $HOGPF) Oct 18, 2025. Amid a continued challenging market environment, recent events highlight the resilience of intelligently structured corporate leverage. Whereas an estimated $5.36 billion in leveraged bitcoin positions and $19.5 billion in total…

After declaring 5x-10x mNAV the new norm for BTCTCs in June, many are now declaring 1x mNAV the new norm. In my view, this way of thinking about mNAV is fundamentally wrong-headed. Historically, mNAV is a volatile, cyclical phenomenon. Not a steady-state value adhering to norms.

One of the things that's difficult to appreciate about BTCTCs from the outside looking in is the amount of legal and compliance work that goes into executing operations. Currently dialing caffeination meter up to 11 and dialed in.

Perpetual futures and the instruments BTCTCs use are fundamentally different exposures to leverage. Margin trading with perps can send an account to zero in an instant on a sharp move in bitcoin. Longer duration, unsecured corporate debt gives time for the thesis to play out.

Positioning 101 is that the category leader takes the lion's share of the market. A BTCTC needs to operate in capital raising niche(s) it can credibly be the largest in. Regional leadership is likely the most important as BTCTCs have natural advantages in their home markets.

Times like these are why it's important for Bitcoin Treasury Companies to be run by bitcoiners. Just as some market conditions are more favorable to operate in than others, some market conditions are more challenging to operate in than others. This is true for any business. But…

Multi-month high trading volume of 2,538,123 for H100 on NGM today. Nearly 200% higher than the trailing 60 day average.

Sentiment may fluctuate, but it's ultimately a simple calculus for me. 1) Do I believe bitcoin will be an integral part of the future global financial system? 2) Will bitcoin CAGR continue to be higher than interest rates for the actionable future? Keep working. Keep building.

Did you know that Sander Andersen, @Sanderandersenn, the master mind behind @finpeers and @H100Group, was a professional swimmer in his youth? Learn more about Sanders' journey, from a swimmer to a health tech entrepreneur, and from Norway via the Baltics to Switzerland. Mr.…

H100 is transitioning to IFRS reporting. This is not just an accounting change, it's a key technical step in unlocking other parts of our roadmap.

H100 Group AB ($H100, $GS9, $HOGPF) initiates transition to IFRS reporting. IFRS is a globally recognized accounting framework. Compared with the Company’s current standard (K3), IFRS provides greater comparability across markets. The adoption of IFRS will strengthen H100’s…

This is one of the best advertisements for "bitcoin only" that you will ever see.

United States 트렌드

- 1. Russ 30K posts

- 2. Arsenal 335K posts

- 3. Lakers 40.6K posts

- 4. Martinelli 37.4K posts

- 5. White House 124K posts

- 6. NASA 73.4K posts

- 7. Crosby 9,149 posts

- 8. Sean Payton 2,619 posts

- 9. Warriors 57K posts

- 10. Atlas 61.8K posts

- 11. Platner 11.8K posts

- 12. Atletico 125K posts

- 13. Simeone 25.8K posts

- 14. John Brennan 31K posts

- 15. Woody Johnson 2,722 posts

- 16. #COYG 7,291 posts

- 17. Gyokeres 48.9K posts

- 18. $BYND 151K posts

- 19. Knicks 10.8K posts

- 20. Napoli 33.6K posts

Something went wrong.

Something went wrong.