Cesar Nuñez, MBA

@cesar_insights

Berkeley MBA. PE and VC Deal Advisor and Operating Company Partner. Sports enthusiast #Finance #VC #PE #IPO #latam #MergersandAcquisitions

You might like

Most AI projects hit pilot targets but miss financial impact at scale. CFOs: Stop chasing AI trends. Start solving real business problems. 7 frameworks to ensure your AI investments deliver measurable ROI: cfoconnect.eu/en/resources/f… #AI #CFO

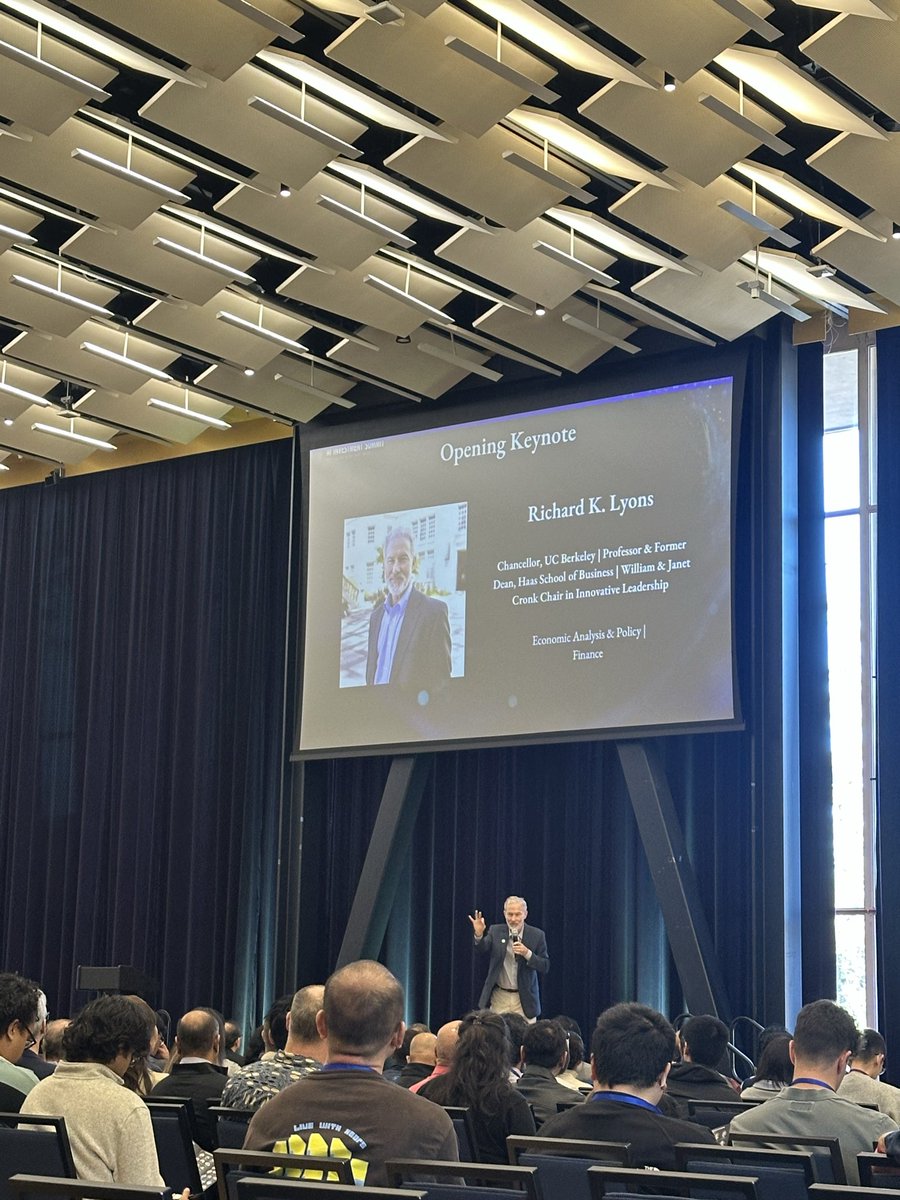

At the @UCBerkeley #AI investment summit. Incredible lineup for today! Thanks to the students and organizers for putting this together.

I have been accepted into the Milestone Circles program at the @Nasdaq Entrepreneurial Center! This is a 12-week program that provides entrepreneurs with access, resources, and knowledge to grow. The program remains free thanks to @WellsFargo Foundation thecenter.nasdaq.org/milestone-circ…

Meta’s $14.8B investment in Scale AI marks a new milestone in the #AI landscape. If we assume Scale AI makes $2B in revenue, that means they valued it at 15x, for context, most SaaS companies are valued between 5-10x revenue

In today’s Expert Contributor, Cesar Alejandro Nuñez explains how successfully exiting private equity and venture capital investments in Mexico requires strategic planning. Don't miss it. Out now! #MBN Article Link: mexicobusiness.news/finance/news/s… Audio Link: mexicobusiness.news/media/audioart…

🚀 PE & VC firms in Latam: How do they secure the best exits? From IPOs to strategic sales, knowing when and how to exit can make or break an investment. 💰 Which exit strategy do you think offers the best returns? Read more: mexicobusiness.news/finance/news/s… 📊 Poll:

The ServiceTitan #IPO marks the beginning of a new wave of Tech IPOs in 2025. Whether your company is in the planning stages of going public or down to the last phase of the S-1, it’s always a good idea to seek help from people that have done it before.

📈 As we approach year-end, M&A activity is heating up! More companies are seizing strategic opportunities before 2025. Is your organization considering an acquisition or partnership? Did you recently close? Let’s discuss how to position your M&A strategy for success. 📊 📩 DM…

📊 Divestitures and Carve-Outs on the Rise! 📊 Companies are increasingly divesting noncore businesses to fuel strategic growth and reinvestment. As businesses focus on agility and future-focused portfolios, divestitures and carve-outs are becoming a powerful way to unlock value.…

Someone recently said “it’s unfortunate startup boards are solely based on who cuts the bigger checks”. Then it’s no surprise you end up with people that went to the same school or work for similar #VC funds. I can’t stress enough the importance of INDEPENDENCE, diversity and…

Private equity’s growing buy-in to public accounting stirs concern. I get the recurring cash flow model of an accounting firm makes business sense to #PE but as this article highlights, it may negatively impact talent pipeline as non-equity partners don't have the same upside as…

Interest rate cuts could help jumpstart the #IPO market for VC-backed companies. It will also enable more M&A activity as cost of debt financing is lower for PE and Strategics. If your company is thinking of an exit, now is the time to assess readiness

I'm excited to share my latest article, where I explore five trends shaping the future of finance #AI #ESG #Cybersecurity #HumanCapital and #Agility Whether you're a seasoned #CFO or an aspiring #finance professional, these insights are essential mexicobusiness.news/ecommerce/news…

I'm honored to be featured by Mexico Business on the IPO landscape for Latin America, which has seen exponential development, prompting companies, VC and PE investors to consider a public listing. But the readiness aspect may pose challenges: mexicobusiness.news/ecommerce/news… #IPO #latam

mexicobusiness.news

Navigating the IPO Journey: Insights for Latam’s Investors

Unlike other exits, IPOs require significant time and preparation. Cesar Nunez outlines the lessons learned from past listings.

Calling investors and company execs in #SanDiego! Dive into the future of #Healthcare, #Pharma, and #LifeSciences with Goodwin RNA Advisors PwC Houlihan Lokey and industry leaders. Join us in-person this Wed, May 8 at 5:30 pm. RSVP by emailing [email protected]

According to Bain & Co Global #PrivateEquity report, there’s $3.2 trillion in unexited assets sitting in portfolios. Firms should reassess M&A vs IPO strategies, divestments for some assets and talk to the LPs about their plans. Gains on paper are not the same as gains realized

Sony Pictures teaming up with Apollo to bid for Paramount is a move that makes commercial sense, though the value of a studio lies beyond IP. It’s creative know-how, individual talent and adaptability to consumer trends in the #entertainment industry that makes it more compelling

I attended the State of Latino Entrepreneurship event at Stanford. The report highlights that Latino/a-owned businesses continue to scale, but work still needs to be done to provide more resources to the ecosystem. Thank you @LBANstrong for your research. gsb.stanford.edu/faculty-resear…

gsb.stanford.edu

2023 State of Latino Entrepreneurship

2023 State of Latino Entrepreneurship

Check out my latest article: 2023 Continuation Fund and Cross-Fund Market Insights linkedin.com/pulse/2023-con… via @LinkedIn

United States Trends

- 1. Luka 57.4K posts

- 2. Lakers 44.2K posts

- 3. Clippers 16.8K posts

- 4. #DWTS 93.3K posts

- 5. #LakeShow 3,377 posts

- 6. Robert 132K posts

- 7. Kris Dunn 2,354 posts

- 8. Reaves 10.2K posts

- 9. Kawhi 5,848 posts

- 10. Jaxson Hayes 2,211 posts

- 11. Ty Lue 1,476 posts

- 12. Alix 14.9K posts

- 13. Elaine 45.8K posts

- 14. Jordan 117K posts

- 15. Collar 40.8K posts

- 16. Zubac 2,247 posts

- 17. Dylan 34.6K posts

- 18. NORMANI 6,076 posts

- 19. Colorado State 2,352 posts

- 20. Godzilla 36.4K posts

Something went wrong.

Something went wrong.