You might like

Good article: Investor Jean-Philippe Bouchaud: ‘The whole bull run is because of an influx of money’ ft.com/content/6f5498… via @ft

Not morons Sven, all hibernating animales have relatively smaller brains as sustaining a larger mind during the long winter sleep would danger your energy store.

A new generation learning all about maturity mismatch

Bank boards are going to be scrambling to find people with risk management experience

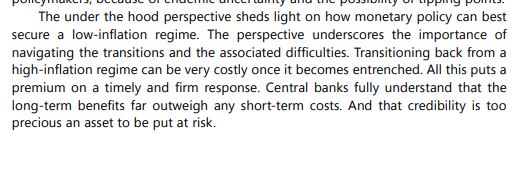

and these final lines from the BIS explain - rightly or wrongly - why central banks no longer care about your P&L are now willing to cause a recession

Isn’t it ironic that in the midst of the highest inflation of the last 40y the asset class that is performing the best is cash?

Dallas Fed's Kaplan: One factor in stock mania is the substantial amount of liquidity. "I still think we need to keep doing what we're doing in the pandemic, but as we move past it will be healthier to limit this liquidity and normalize monetary policy." cnb.cx/3tnnO3A

Janet Yellen’s ‘Starving’ Americans Look On As Global Stocks Hit All-Time Highs heisenbergreport.com/2020/08/26/jan…

This really is the Powder Keg Economy. Create a powder keg in tech stocks; solve it w a powder keg in real estate; solve that w a powder keg in corporate credit; when it blows during a pandemic, build another powder keg. BTW the Inequality Powder Keg is just beginning to blow up.

The Dollar Wrecking Ball: I hear the narratives that the Fed is printing money...Brrr... and that is going to cause a dollar collapse. I worry that this narrative is very wrong. My strongly held view is that the dollar is the pinnacle of all the macro issues we face. 1/

I'm still really struggling to get my head around predictions that the economy will bounce back quickly, given there are tens of millions, if not hundreds of millions of newly unemployed people all around the world.

Kommer en del sterke meninger her nå men altså hallo i luka... Nå er det på tide å ta innover seg hva som faktisk foregår i landet. Retail sales er ned til under finanskrise-nivåene. Det betyr at selskaper ikke får inntekter. Ingen inntekter = permitteringer og oppsigelser.

In the spirit of intellectual honesty, must confess that I was expecting $SPX to find support around 2.450-2,500 area. I was wrong. The selling has been relentless and the fact that the indices haven't even put together a two day rally suggests the economy is in big trouble!

We are either entering a new paradigm, or the speculative energy in the market is out of control. I think it is the latter. I have said before that we have entered the silly season, but I stand corrected. We are in the ludicrous season. gugg.gp/39y66zP

Leser mye rart om virus, markeder og økonomien nå om dagen, og det er på tide med noen få oppklaringer. Disclaimer: Som finansmann kan jeg ingen ting om virus, men jeg kan litt om kinesisk økonomi og politikk. Lang tråd følger. Om viktig tema. Les.

It appears to me that the Rules-Based Global Order system put in place mainly by the US after WW2 is being dismantled - WTO, G7, UN, Kyoto, IMF, World Bank, NAFTA. What system emerges is unclear as its early days, but this is the potential biggest geopolitical change in 60 years.

United States Trends

- 1. Renee 533 B posts

- 2. Minneapolis 1,69 Mn posts

- 3. Macklin Celebrini 2.952 posts

- 4. Trae 93,4 B posts

- 5. hudson 245 B posts

- 6. #TheFutureIsTeal 1.884 posts

- 7. jimmy fallon 41,7 B posts

- 8. Charlie Kirk 113 B posts

- 9. Hawks 47,9 B posts

- 10. The ICE 1,71 Mn posts

- 11. Wizards 49,9 B posts

- 12. Blazers 3.416 posts

- 13. Salt Lake City 9.962 posts

- 14. #AEWDynamite 29,1 B posts

- 15. FAFO 133 B posts

- 16. Noem 367 B posts

- 17. George Floyd 116 B posts

- 18. Sharks 9.218 posts

- 19. Tari Eason N/A

- 20. Philon 1.002 posts

Something went wrong.

Something went wrong.