Matt Morley

@morleysc

Skeptic by day. Optimist for life.

You might like

I think AI is awesome and in the 1st inning. That’s why I’m doing something that has nothing to do with it. It doesn’t matter if it can replace your expertise. For the next few years, it only matters if people THINK it can replace your expertise.

ChatGPT 5 really sucks so far. Feels like I lost 2 employees replaced with a dimwit. Ask questions and it comes back with: “so what can I help you with?” Doesn’t remember what we’re talking about (in the middle of a convo). Doesn’t live up to @sama’s assessment. Disappointed.

Favorite quote (so far) from the new season of King Of The Hill: “Investing isn’t like raising children. You can’t just make it up as you go.”

Bill Gross is to unrepentant value investors what Fox News is to rural retirees.

Investors wake up! The timing of the new Fed chair is less significant than the influence he will have on his committee. If he can sway the committee’s thinking over time, bond markets will increasingly go curve positive, the dollar will weaken, and inflation will likely move to…

Mae jalapeño infused simple syrup tonight. The possibilities are endless.

Well, I couldn’t not buy some UNH this morning. Again, I’m ok being wrong. There’s a lot of hair on it right now, and it could take forever to (or it might never) get back to the company it was. At current levels, I don’t think it has to do that to be owned.

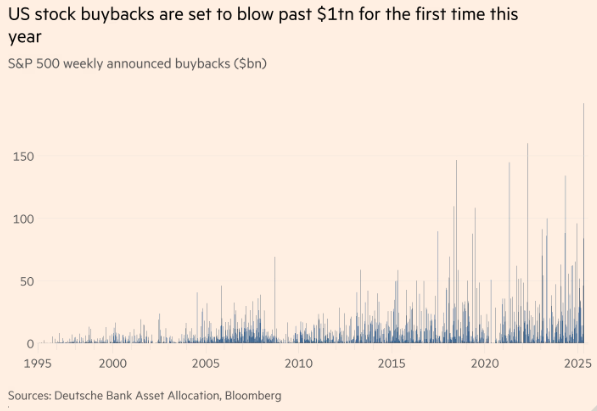

Perhaps this says as much about trepidation regarding other options for capital allocation, cost of debt<earnings yields, and EPS management headed into murky macro environment threatening declining demand and margin compression than mgmt views on current valuation.

“Companies listed on the blue-chip S&P 500 index said last week they expect to repurchase $192bn of their stock over the coming months, the highest weekly figure in data going back to 1995, according to @DeutscheBank . The tally of announced buybacks over the past three months…

I was told this would not happen anymore.

Assuming this is a genuine position, it is the best example of self-attribution bias a behavioral economist could hope for. Everyone is afflicted to some (usually lesser) degree. It’s one of those things: if you think you’re immune, you’ve probably got it worse.

I run a small textile manufacturing business. Literally small, not to be confused with what the "media" refers to as small... Our GROSS sales are around $1.5mil/year. However, we do import fabrics and supplies for our production line, which is a stressful cash flow negative…

We got there… barely. Over the last 2 weeks I’ve learned something about myself: I pretty much always feel that stocks are expensive. At the depths, I got FOMOOB (FOMO-on-bargains) looking for deep value. Glad I followed my own process and deployed some cash on the way down.

There’s something kinda funny about a credit ratings company getting leveraged to the hilt.

*ARES LEADS $5.5 BILLION PRIVATE DEBT FOR DUN & BRADSTREET LBO (BN) Ares coordinating one of the largest private credit deals EVER for D&B buyout 👀

Asking the right question has always been more important than having all of the answers. Feels more important now than ever, as AI has a (basically) free answer to (almost) any question, complete with citations.

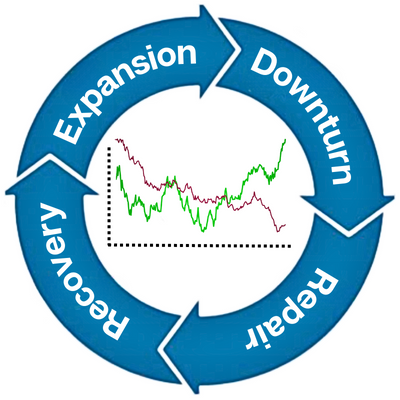

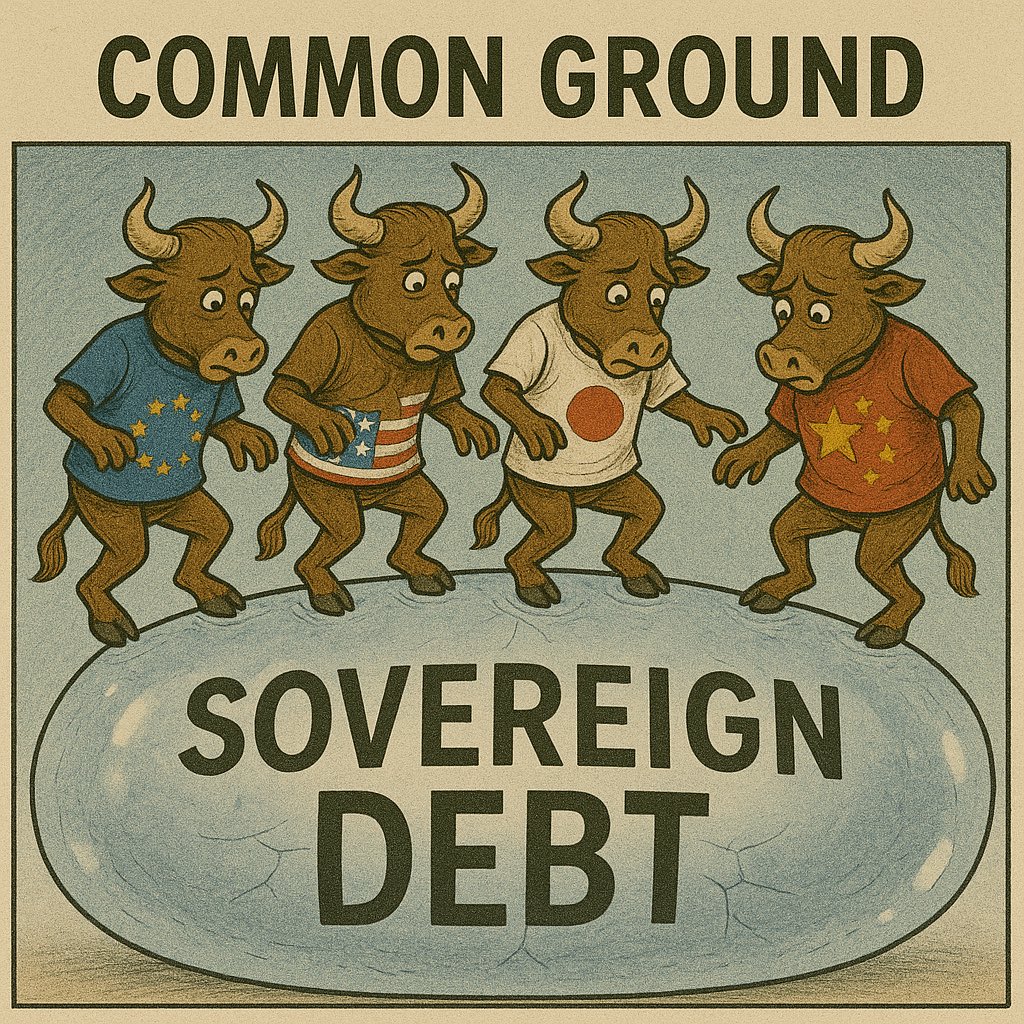

How many different ways are there to say this? We’ve lived in a world where “kick the can” has been a close cousin to “buy the dip.” Trump just opened the can and dropped in a Mento. Not the end of the world, but also not business as usual anymore.

United States Trends

- 1. Good Thursday N/A

- 2. #Crew11 N/A

- 3. #SpaceX N/A

- 4. Hobbs N/A

- 5. #NYGiants N/A

- 6. Dragon N/A

- 7. AI Summary N/A

- 8. NFC East N/A

- 9. Walt N/A

- 10. #Zetarium N/A

- 11. Hubert N/A

- 12. Nigerians N/A

- 13. Jalen Brunson N/A

- 14. Deadpool N/A

- 15. AFCON N/A

- 16. $ZET N/A

- 17. Stanford N/A

- 18. Ghanaian N/A

- 19. Chukwueze N/A

- 20. Mike Brown N/A

You might like

-

Greg Widmer

Greg Widmer

@greg_widmer -

Morning Brew Daily

Morning Brew Daily

@mbdailyshow -

Consuelo Mack

Consuelo Mack

@ConsueloMack -

Biggie Capital (fka Hem, fka LFG)

Biggie Capital (fka Hem, fka LFG)

@lfg_cap -

SouthernValue

SouthernValue

@SouthernValue95 -

Alex

Alex

@TickerSymbolYOU -

Ernest Wong

Ernest Wong

@ErnestWongBWM -

This Week in Intelligent Investing

This Week in Intelligent Investing

@twiii_podcast -

Mark R Camus

Mark R Camus

@MarkRCamus -

🥦 Jake Taylor 🎉

🥦 Jake Taylor 🎉

@farnamjake1 -

Pendleton Street Business Advisors

Pendleton Street Business Advisors

@PendletonStreet -

Matthew Peterson

Matthew Peterson

@MattPetersonCFA -

caleb silver

caleb silver

@calebsilver -

Keith D. Smith, CFA

Keith D. Smith, CFA

@Bonhoeffer_KDS -

𝗕𝗜𝗟𝗟 𝗦𝗪𝗘𝗘𝗧

𝗕𝗜𝗟𝗟 𝗦𝗪𝗘𝗘𝗧

@billsweet

Something went wrong.

Something went wrong.

![fitbook's profile picture. creators of fitbook + wellness planning lifestyle products to inspire goal getters to #livelifefit. 💪🏼📕🖊[as seen in forbes, shape, popsugar + more]](https://pbs.twimg.com/profile_images/1020284148123086848/RTJLEsoF.jpg)