Siyu Li

@siyul

private investor | ex-NYSE, Bridgewater, Bernstein. Write "Under The Hood" http://underhood.substack.com

You might like

Many "Under the Hood" portfolio winners were quality business sold at bargain price when the sector was max-hated. Some examples: 2022/23's GSI-B( $C $DB ) 2023's NYC REITs ( $VNO ) 2024's dollar stores ( $DLTR ) Early 2025's offshore drilling ( $VAL ) today I bring it to you…

Contrarian Investing is to grasp the market consensus, to have a variant view (why the market is wrong), and have data/reasoning to support it. In the latest work, I discussed why gov't-sponsored healthcare insurers are being hated, and why they deserve a look. I discussed…

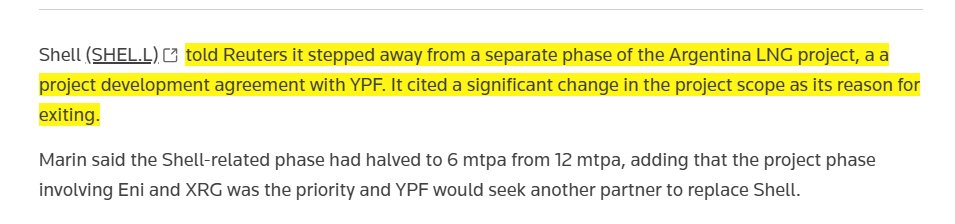

$GLNG Some intriguing development today. YPF's Vaca Muerta has massive natural gas reserves and has 2 large-scale projects. Golar/YPF is its LNG Phase I (6Mtpa, Hilli and MKII). Shell was YPF's LNG Phase II partner. Shell announced today that it will exit the project,…

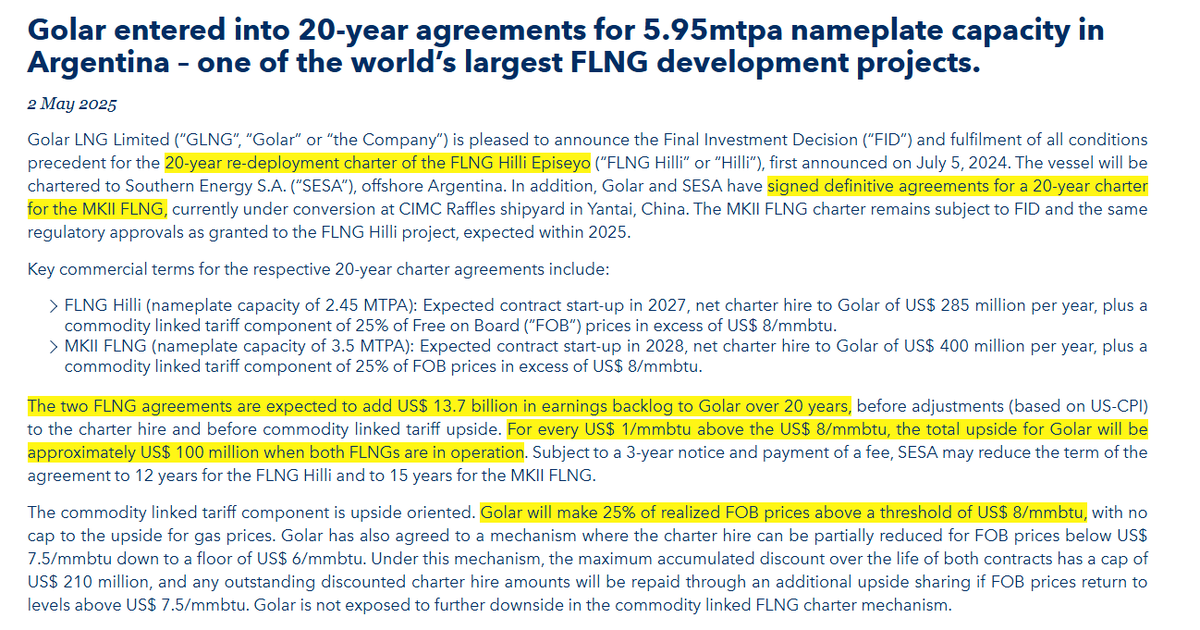

$GLNG ⚡️BAM - YPF's "🇦🇷LNG1" goes to Golar's Hilli and MKII, 6Mtpa total, it is official now. $685Mn combined annual net, 25% commodity upside if TTF>$8/mmbtu (each $1/mmbtu ~= $100Mn). At ~$10.5/mmbtu today, extra $250Mn/year. "Under the Hood" first discussed this re-rating…

Contrarian Investing is to grasp the market consensus, to have a variant view (why the market is wrong), and have data/reasoning to support it. In the latest work, I discussed why gov't-sponsored healthcare insurers are being hated, and why they deserve a look. I discussed…

Keith, if you apply the same intellectual rigor to $OPEN, would you still make "We (Opendoor) are making money every year" claim? I remind, as David Beckham famously suggested: "Be Honest."

1/ Cool growth chart. Have you disclosed to US customers like @Rippling, @Billcom, @TheZipHyouQ, @brexHQ, and @Navan that you’re quietly sending their customers’ data to China? Airwallex has become a Chinese backdoor into sensitive American data like from AI labs and defense…

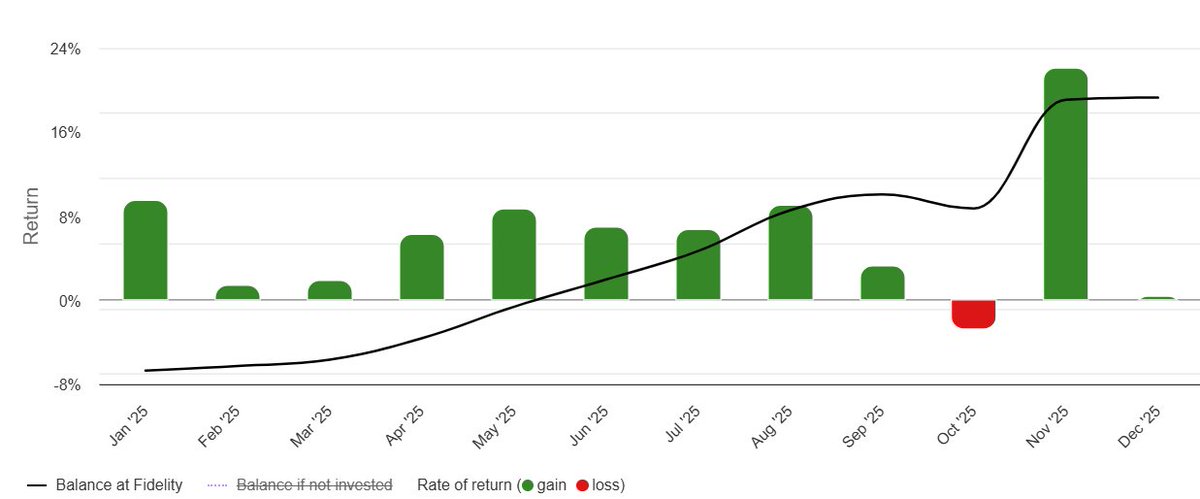

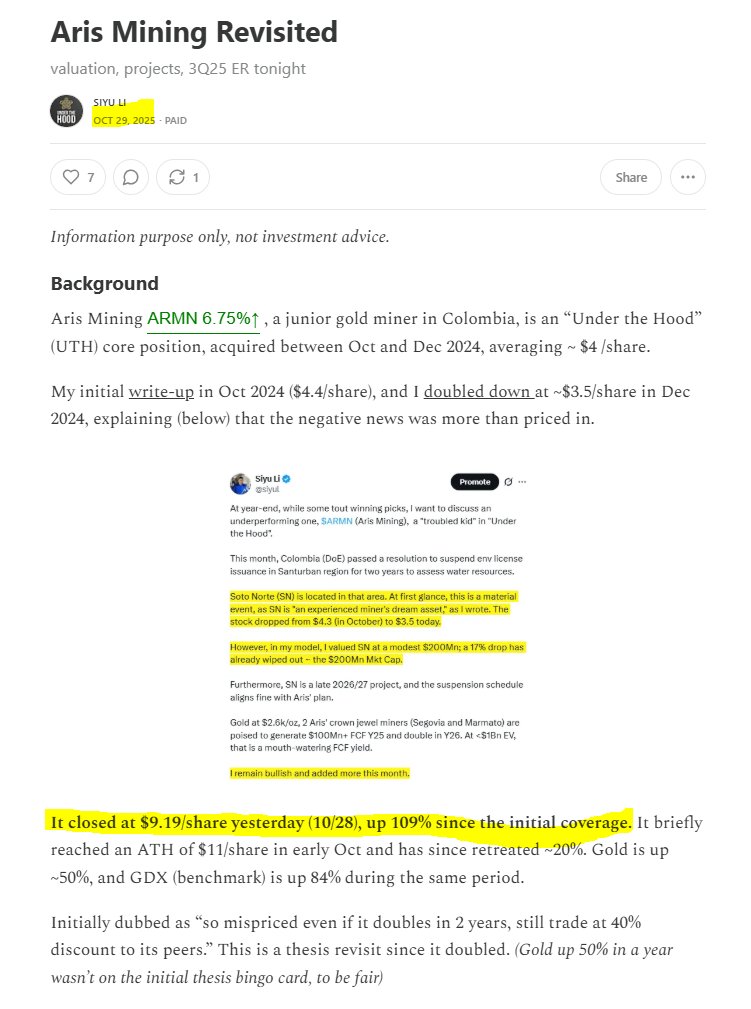

"Good business bought at low price" strategy continues to do well at "Under the Hood" (UTH), the core account finished a strong November, and now has 11 positive monthly returns out of 12. What contributed to Nov outsized return is mostly from gold/silver mining $ARMN $USAS, a…

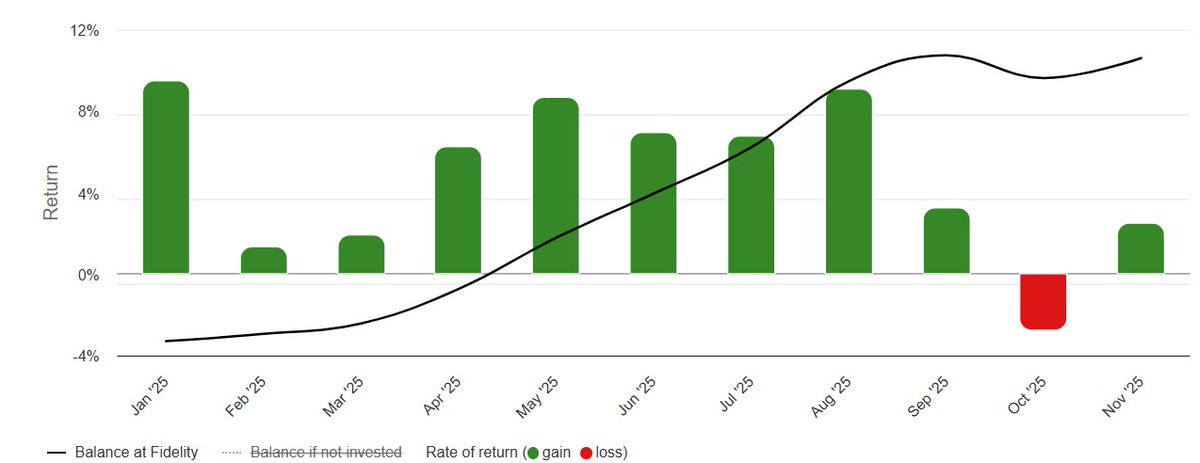

If you follow me at "Under the Hood" (link in bio), you prob won't be surprised that it has been an exceptional year so far. I'm particularly pleased that the core account has 10 positive monthly returns out of 11, mostly "good business bought at low price", without AI darlings…

The most precious thing I learnt at Bridgewater and from Ray was to examine myself critically, to know my own weaknesses, to learn humanity, and to take failure as a learning opportunity. Some of these experiences were painful, but they shaped me into a better man and a better…

In 1979, I was so broke that I had to borrow $4,000 from my Dad to help take care of my family. I had calculated that American banks had lent much more money to foreign countries than they would be able to pay back, and anticipated an imminent debt crisis. But I couldn’t have…

Who are old enough to remember the heated $RICK bull vs bear ring fights back then? My takeaway? The loudest, fiercest voice spoken with 100% confidence <> truth. Let me double down, it is often the opposite.

The CEO & CFO of $RICK resigned their roles, mere days after paying a senator’s son 50% more than his shares were worth (he was stuck in a 10% position). All while being charged with bribery and tax evasion. I, for one, am shocked! at this odd behavior by strip club operators.

Aris Mining $ARMN $ARIS.TO up another 50% since the Oct revisit, making it the 3rd 3x+ bagger (Other 2 are $DB $USAS) from UTH in the last 18 months. I'm excited about the next writeups: a key player in a decade-long growing sector, facing temporary uncertainty, trading at a…

I wrote $LODE in Oct at UTH. My readers discussed some concerns in the s/s Chat today; I find some worth highlighting. FYI. Self-dealing Concerns: "They advanced another $2.5M (totaling $5M now) interest-free for land rented from SSOF. The company has an interest in SSOF, but…

Among 50+ ideas from my best ideas for 'YTD underperformers' thread, I find $LODE the most intriguing. Over the last 3 weeks, I reviewed SEC filings, studied the industry setup, exchanged thoughts with several involved investors, and spoke with the CEO. I could easily write a…

In awe to think in Google, there is a better $NFLX (YouTube), an autonomous $UBER (Waymo), an open $AAPL (Android), a failed $META (ouch😂) Now, we discover a legit $NVDA competitor (TPU) Why should Google not be the most valuable co on Earth?

Variant Perception (VP) $meta in Y22 $100, VP was meta will defeat TikTok, Snap, and Zuck will manage cash burn. $goog in Apr25 $140, VP was Google has AI talents/stacks to defend its moat, just hesitate to use so as to defend its search profit. but it will change. Both…

I beg to differ. Both $AMZN $GOOG are great businesses. I just don't think P/E is an appropriate metric for comparison. For example, $AMZN can easily increase 50% of its 1P earnings by raising its price by 2%. My point is that assessing these giants is hard, and we should…

$GOOG is up +55.1% YTD and at 27.0x ‘25 P/E (consensus estimate). $AMZN is only +0.5% YTD yet is STILL trading at a premium, at 31.5x ‘26 P/E (cons), despite slower growth. If there’s ever been a year where people had to learn a hard growth/valuation lesson, it’s this year.

Truth "On Substack most writers are in the business of farming Buffett quotes and covering whatever tickers are trending to boost paid subs." I concur that resisting the temptation to sell 'sugar water' is hard when you run a paid service. 2 guidelines I follow: 1. I don't…

Just like in the investment industry, where many fund managers focus on philosophical quarterly letters and podcast appearances to sound smart and raise AUM, on Substack most writers are in the business of farming Buffett quotes and covering whatever tickers are trending to boost…

We Value Bros remember one thing: In a frothy market, when ridiculously overvalued meme stocks finally collapse, before we're ready to💃, remember our deeply valued picks often follow too 😂.

> He manages a fund with AUM > $18Bn > He leads $HHH, $5Bn Mkt Cap, branded as "the next-Berkshire". > Heck, he owns 40% Seaport $SEG, with premium NYC assets. > But he will go down in history as the "May I meet you" dating advice legend on X.

I hear from many young men that they find it difficult to meet young women in a public setting. In other words, the online culture has destroyed the ability to spontaneously meet strangers. As such, I thought I would share a few words that I used in my youth to meet someone that…

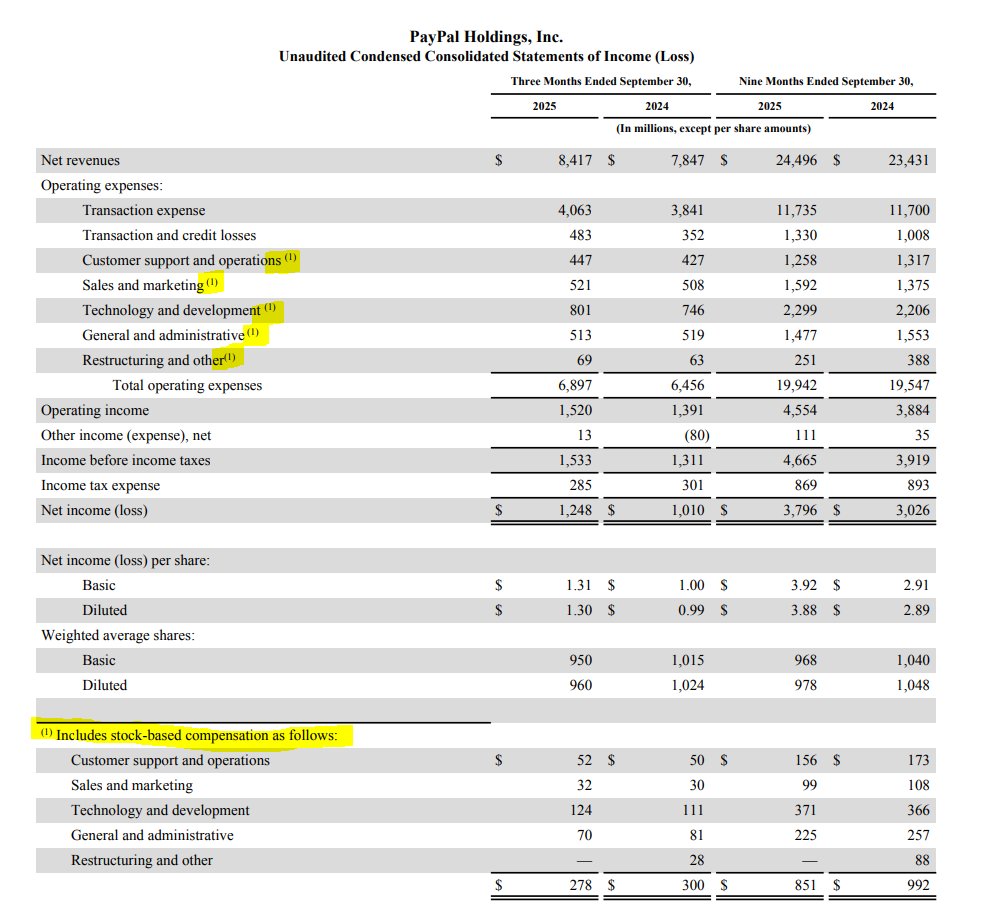

"Akamai reports EPS $1.86 instead of $0.97... pay employees $115 Million in stock... repurchase... with cash, and leave that expense out of adjusted EPS" But the worst part? The mgt, which got paid ~$100Mn, its single biggest 'achievement' is to bump ADJUSTED earnings by…

If you have a deep underwater position, and you can't help talking about it. Shoot your shots here, and I'm (we) listening!

I have respect for investors who continue to hold a deep-under-the-water position and discuss it openly & calmly. This one earns it with $SOC Not saying he is right or wrong; it is not about that. It is your process and mental agility to analyze info, adjust view, and make…

I have respect for investors who continue to hold a deep-under-the-water position and discuss it openly & calmly. This one earns it with $SOC Not saying he is right or wrong; it is not about that. It is your process and mental agility to analyze info, adjust view, and make…

$SOC $CRC The most unoriginal take today is to hate on Sable with maybe only oil broadly being hated more. It is our belief that the federal government has an incentive to extract these barrels and by extension their revenues, revenues that we are in no position to be turning…

United States Trends

- 1. #WWENXT 8,788 posts

- 2. Cooper Flagg 4,090 posts

- 3. #LGRW 2,169 posts

- 4. Bruins 4,554 posts

- 5. Maxey 2,532 posts

- 6. Larkin 1,697 posts

- 7. Embiid 2,826 posts

- 8. Markstrom N/A

- 9. Christmas Eve 146K posts

- 10. Rosetta Stone N/A

- 11. Southern Miss 1,652 posts

- 12. Fight Club 2,595 posts

- 13. Dunesday 1,851 posts

- 14. Insurrection Act 13.7K posts

- 15. Nets 6,395 posts

- 16. Jordy Nelson N/A

- 17. Western Kentucky 1,152 posts

- 18. Red Wings 2,047 posts

- 19. UNLV 1,565 posts

- 20. Trae Young 1,206 posts

You might like

-

Fred Liu

Fred Liu

@HaydenCapital -

LC Investing

LC Investing

@LCinvesting -

Implied Expectations

Implied Expectations

@LongHillRoadCap -

Irnest Kaplan

Irnest Kaplan

@IrnestKaplan -

SouthernValue

SouthernValue

@SouthernValue95 -

MJH📈📉

MJH📈📉

@hedgie007 -

Leviathan Capital

Leviathan Capital

@LeviathanCapit1 -

Westpine Capital

Westpine Capital

@buckbid -

Drowsy Investor (Shooting the Bull Pod)

Drowsy Investor (Shooting the Bull Pod)

@drowsyinvestor -

Andrew Rosenblum

Andrew Rosenblum

@Anrosenblum -

Ethan Tucker

Ethan Tucker

@TheGarpInvestor -

FLinvestor

FLinvestor

@FLinvestor_ -

John Rotonti Jr

John Rotonti Jr

@JRogrow -

Brett

Brett

@CCM_Brett -

Cundill Capital

Cundill Capital

@CundillCapital

Something went wrong.

Something went wrong.