Valentin Teruggi

@valeteru

Economist | MBA | Business Cycles Expert | Investing is Simple But Not Easy | Podcast en ESPAÑOL https://macrosinfiltro.substack.com/

You might like

The Roaring '20s were also based on the American dream of cheap credit and leverage. Every recession is preceded by an expansion in credit. Recessions are also part of the cycle. If you want to avoid a recession, then do not expand credit beyond the productivity rate.

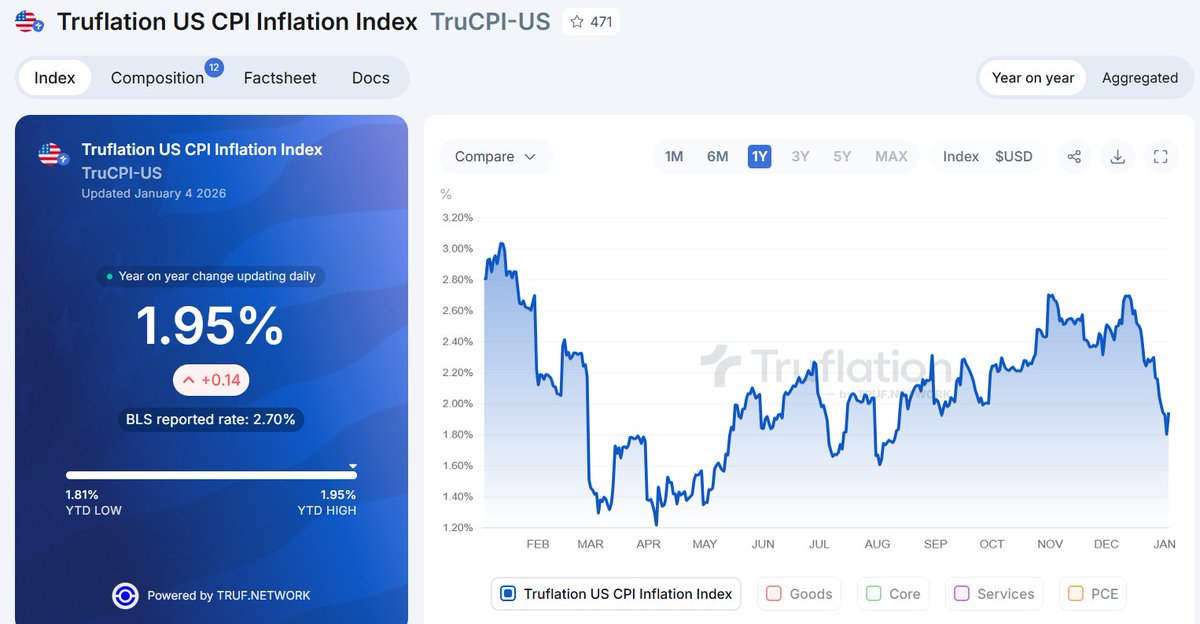

Is anyone who bought the stagflation narrative still alive? Deflation will it be!

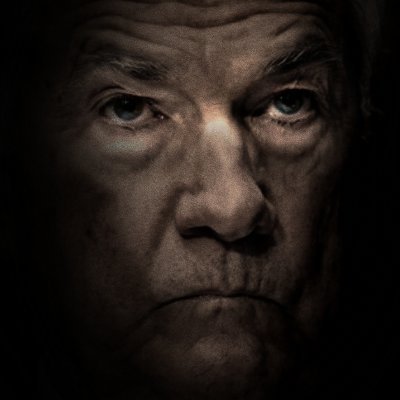

Truflation US inflation today 1.73% Today, US inflation dropped from 1.87% to 1.73% on the prices of housing, specifically rented dwellings. New leases are flat to down, concessions are rising, and vacancies are higher. Pricing power has shifted to renters. We see quite a lot…

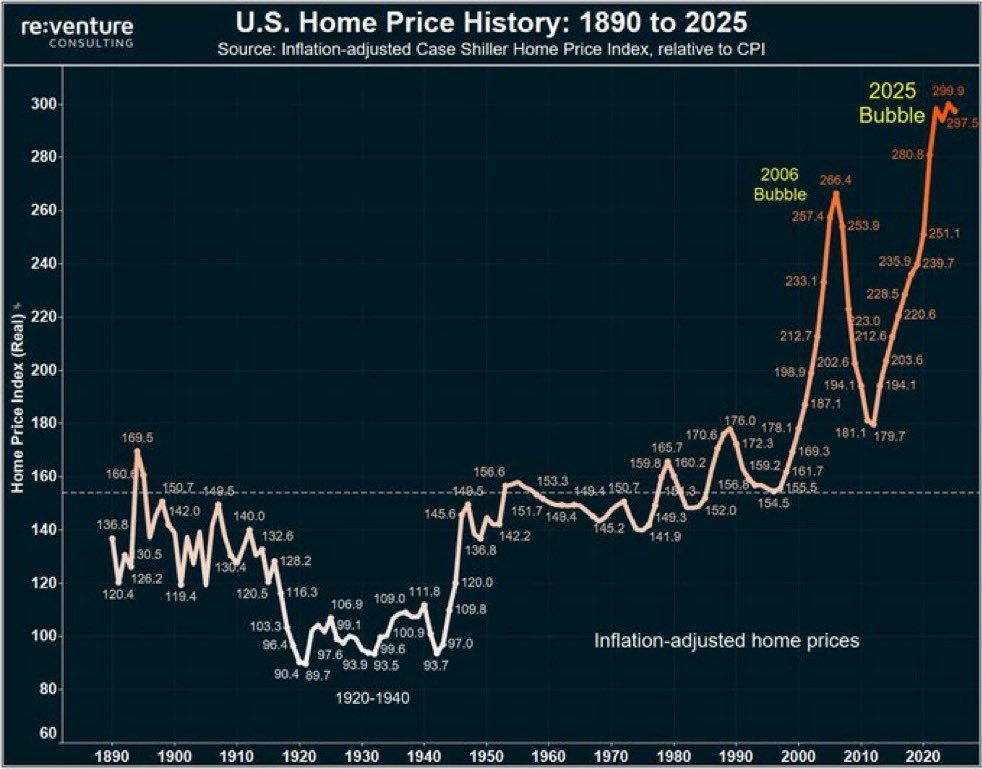

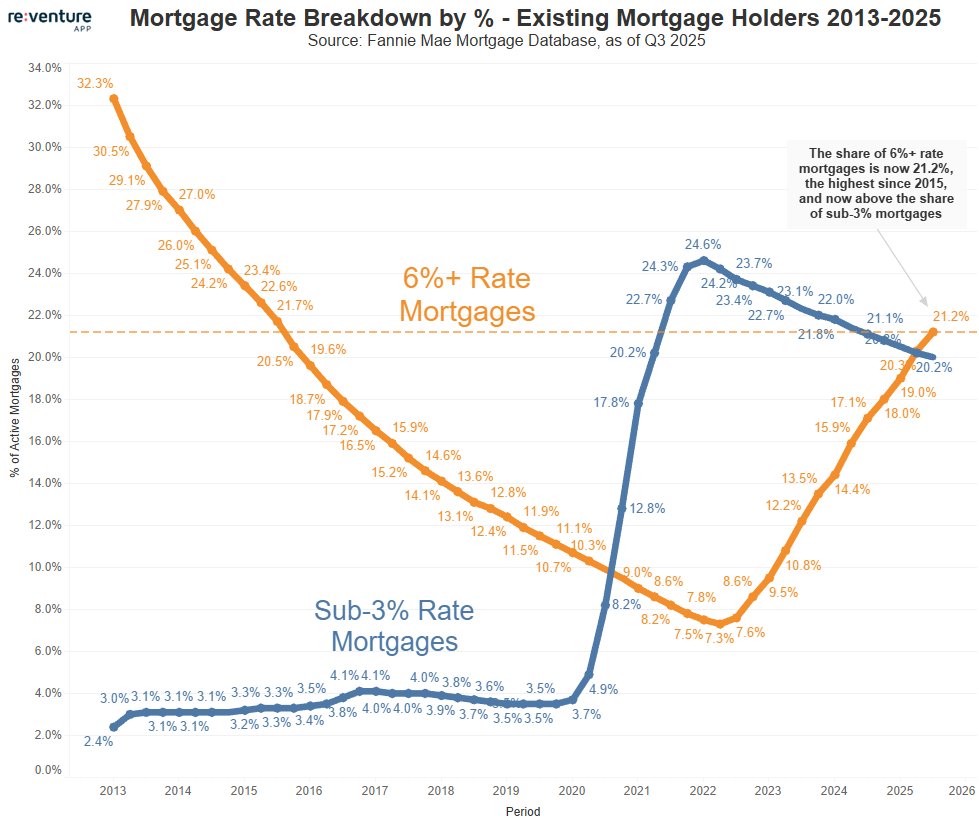

THIS IS GOING TO END SO BADLY. I said this before. Out of the three bubbles (stocks, housing, crypto), the housing one is the most dangerous, as its impact is the highest in terms of household wealth. This can easily produce a deflationary spiral that will end in bankruptcies.

The Equity Risk Premium - Why today’s S&P 500 valuation implies much lower returns ahead open.substack.com/pub/valentinte…

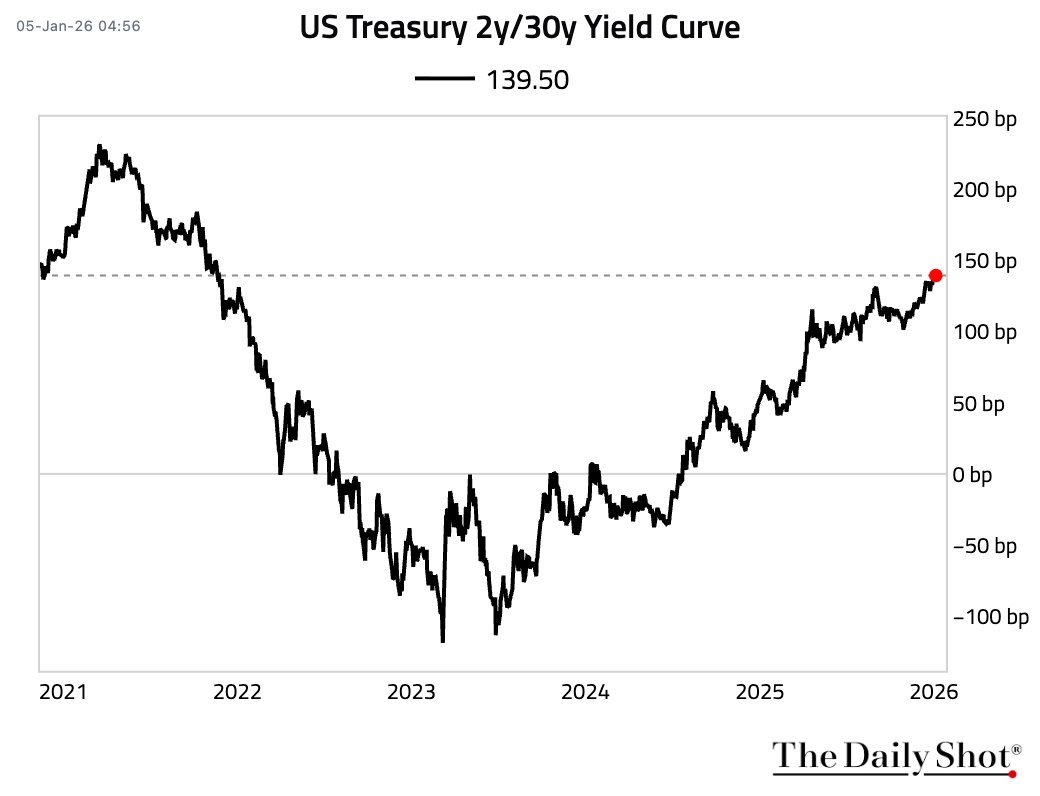

Step 1 - Yield Inversion Step 2 - Yield uninversion Step 3 - Yield curve steepening - You are here Step 4 - Recession

The economy is cooling as the business cycle rolls over. Recession is closer than ever.

US December ISM Manufacturing reading hits 14 month low, manufacturers report significant slowdown in activity Bullish for assets #MacroEdge

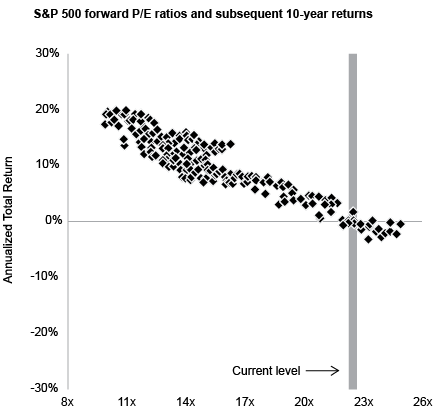

MUST READ! Why you shouldn't trust Wall Street’s “bullish” 10-year stock forecasts! Here are the 10-yr annualized return forecasts (nominal) from the top investment banks out there: - Goldman Sachs ( $GS ): ~6.5% - JPMorgan ( $JPM) AM: ~6–7% - Vanguard ( $VTI) : ~4–5.5% -…

Still worried about inflation? Real rates are about to go VERY negative. $TLT

Exactly!!

Always find it amusing when the same people hyping dollar collapse also hype collapse of house prices. A home is by far the largest inflation hedge average Americans have.

More disinflation, you say? Housing is the biggest component of CPI. Every major inflationary period is led by oil and real estate. It is now disinflationary. Deflation is the real risk in the US right now. And, of course, if you get deflation, recession is guaranteed.

Something big just happened in the U.S. Housing Market. As of the end of 2025, there are now more 6%+ rate mortgage holders than sub-3%. Meaning that the dreaded Mortgage Rate "Lock-In" Effect is fading. Since more existing owners have a higher rate, that means more have a…

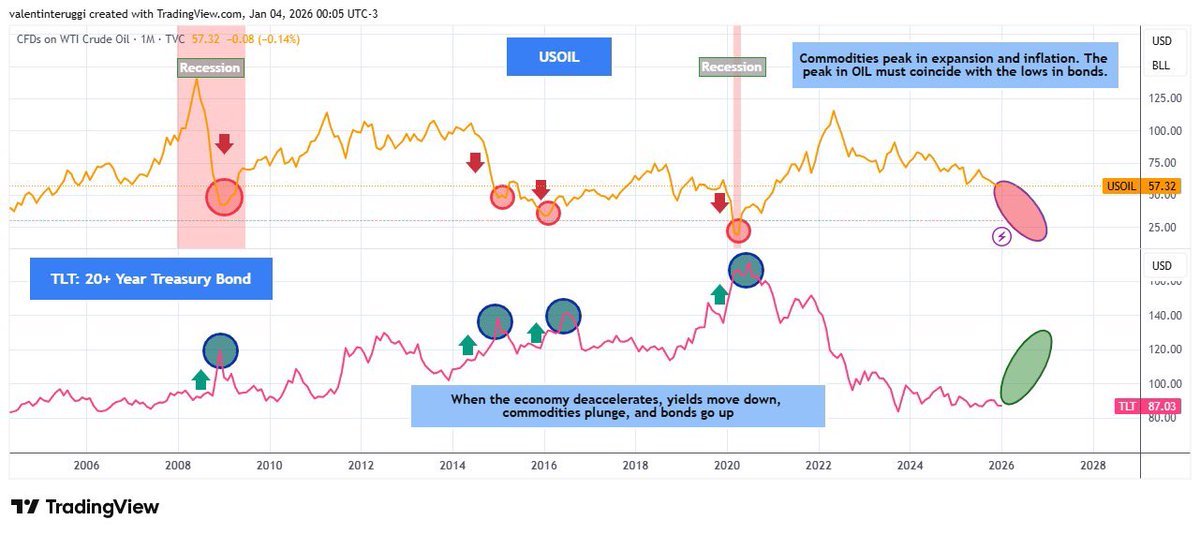

Agreed. As oil disinflates, yields will move down and TLT up!!

Cathie Wood has said inflation will reach 0% this year in 2026. “We think at some point, it could drop to at 0 or below 0” In true disinflation/deflation, long-term yields historically fall 100–200 bps. $TLT has ~17–18yr duration, that implies roughly +17% to +35% upside on…

I do Commodities perform well in expansion and inflation phases. Inflation causes higher yields, meaning lower bond prices. As the economy NOW transitions toward more disinflation or deflation, with lower oil prices, TLT will eventually rally.

Anyone else think long duration Treasury yields are about to crash? Oil is the bigger driver of inflation expectations. Venezuela?

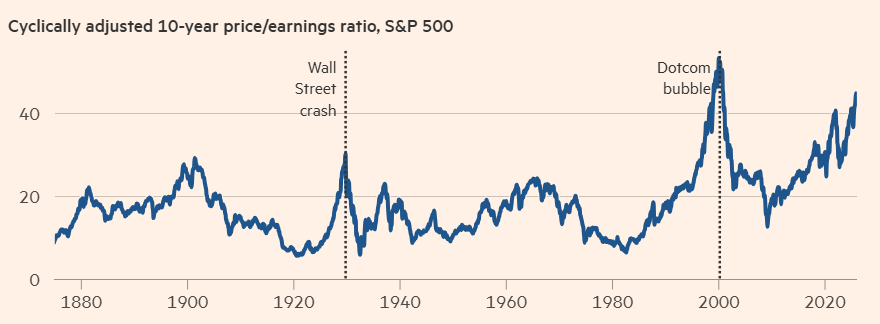

This is the best valuation indicator you can use, as it smooths earnings over 10 years to remove any cyclical movements. It is a bubble. And we don’t need to reach to the 2000 levels. That was extreme.

The S&P 500 is almost as expensive on a cyclically adjusted 10-year P/E ratio than at the peak of the Dot-com bubble. WELCOME TO THE AI BUBBLE.

It won't be any different.

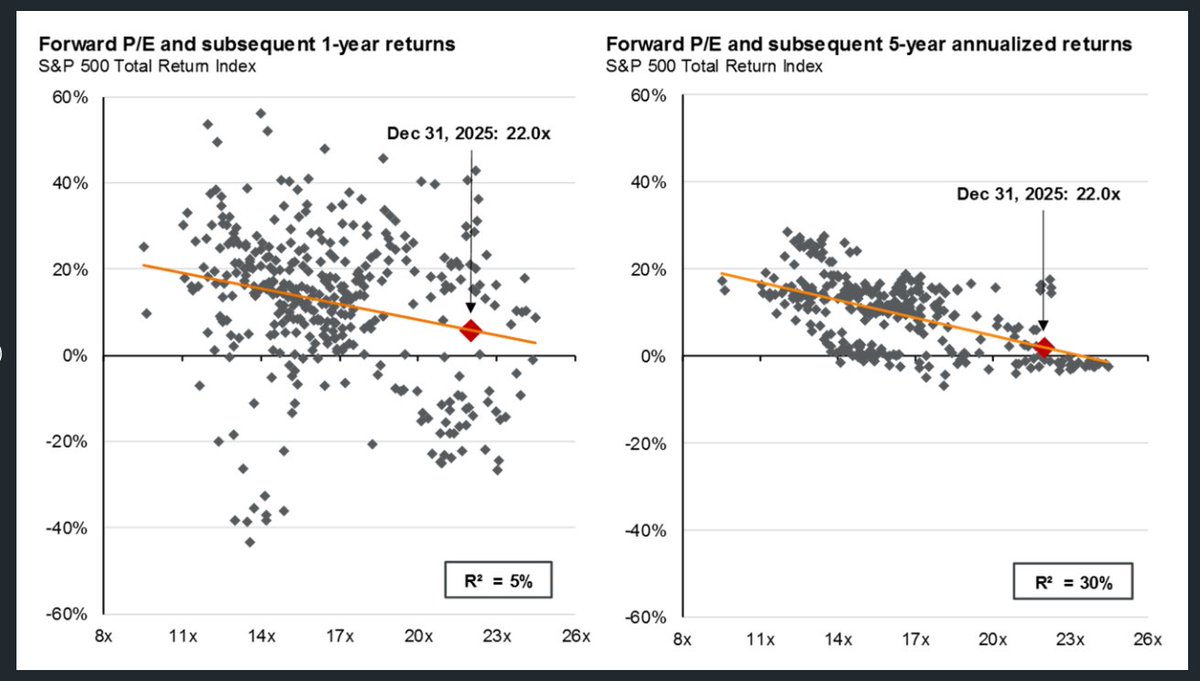

High P/Es often mean lower S&P 500 forward returns. Will it happen this time? JPMAM

When Oil Peaks, Bonds Bottom - How the 2008, 2015, and 2020 cycles reveal the hidden rotation from commodities to long-duration Treasuries open.substack.com/pub/valentinte…

Commodities perform well in expansion and inflation phases. Inflation causes higher yields, meaning lower bond prices. As the economy now transitions toward more disinflation or deflation, with lower oil prices, TLT will eventually rally. #TLT #BONDS #OIL

Exactly! Oil and real estate are the main drivers of the CPI, and both are plunging! Deflation it will be.

The price of oil is a big driver behind the prices of not just utilities but goods, services, manufacturing and transportation. If the US is indeed going to be 'very strongly involved' in Venezuela’s oil industry, it will definitely have an impact on US inflation and GDP.

As expected when the Business Cycle rolls over..... Remember FED's talk about inflation? They are horribly late!

Keeping it simple. Oil market dynamics turn more bearish by the day. Disinflationary pressures mounting. Rate cuts will be deeper than Wall St assumes. Have a nice day.

United States Trends

- 1. Minneapolis 1,33 Mn posts

- 2. #AEWDynamite 13,5 B posts

- 3. Renee 234 B posts

- 4. #TheMaskedSinger 6.006 posts

- 5. Andrade 6.558 posts

- 6. FAFO 112 B posts

- 7. The ICE 1,56 Mn posts

- 8. Frey 333 B posts

- 9. #conformitygate 105 B posts

- 10. George Floyd 81,9 B posts

- 11. Ashli Babbitt 89,4 B posts

- 12. Noem 265 B posts

- 13. Mark Pope N/A

- 14. Federal 875 B posts

- 15. Missouri 37,2 B posts

- 16. Murder 516 B posts

- 17. #Minnesota 12 B posts

- 18. Jake Something 11,6 B posts

- 19. UConn 4.230 posts

- 20. Gestapo 82,1 B posts

Something went wrong.

Something went wrong.