你可能會喜歡

Does anyone know if $XPEV monthly deliveries includes its export sales? If yes, does that mean $NIO monthly deliveries in China is higher than $XPEV?

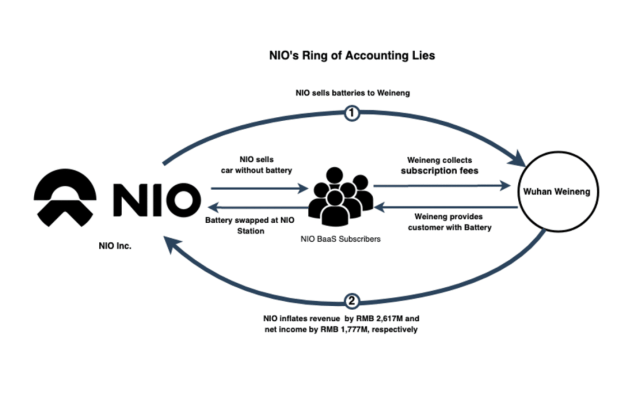

$NIO is also listed on the Singapore Exchange. If it is true that NIO inflated its revenue in 2022 as alleged by GIC, then it is still inflating its revenue today, as the revenue recognition practice continues. SGX should suspend NIO stock immediately.

Singapore sovereign wealth fund GIC sues Nio over losses from three years ago The catalyst for GIC's lawsuit against Nio was a short-selling report released in June 2022, which has since been refuted. cnev.co/83EaiCc 👇

cnevpost.com

Singapore sovereign wealth fund GIC sues Nio over losses from 3 years ago

The catalyst for GIC's lawsuit against Nio was a short-selling report released in June 2022, which has since been refuted.

$NIO has 2 customers for every unit sold under BaaS. Both the car and battery are outright sale to the end user and Weineng, hence full recognition of the revenue. Meanwhile Weining will gradually recognize revenue from end user on the subscription fees.

How Singapore’s GIC Alleges Nio Used Another Firm to Inflate Over $600M in Revenue — EV $NIO via @EV_CARBA eletric-vehicles.com/nio/how-singap…

$NIO: Instead of suing NIO, GIC should fire the PM for failing to understand NIO's revenue model, causing significant losses and now harming GIC's reputation with the lawsuit.

$NIO down 10% in Hong Kong on news of GIC lawsuit. But I’m wondering two things: 1. Why did GIC suffer significant losses when NIO shares went up because of this. 2. How is recognizing full revenue from an affiliate’s purchase of NIO’s batteries illegal? How is that worse than…

Will the "value for money" new ES8 cannibalize sales of the L90 and other models? If yes, then it will be impossible for NIO to achieve profitability in Q4. $NIO

We just started the @Deepvue Black Friday Sale I'm giving away a 1 year Subscription each week this month. To enter: 🔁 Retweet 🔁 👉 Follow @Deepvue I'll announce the first winner Tomorrow 11/15 deepvue.com

Before the deal, NIO owns 92.1% in Nio China while the Hefei investors owns the remaining 7.9%. Under the deal, NIO's stake in Nio China will get diluted from 92.1% to 88.3% despite investing 3x more capital. Why is Nio paying a 3x higher price than Hefei for Nio China? $NIO

United States 趨勢

- 1. Cloudflare 228K posts

- 2. Gemini 3 31.7K posts

- 3. Saudi 141K posts

- 4. #AcousticPianoCollection 1,327 posts

- 5. Jamal Khashoggi 4,785 posts

- 6. Piggy 69.1K posts

- 7. Salman 41.3K posts

- 8. Robinhood 4,427 posts

- 9. Antigravity 3,151 posts

- 10. Olivia Dean 4,197 posts

- 11. CAIR 27.3K posts

- 12. Merch 65.5K posts

- 13. #LaSayoSeQuedóGuindando 1,549 posts

- 14. La Chona 1,798 posts

- 15. Taco Tuesday 15.6K posts

- 16. Presidential Walk of Fame 3,709 posts

- 17. #MSIgnite 1,038 posts

- 18. #ONEPIECE1166 5,086 posts

- 19. Lane Kiffin 15.2K posts

- 20. #tuesdayvibe 3,353 posts

Something went wrong.

Something went wrong.