Number Go Up

@zerocooltrader

Options trader. My trades & market commentary. Not financial advice.

AI disruption isn’t the death of software; it’s a catalyst for evolution. The software companies that adapt fast will thrive—those that don’t, will go under. Think of it like retail: some evolve like Amazon, others stall like Macy’s or Kohl’s.

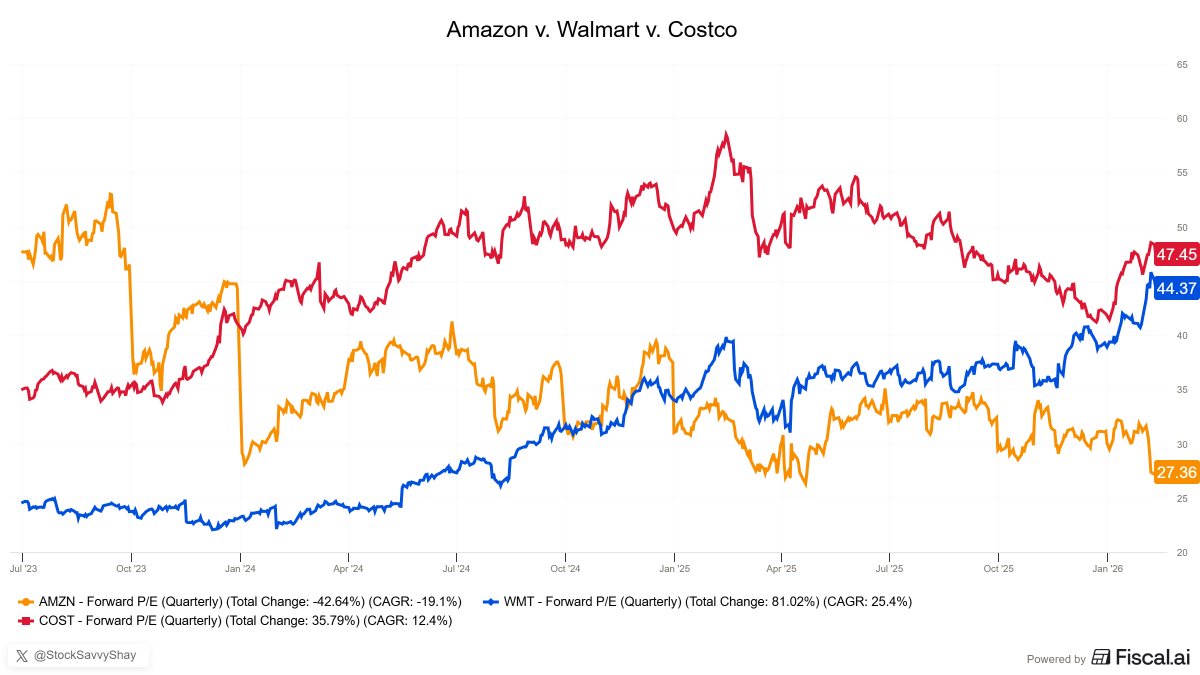

Make this make sense to me: • $AMZN growing revenue ~14% with ~10% margins trading at ~27x earnings • $COST growing revenue ~8% with ~3% margins trading at ~47x earnings • $WMT growing revenue ~6% with ~3% margins trading at ~44x earnings

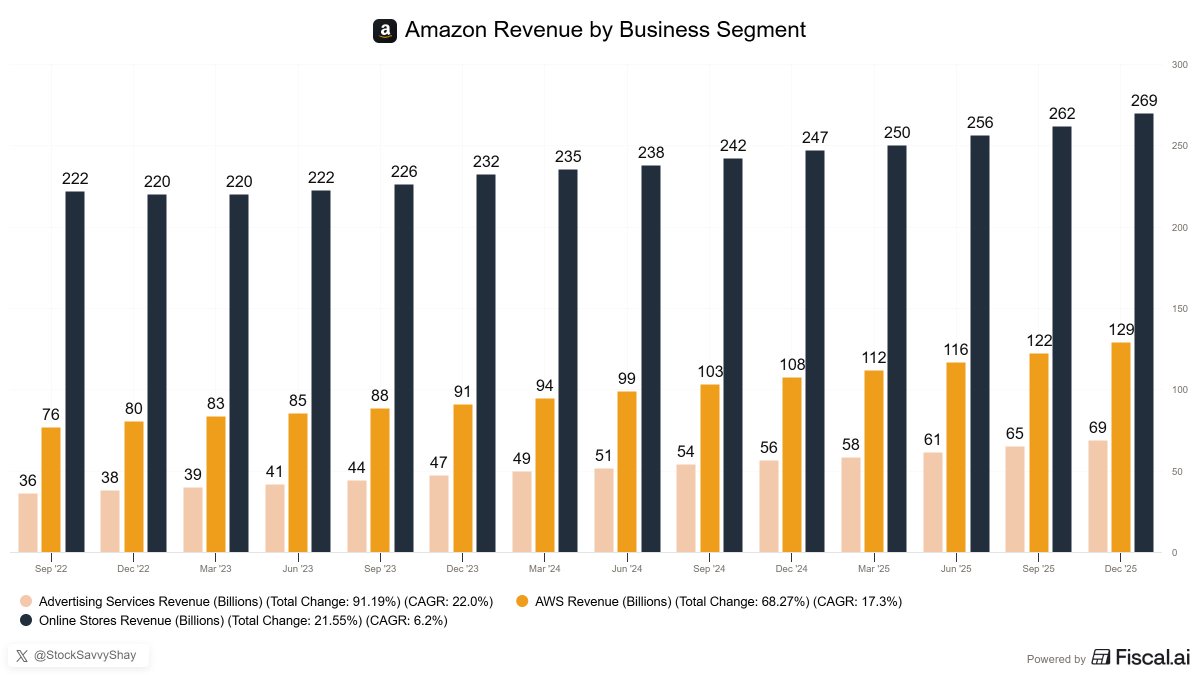

Buying $AMZN at ~$208 (~$2.2T market cap) implies you’re getting: • $269B e-commerce growing ~10% (arguably worth ~$300B) • $129B AWS growing ~24% (easily a ~$1.8T business) • $69B ads growing ~23% (a ~$500B business)) On a sum-of-the-parts basis, that points to Amazon being…

$F had its worst quarterly miss in 4 years: adj. EPS $0.13 vs. $0.19 est., revenue barely met expectations... and the stock is up in after-hours trading.

AI DISRUPTION DILEMMA Everyone focuses too much on the risks AI brings and sells. Not enough investors realize the benefits AI will bring to every sector.

$AMZN GEX setup: expect chop between 200-215 into Feb 20 opex. Dealers are net long gamma (232M total GEX) — they're selling into strength. 215 = max positive GEX magnet (51.7M). 200 = max negative GEX trapdoor (-78.2M). After Feb 20 opex, that gamma rolls off and the real…

$KO Coca-Cola's Tepid Outlook The "rotation to value" poster child — up 13% YTD. But it sells of after Q4 earnings report. If the defensive bid is real, why punish the safe haven? Because pricing-over-volume is running out of runway. - First revenue miss in 5 years. - 2026…

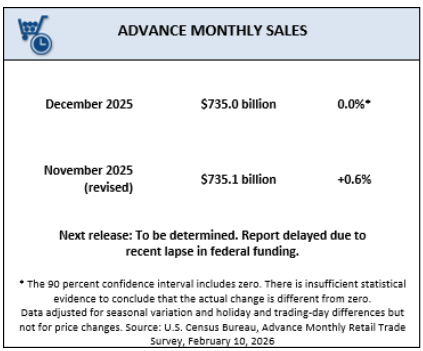

December retail sales are flat vs +0.4% expected. More importantly, 2.4% y/y didn't keep pace with 2.7% CPI (alleged CPI). Real consumer spending went negative. The consumer is losing purchasing power, and tariff-hit categories (furniture, clothing, electronics) are taking the…

United States Trends

- 1. #WWENXT N/A

- 2. Purdue N/A

- 3. Nebraska N/A

- 4. Real ID N/A

- 5. SWAT N/A

- 6. Jaida Parker N/A

- 7. Courtney Love N/A

- 8. Alaska N/A

- 9. RINO N/A

- 10. Kurt Cobain N/A

- 11. Murkowski N/A

- 12. #RingRoyale N/A

- 13. Jackson Drake N/A

- 14. Cluff N/A

- 15. Collins N/A

- 16. Baylor N/A

- 17. Greg Gutfeld N/A

- 18. ALDO EN RR N/A

- 19. Sesko N/A

- 20. Nancy Guthrie N/A

Something went wrong.

Something went wrong.