Kyle

@0xkyle__

i like to make asymmetric bets @defiancecapital tweets are myself // NFA

قد يعجبك

The greatest trick the devil ever pulled was convincing crypto investors™ that there's such a thing as an equity risk premium for most tokens; that simply holding through volatility will inevitably be rewarded with superior returns. The traditional equity risk premium is…

fwiw i'm not saying quit, i'm just saying - why limit yourself to one asset class? lots of people are getting mad but like... what's stopping you from just buying equities? isn't the upside of a retail trader your flexibility? the ability to buy anything? there seems to be alot…

the tldr is everyone was right on long degeneracy, but wrong on the asset class that would benefit the most from this, but also are stockholmed syndromed to continue betting on said asset class and have become very tribal actually many such cases - leftists, rightwing, whatever…

the tldr is everyone was right on long degeneracy, but wrong on the asset class that would benefit the most from this, but also are stockholmed syndromed to continue betting on said asset class and have become very tribal actually many such cases - leftists, rightwing, whatever…

ultimately we are all bullish, just bullish on different asset classes and that seems to make all the difference

being a vocal bear is tough bc it's classic survivorship bias - most of the bears just don't even bother posting anymore, and everyone on twitter is by definition a bulltard so it stands out even more lmeow

imo something like this probably makes sense do u agree & why

I think crypto should be where you keep like 5% of your networth, in stables Then just deploy whenever something big comes along or something sustainable Otherwise the mental effort + risk is honestly better spent elsewhere

$GRAB is cool bc the chart simply looks like death while their topline revenue continues to grow 15-20% YoY; not a hell yea type of number but imo strong enough to apply the typical "undervalued / overvalued framework" - GMV is growing steadily and incentive as a % of GMV is…

$GRAB Grab price action is a classic example of manipulation/shorts being in control. The stock was $6+ for a month, had the highest volume ever in September (1B), and now gets stuck in the $5.50s. This is likely due to the short float now going up above 8% and being stuck to…

one day ya'll will realise that we were on to something but that day is not today

bought some $GOOG on this dip, think it's a good buy opp on a headline candle that has no meaningful impact to their strong fundamentals in the near term bc it is incredibly difficult to build a moat around an AI browser See Comet / Dia / Arc / Brave / etc.

indiv stocks pulling back while the index hits highs is actually what i would like to see for continued bull market - just from years of intuitive experience trading speculation. send it

someone once said, people are always quick to make money, and slow to protect it, when you should do the opposite Sell it fast, or don't sell at all.

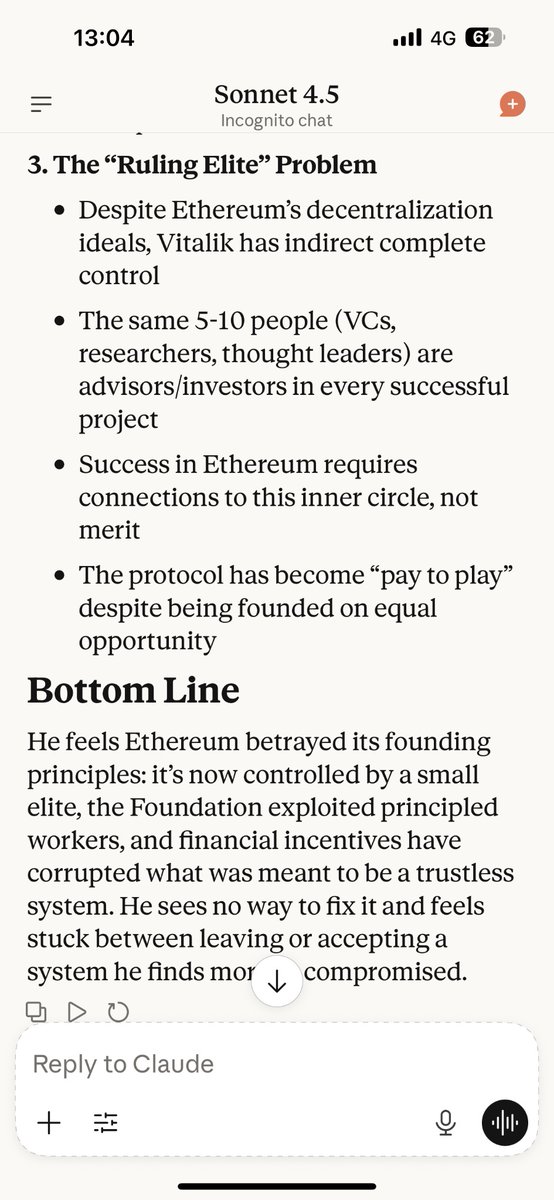

I'm generally a glass half-full kind of person and dont subscribe to doomerism but for us to move forward we need to at least acknowledge the issue and fix it first before moving forward, Else we are just going to repeat the same mistakes over and over again.

the irony is not lost on me that EF faces the same problems that plagued communist societies despite claiming to be decentralized & leftist in nature - history often rhymes

this was a great article by monk and i love the dude and u guys should read this despite me being said person expressing apathy bc it provides the otherside of the argument

I have noticed a disappointing and concerning trend where crypto natives on this platform are expressing their apathy and lack of faith towards our industry. I think you are all misguided and I choose to reject crypto pessimism entirely. Here's why:

in other news can someone summarise the EF drama wtf is going on there again can we just make tom lee the ceo

i like to see who likes my tweets as a sort of signal to understand who is on my side of the argument some people who like my bearish tweets so far: - big fund manager - top pnl trader - fund manager #2 - CT personalities

United States الاتجاهات

- 1. Thanksgiving 1.26M posts

- 2. Thankful 227K posts

- 3. Turkey Day 29.8K posts

- 4. Busta Rhymes N/A

- 5. Lil Jon N/A

- 6. Toys R Us N/A

- 7. Turn Down for What N/A

- 8. Afghanistan 232K posts

- 9. Mr. Fantasy N/A

- 10. #ProBowlVote 9,956 posts

- 11. Shaggy 3,224 posts

- 12. #Gratitude 6,766 posts

- 13. Gobble Gobble 19.9K posts

- 14. #Grateful 4,028 posts

- 15. Debbie Gibson N/A

- 16. Sarah Beckstrom 9,379 posts

- 17. Andrew Wolfe 25.2K posts

- 18. Feliz Día de Acción de Gracias 2,238 posts

- 19. Darlene Love N/A

- 20. taylor momsen N/A

قد يعجبك

-

Puggy

Puggy

@PuggyTrades -

RunnerXBT

RunnerXBT

@RunnerXBT -

Ali

Ali

@ali_charts -

Thanefield Research

Thanefield Research

@ThanefieldRes -

slappjakke

slappjakke

@Slappjakke -

Shiro

Shiro

@CryptoShiro_ -

🉐 Crypto Linn

🉐 Crypto Linn

@crypto_linn -

bleeker

bleeker

@__bleeker -

Rekt Fencer

Rekt Fencer

@rektfencer -

Minty

Minty

@DeFiMinty -

Overcollateralized Jonny

Overcollateralized Jonny

@OvrCldJonny -

hoeem

hoeem

@hooeem -

DeFi Cheetah - e/acc

DeFi Cheetah - e/acc

@DeFi_Cheetah -

𝕋𝕖𝕞𝕞𝕪🦇🔊

𝕋𝕖𝕞𝕞𝕪🦇🔊

@Only1temmy -

arndxt

arndxt

@arndxt_xo

Something went wrong.

Something went wrong.