You might like

Observations: 1. Bond markets are the signal. 2. Floods start as trickles.

$STRC closed today at an all-time high of $100.01, with 1 million shares traded.

17 years after the white paper, the Bitcoin network is still operational and more resilient than ever. Bitcoin never shuts down. @SenateDems could learn something from that.

High Grade. It’s coming.

Gm ☀️☀️ The water you are swimming in is about to undergo another phase change.

First example of much more of this to come. Dump redundant assets for BTC.

JUST IN: Scilex Holding Company to sell $200 million worth of Semnur Pharmaceuticals stock for $200 million Bitcoin 🚀 Pharmaceutical companies buying Bitcoin 💊🧬

“I was wrong because regulators, crooks and the President.” Externalization is always dishonest. Harvard and IMF don’t disappoint.

Almost a decade ago I was the Harvard economist that said that bitcoin was more likely to be worth $100 than 100k. What did I miss? I was far too optimistic about the US coming to its senses about sensible cryptocurrency regulation; why would policymakers want to facilitate tax…

The next phase of the BTCTC idea is going to come from corp's with serious underlying businesses, priced at ridiculous multiples that can sustain stock sales to raise cash for BTC.

This man understands the relevant metric.

We've increased our Bitcoin per share by 37x since this time last year. Our mission is clear: to maximize BTC per share—responsibly, consistently, securely, and indefinitely, with full transparency.

Companies printing shares for bitcoin precedes countries printing money to do the same. As sure as day follows night.

No exceptions.

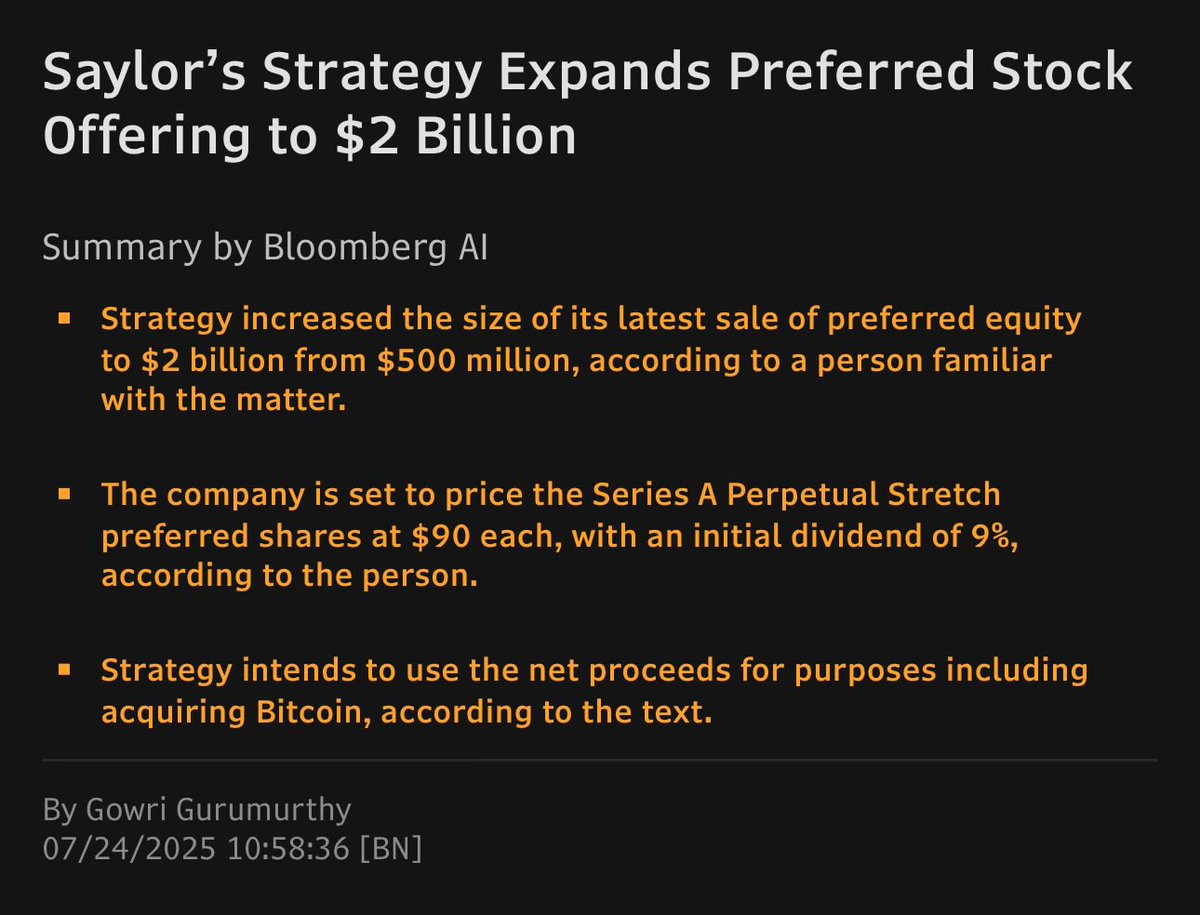

$MSTR Upsizes $STRC IPO 4x to $2B From $500M; Prices at $90, 9% Initial Dividend, 10% Effective Yield - Bloomberg

The forced buyer era. Begins when sellers of raw commodities require settlement in BTC. When a 10% gain in BTC price causes a 1% gain in global M2. When the marginal treasury buyer realizes the game is up. We may not know exactly when, but we do know it’s inevitable.

BTCTC’s make Bitcoin demand price agnostic. mNAV multiples, PE’s and rates of accretion are the new drivers. Is this the change that breaks the cycle?

Reminder. Moving to a Bitcoin standard is not optional. You only get to choose when you do it.

No permission required.

This is important. GM 🌞☕️

United States Trends

- 1. Christmas 8.02M posts

- 2. Hawaii 22.3K posts

- 3. Santa 1.48M posts

- 4. Feliz Navidad 793K posts

- 5. #ShowSVPTheTree N/A

- 6. Dan Fouts N/A

- 7. Rainbow Warriors 1,031 posts

- 8. Timmy Chang N/A

- 9. Merry Xmas 271K posts

- 10. Micah Alejado N/A

- 11. Drew Brees N/A

- 12. Wonderful Life 14.5K posts

- 13. Rudolph 32.1K posts

- 14. Stan Humphries N/A

- 15. Marty Supreme 16.7K posts

- 16. Home Alone 36.4K posts

- 17. Go Bows N/A

- 18. Carti 13K posts

- 19. Midnight Mass 9,519 posts

- 20. Phil Donahue N/A

You might like

-

Streets of Value

Streets of Value

@ValueWolf -

Global Value Hunter

Global Value Hunter

@stockjock84 -

LSigurd

LSigurd

@LSigurd -

Thompson Clark

Thompson Clark

@rtclark -

Woodmont Partners

Woodmont Partners

@WoodmontPartnrs -

Siegfried Eggert

Siegfried Eggert

@SGEggert -

John Allen

John Allen

@JAllenCapMgmt -

Benjamin G Cap

Benjamin G Cap

@gram_benny -

CDM Capital

CDM Capital

@CDMCapital -

Falling Knife Cap

Falling Knife Cap

@mac003_c -

Dempster Mill

Dempster Mill

@DempsterMill -

Jay Braz

Jay Braz

@JayBraz -

OC Family Office

OC Family Office

@thrivecap -

Olmsted

Olmsted

@Olmsted2 -

I'veBeenHad

I'veBeenHad

@IveBeenHad

Something went wrong.

Something went wrong.