Barry Dawes

@DawesPoints

Helping investors profit in the resources sector Many years experience commodity and equity research [email protected] #gold #copper #ASX #commodities

You might like

#Mining #Commodities Updating this six years later @DawesPoints Global Boom on track Commodity prices over the next decade need to reflect: 1 3,400m in Asia improving living standards 2 High mine capacity utilisation rates in many resources 3 Low stocks of…

The biggest gains are made buying low to sell high. Nickel is hated as much as T Bonds so here's low risk play. Look at Ni vs Au! WMG.AX has 5.3mt cont Nickel @ 0.27%Ni that can only get bigger & with 🔼🔼higher grades. Just US$20m mkt cap. Inground value…

A big question. The US$ is clearly in a major bull market. The major currencies look very weak long term. US T yields are falling across the maturities. So is #gold worth $27tn mkt val? Can the $9tn 2025 gain hold (biggest yearly gain ever, in anything), let alone rise?…

Fascinating that the 6.9bnoz of global #gold at $4400 was worth $30.4tn and up ~$12tn in 2025. Was this the biggest market value gain ever? Today its $27.6tn at $4000. Big overhang to profit from the short side? How much buying is needed to push it to $5000 and $34.5tn?

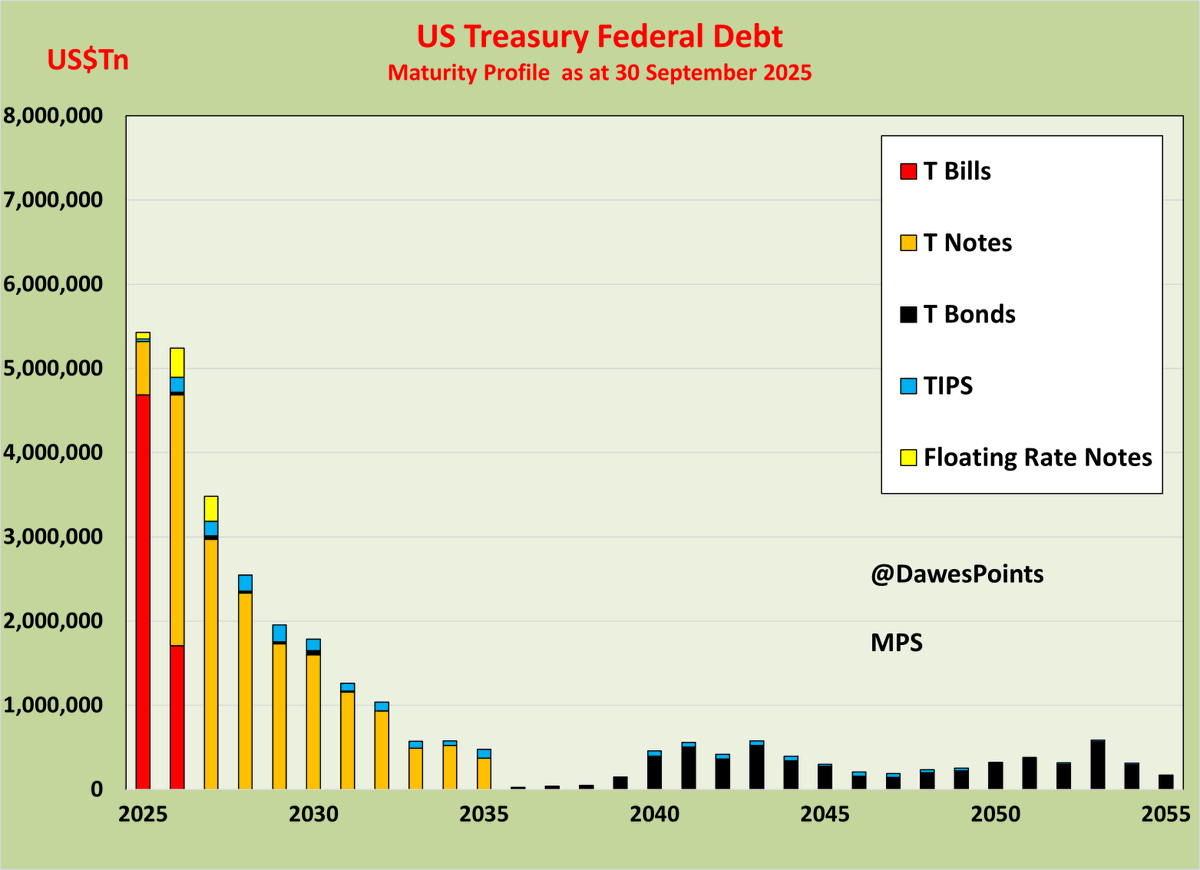

Budget Repair in the US brought a $198bn surplus in Sept and reduced FY25 by $200bn. TBill rates are plummeting so Int Exp peaking and CPI heading lower. TBond yields dropping and prices breaking higher. Uncrowded trade. US$ strong. Major LT peak in #gold.

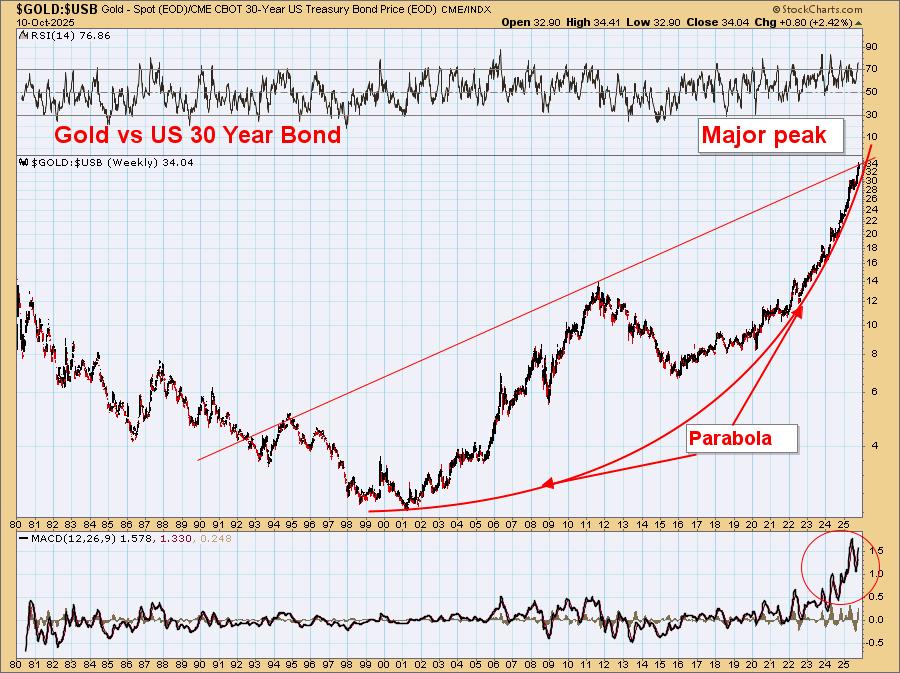

Parabolas show increasing & peaking r of c of prices. The final stages soak up all the available buying power and emotional energy. Consensus market direction creates a bubble. Unwinding is not pleasant. All #gold's parabolas have ended in tears. No different this time.

The breakouts of these major resources companies bodes well for the coming global resources boom. Growing sales volumes, good product prices and excellent balance sheets driving dividend high yields. Their performances vs $NEM strongly suggesting #gold has peaked. $RIO $BHP

High gold prices have provided strong revenues and earnings to gold producers. Sadly share price performances are indicating the market is not expecting high gold prices for much longer. It seems goodbye kisses all round. #Gold heading lower. $NEM $GDX $AEM $XAU $B $KGC

US$ de-dollarizing not working very well at all. These major currencies are now in free fall & will be much lower in 2026. US Doctrine of Budget Repair, reduced Outlays, rising Receipts, tax cuts & falling Tbond yields is clearly driving capital inflows. Gold to follow…

Gold now retreating from a major LT high. De dollarisation is factually incorrect. US$ in LT bull Budget repair underway. Inflation declining Big Beautiful Bond Bull market.

Gold has ~$28tn market value and is up ~$12tn in 2025. A big & very profitable overhang. Everyone has his own set of technicals for #gold. These are mine. No support before $3500. Some at $3300 Some at $2900 Best at $2500. I am not in any competition. These are my…

$NEM has Q3 strong earnings reported yesterday. Ave realised $gold was US$3,539/oz $1.71 EPS x 4 = $6.84 annualised EPS = 13x EPS. Is this cheap? Or will the market not really care? $GDX

Nth American Gold Stocks formed an `island reversal' pattern after gapping higher. Gold is now US$68 lower than the 23 Oct close. Will these two gap lower on the opening? Where might they be by end of the day? Will the CPI be much lower? #gold $NEM $GDX

Being a US T Bond Bull based on Budget Repair and falling Deficit/GDP ratio together with falling CPI/PPI & overall bond yields this graphic is no longer preposterous. Those wonderful parabolas are leading the way here as well. ST is looking good! Conflicts with most Gold Bull…

Parabolic rises are wonderful watch & to estimate when they will exhaust their energy. The rapid rate of change reflects universal agreement on market direction. In effect, they tell you when everyone has bought and no further buying remains. Breaching, then backtesting the…

Parabolas doing what parabolas do. Hyperbolic rate of change brings exhaustion. US$27tn overhanging the market. Golden Fleece sting underway. #gold. $NEM $GDX

I fear it is all over. Irrational exuberance. US$ collapsing. It isn't. Bonds collapsing. They aren't. Inflation surging. it isn't. War. Not likely inflation. No Parabolas tell us a lot. Maximum rate of change leads to exhaustion. 220kt overhang. $27tn overhang. #gold…

How amazing. The shiny rock sure produces gold fever. Gold blindness. Gold deafness. Gold brain short circuits. Cognitive dissonance against all your faculties of observation. Not US$, bonds, inflation, war. Just the `vibe'. Parabola. Rate of change. US$27tn. #gold…

Wouldn't it be fun if I got this one correct? Will I? Super counter intuitive contrarian outcome. My facts support it? Will the market's facts be the same as mine? Who knows! $14tn in falling ST Bills/Notes. NO ONE owns any LT Bonds. #Gold $GDX $NEM

United States Trends

- 1. Cowboys 68.7K posts

- 2. Nick Smith 14.3K posts

- 3. Kawhi 4,329 posts

- 4. Cardinals 30.8K posts

- 5. #LakeShow 3,411 posts

- 6. #WWERaw 62K posts

- 7. Jerry 45.3K posts

- 8. Kyler 8,445 posts

- 9. Blazers 7,951 posts

- 10. Jonathan Bailey 22.9K posts

- 11. Logan Paul 10.2K posts

- 12. No Luka 3,589 posts

- 13. #WeTVAlwaysMore2026 211K posts

- 14. Jacoby Brissett 5,607 posts

- 15. Valka 4,843 posts

- 16. Cuomo 175K posts

- 17. Pickens 6,666 posts

- 18. Dalex 2,537 posts

- 19. Bronny 14.8K posts

- 20. Pacers 12.8K posts

You might like

-

The Assay - Mining Magazine

The Assay - Mining Magazine

@TheAssay -

ResourcesRisingStars

ResourcesRisingStars

@RR_Stars -

Edward Gofsky

Edward Gofsky

@EdwardGofsky -

American Rare Earths Limited (ASX: ARR)

American Rare Earths Limited (ASX: ARR)

@ARRLimited -

Gavin Wendt

Gavin Wendt

@MineLifeReport -

Making Money Matter and Gold Events

Making Money Matter and Gold Events

@GoldEventsAU -

Nicholas Read

Nicholas Read

@nicholas_read -

Ken Watson

Ken Watson

@ken_kfwatson -

NWR Communications

NWR Communications

@NWRcomms -

The Mining Bartender

The Mining Bartender

@jtourzan -

TheHedgelessHorseman 🏇

TheHedgelessHorseman 🏇

@Comm_Invest -

Julia Maguire

Julia Maguire

@MsJuliaMaguire -

MakCorp

MakCorp

@makcorppl -

Simon

Simon

@sich8 -

High Grade 🚜⚒🌎🇺🇸🇨🇦

High Grade 🚜⚒🌎🇺🇸🇨🇦

@EconomicAlpha

Something went wrong.

Something went wrong.