Barry Dawes

@DawesPoints

Helping investors profit in the resources sector Many years experience commodity and equity research [email protected] #gold #copper #ASX #commodities

내가 좋아할 만한 콘텐츠

#Mining #Commodities Updating this six years later @DawesPoints Global Boom on track Commodity prices over the next decade need to reflect: 1 3,400m in Asia improving living standards 2 High mine capacity utilisation rates in many resources 3 Low stocks of…

Gold Is About To Get Ugly ow.ly/z3t850Xt2gi Barry Dawes of Martin Place Securities shares his thoughts on where the gold market is headed and takes a look at a few gold stocks. @DawesPoints

Gold Is About To Get Ugly ow.ly/z3t850Xt2gi Barry Dawes of Martin Place Securities shares his thoughts on where the gold market is headed and takes a look at a few gold stocks. @DawesPoints

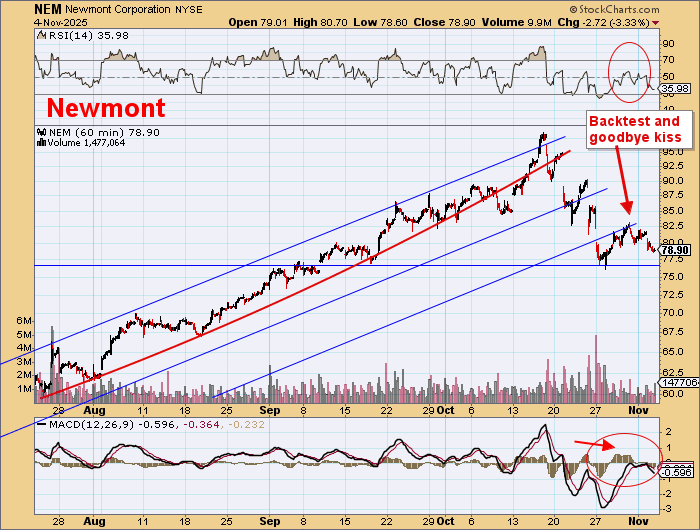

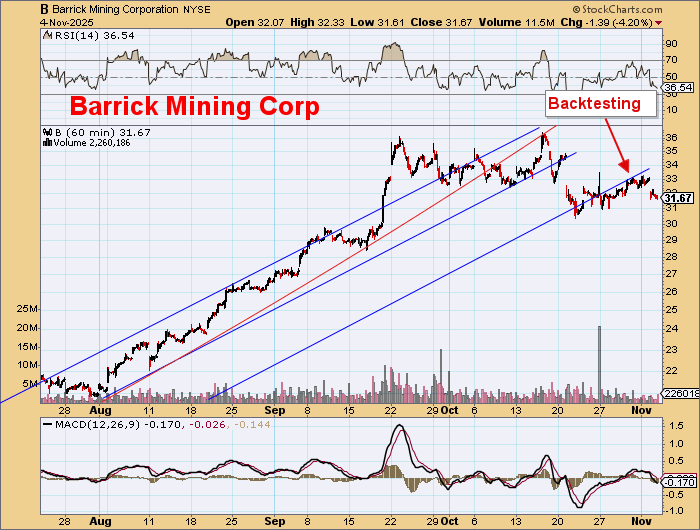

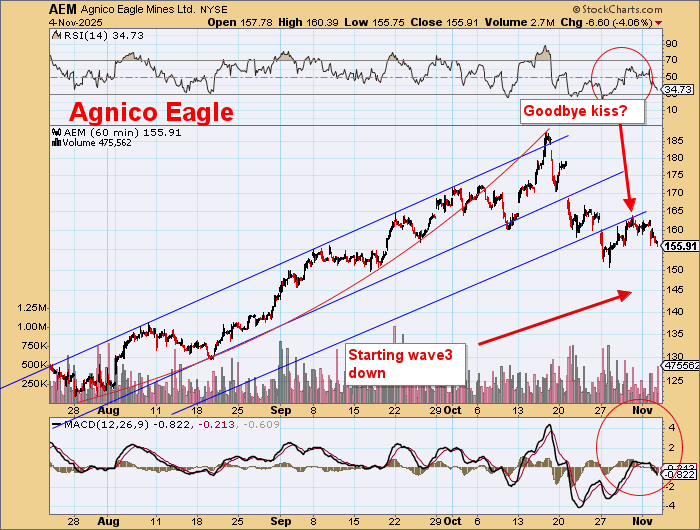

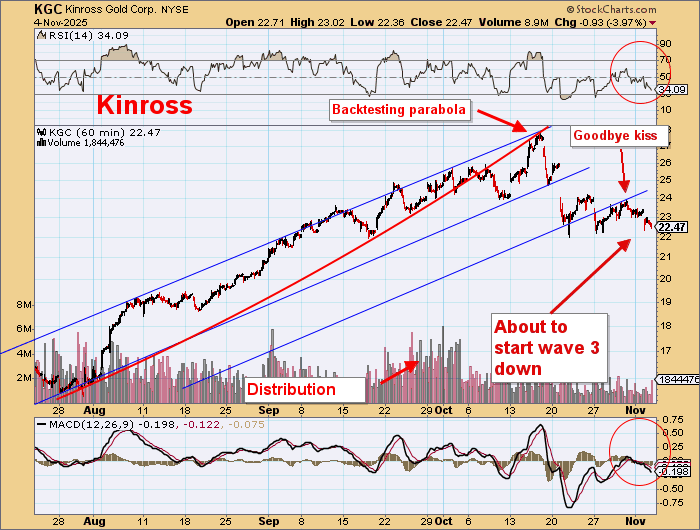

There was supposed to be a big bull market in gold stocks around here somewhere. Anyone seen one? You would know it if you saw it. Big, bright and shiny. Very big. These aren't in it, are they? No. It's probably hiding somewhere else. $NEM $AEM $B #gold

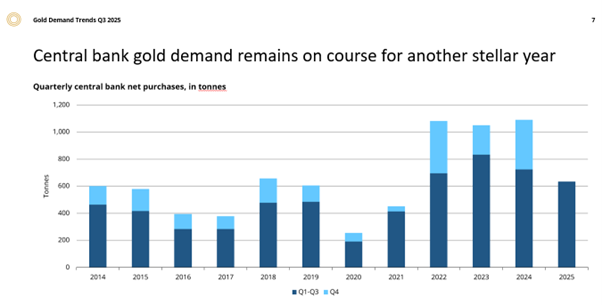

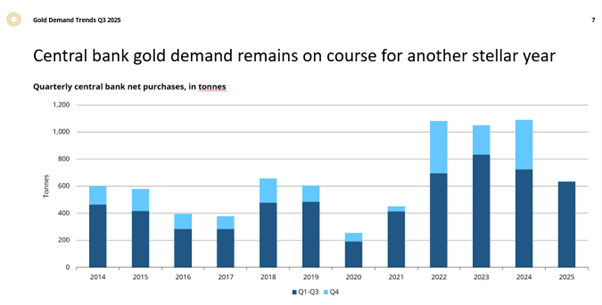

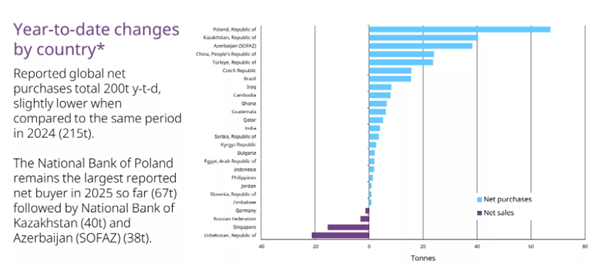

Holes appearing everywhere for the gold bulls. US$ strong Collapsing Euro and Yen CBs bought 22% less gold in 2025 Budget repair underway The $25k gold kids are thinking $170tn is good value for #gold. Gold security biz will be bigger than AI! 🤣 $NEM $AEM $GDX $XAU

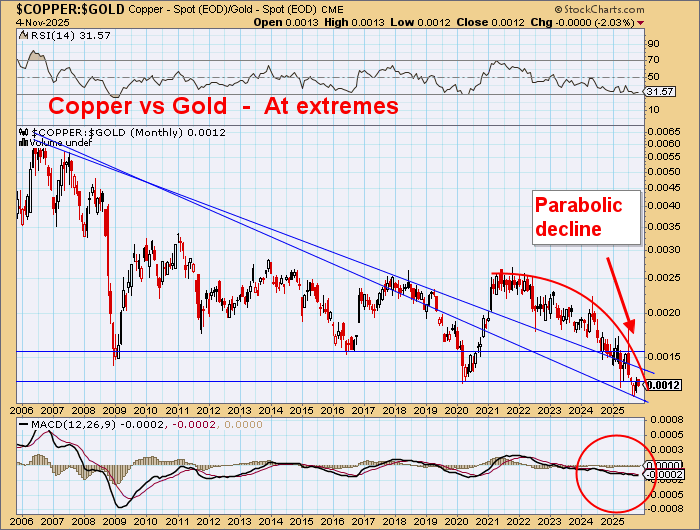

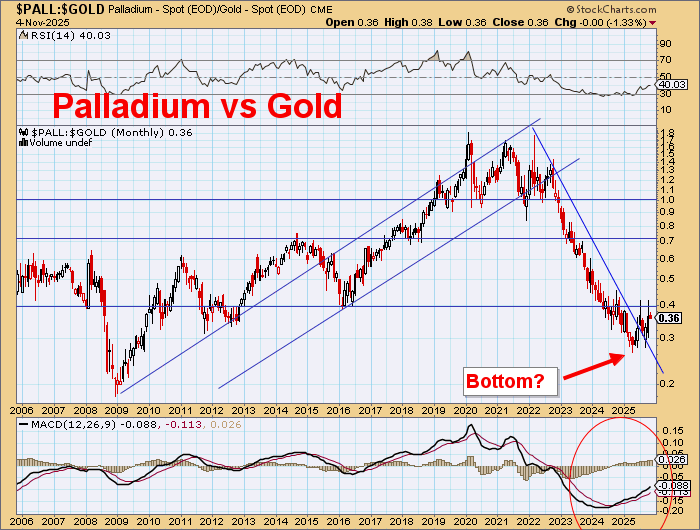

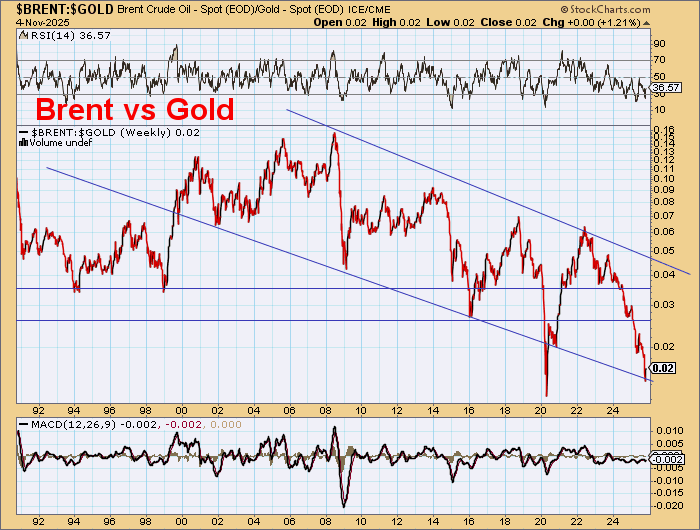

All these industrial commodities are about to break up strongly against gold. Silver is LT v cheap and ready to break higher Copper is now at extreme low so ready to snapback Platinum will have a big boost soon Palladium ready to go All say #gold is way overpriced

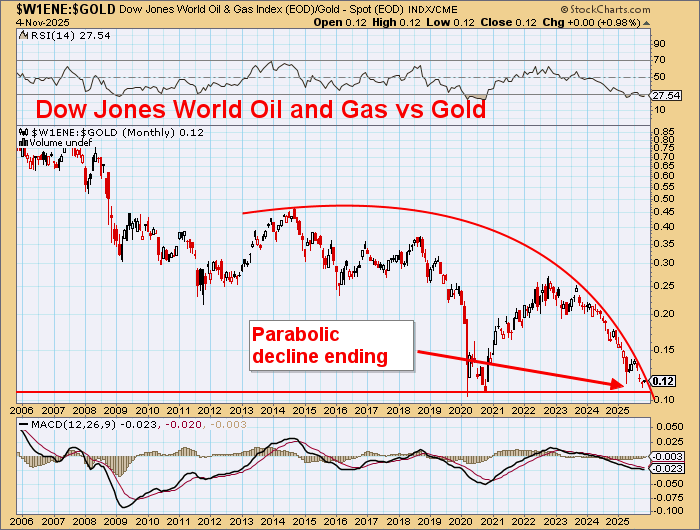

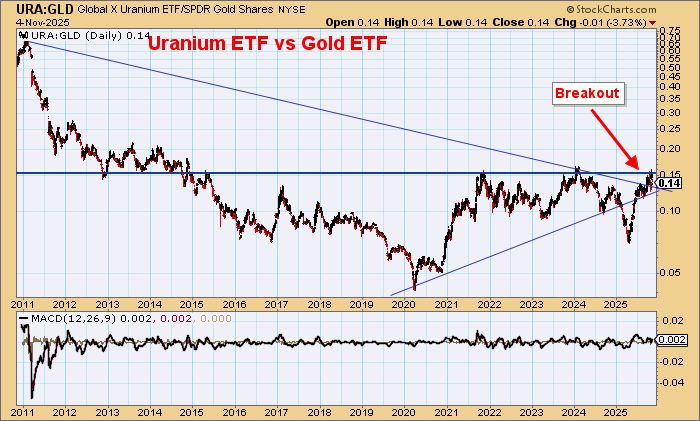

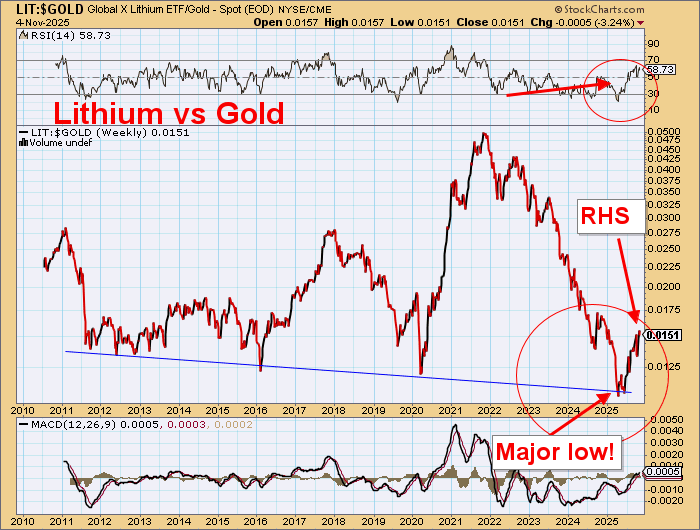

Many industrial commodities are overextended vs gold -now are ready to snap back. Oil has declined parabolically to an important technical low. The oil sector is following - ready to turn. Uranium is ready for a big move. Even lithium is changing. #gold heading MUCH lower.

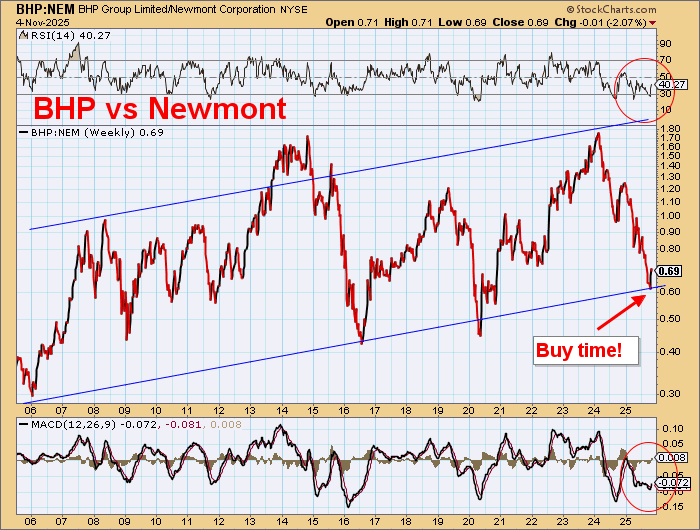

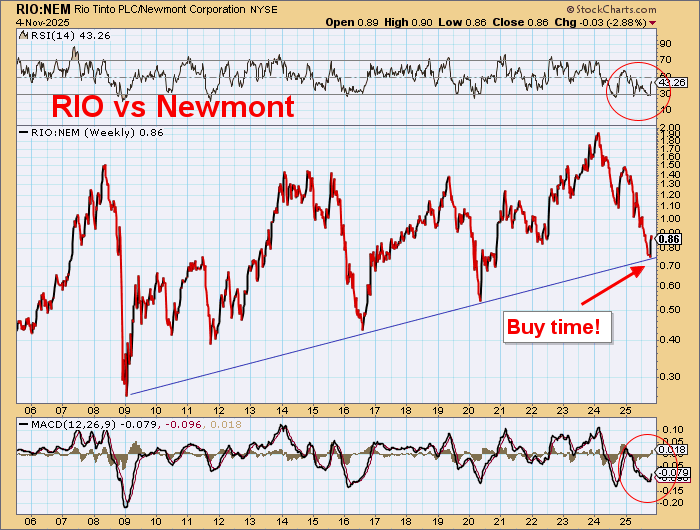

The performance of big resources stock vs big gold stocks tells a big story. The peak in gold has been achieved & basic resources are heading higher. Gold has reached a peak against almost all asset classes and now will fall away. Reality. #gold $BHP $RIO $NEM $AEM $GC $B

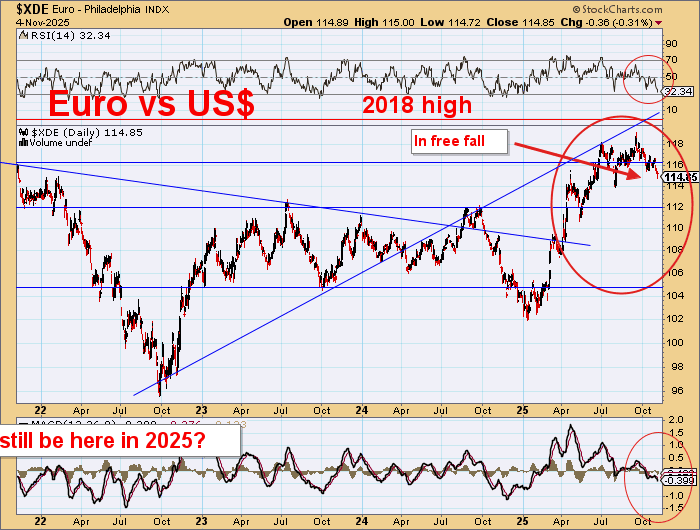

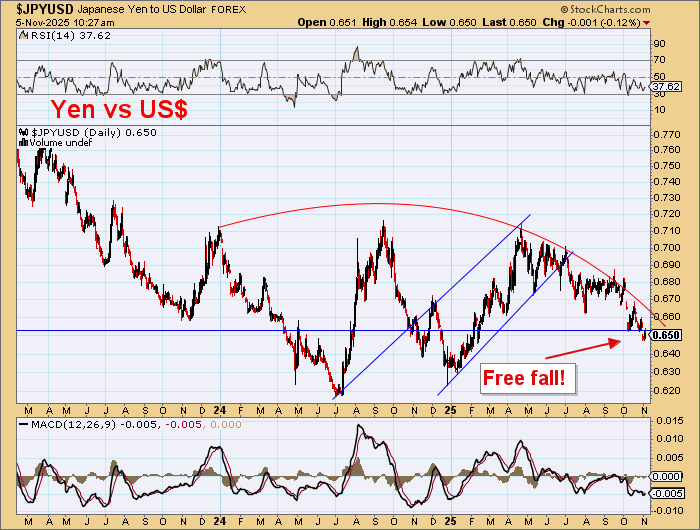

US$ strength continues & the major currencies are now in freefall. As they fall it will become increasingly difficult for these countries to find funding to buy bonds to finance woke NET ZERO type deficits. Falling yields in the US make the US$ even more attractive. #gold

Are we allowed to say CB buying YTD is the lowest in 4 years and only smaller players & CCP bought in 2025. Probably like gold can rise with a strong US$ and falling US Tbond yields mean falling real yields (even though inflation is falling). Do I have that right? #gold

The biggest gains are made buying low to sell high. Nickel is hated as much as T Bonds so here's low risk play. Look at Ni vs Au! WMG.AX has 5.3mt cont Nickel @ 0.27%Ni that can only get bigger & with 🔼🔼higher grades. Just US$20m mkt cap. Inground value…

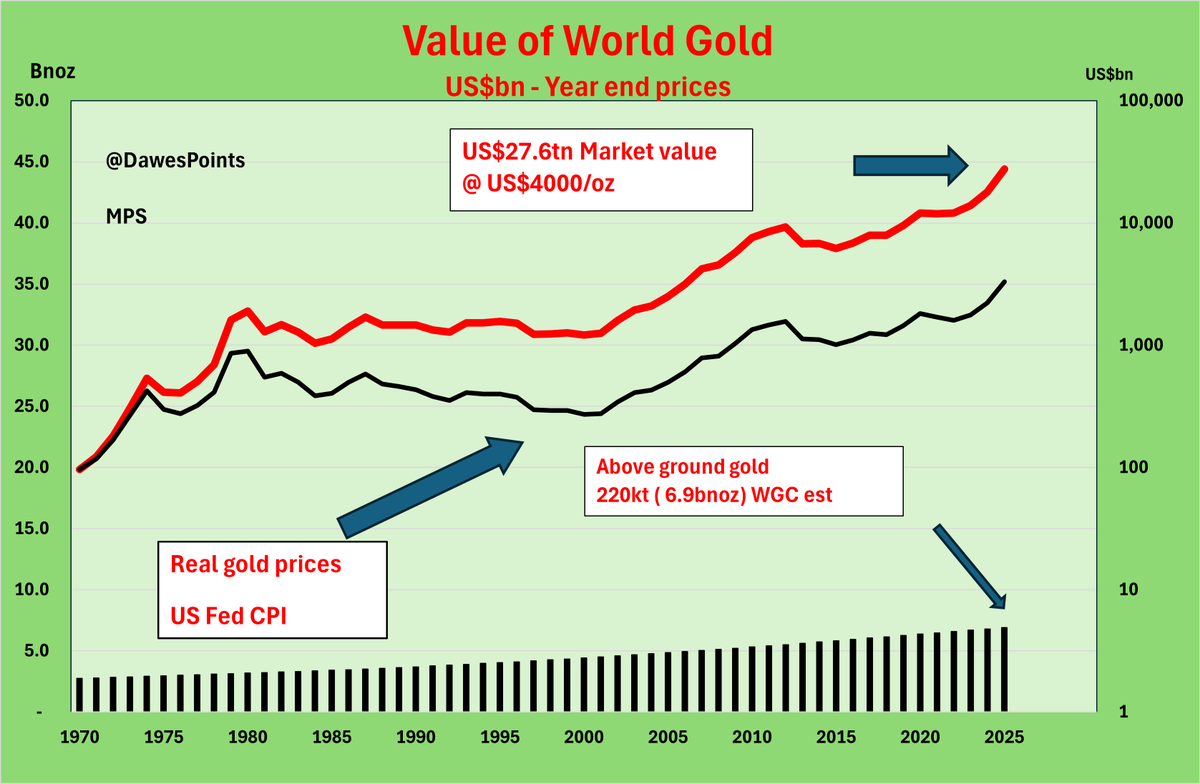

A big question. The US$ is clearly in a major bull market. The major currencies look very weak long term. US T yields are falling across the maturities. So is #gold worth $27tn mkt val? Can the $9tn 2025 gain hold (biggest yearly gain ever, in anything), let alone rise?…

Fascinating that the 6.9bnoz of global #gold at $4400 was worth $30.4tn and up ~$12tn in 2025. Was this the biggest market value gain ever? Today its $27.6tn at $4000. Big overhang to profit from the short side? How much buying is needed to push it to $5000 and $34.5tn?

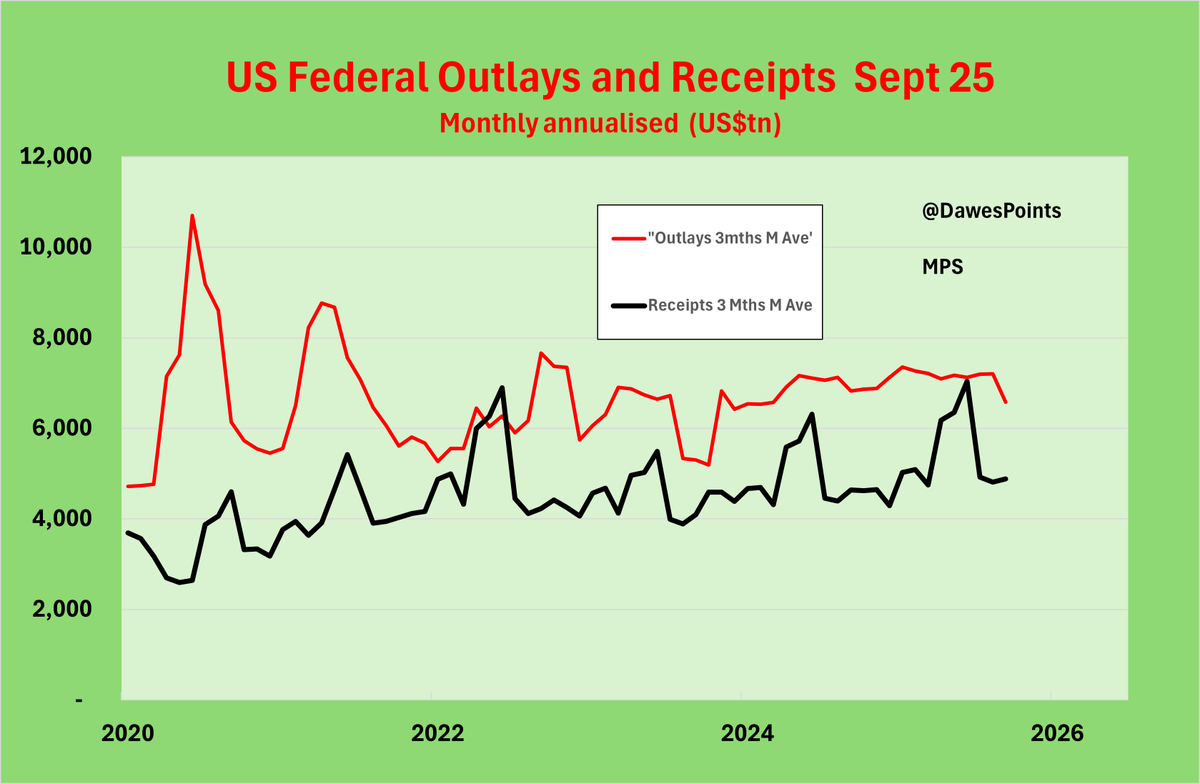

Budget Repair in the US brought a $198bn surplus in Sept and reduced FY25 by $200bn. TBill rates are plummeting so Int Exp peaking and CPI heading lower. TBond yields dropping and prices breaking higher. Uncrowded trade. US$ strong. Major LT peak in #gold.

Parabolas show increasing & peaking r of c of prices. The final stages soak up all the available buying power and emotional energy. Consensus market direction creates a bubble. Unwinding is not pleasant. All #gold's parabolas have ended in tears. No different this time.

The breakouts of these major resources companies bodes well for the coming global resources boom. Growing sales volumes, good product prices and excellent balance sheets driving dividend high yields. Their performances vs $NEM strongly suggesting #gold has peaked. $RIO $BHP

High gold prices have provided strong revenues and earnings to gold producers. Sadly share price performances are indicating the market is not expecting high gold prices for much longer. It seems goodbye kisses all round. #Gold heading lower. $NEM $GDX $AEM $XAU $B $KGC

US$ de-dollarizing not working very well at all. These major currencies are now in free fall & will be much lower in 2026. US Doctrine of Budget Repair, reduced Outlays, rising Receipts, tax cuts & falling Tbond yields is clearly driving capital inflows. Gold to follow…

Gold now retreating from a major LT high. De dollarisation is factually incorrect. US$ in LT bull Budget repair underway. Inflation declining Big Beautiful Bond Bull market.

Gold has ~$28tn market value and is up ~$12tn in 2025. A big & very profitable overhang. Everyone has his own set of technicals for #gold. These are mine. No support before $3500. Some at $3300 Some at $2900 Best at $2500. I am not in any competition. These are my…

United States 트렌드

- 1. $NVDA 75K posts

- 2. Jensen 23.4K posts

- 3. GeForce Season 5,574 posts

- 4. Peggy 38.8K posts

- 5. NASA 54.2K posts

- 6. #ใครในกระจกEP5 9,413 posts

- 7. Sumrall 2,355 posts

- 8. Martha 20.2K posts

- 9. Stargate 6,811 posts

- 10. Saba 11.1K posts

- 11. #WickedWaysToMakeABuck N/A

- 12. #WWESuperCardNewSeason 1,079 posts

- 13. Kwame 6,722 posts

- 14. Poverty 53.9K posts

- 15. Comey 58K posts

- 16. #2Kgiveaway 1,080 posts

- 17. Arabic Numerals 3,323 posts

- 18. Jason Crow 3,151 posts

- 19. EPS of $1.30 N/A

- 20. Halligan 29.4K posts

내가 좋아할 만한 콘텐츠

-

The Assay - Mining Magazine

The Assay - Mining Magazine

@TheAssay -

ResourcesRisingStars

ResourcesRisingStars

@RR_Stars -

Edward Gofsky

Edward Gofsky

@EdwardGofsky -

American Rare Earths Limited (ASX: ARR)

American Rare Earths Limited (ASX: ARR)

@ARRLimited -

Gavin Wendt

Gavin Wendt

@MineLifeReport -

Making Money Matter and Gold Events

Making Money Matter and Gold Events

@GoldEventsAU -

Nicholas Read

Nicholas Read

@nicholas_read -

Ken Watson

Ken Watson

@ken_kfwatson -

NWR Communications

NWR Communications

@NWRcomms -

The Mining Bartender

The Mining Bartender

@jtourzan -

TheHedgelessHorseman 🏇

TheHedgelessHorseman 🏇

@Comm_Invest -

Julia Maguire

Julia Maguire

@MsJuliaMaguire -

MakCorp

MakCorp

@makcorppl -

Simon

Simon

@sich8 -

High Grade 🚜⚒🌎🇺🇸🇨🇦

High Grade 🚜⚒🌎🇺🇸🇨🇦

@EconomicAlpha

Something went wrong.

Something went wrong.