Excel for CRE

@ExcelCRE

A duo of a CRE & Excel wizard. Both ex-Big4, now innovating CRE with spreadsheets. Startup survivors and opportunity seekers. Did we mention that we love Excel?

قد يعجبك

1/n Sam Zell, the high-stakes risk-taker who revolutionized real estate. His rise from humble beginnings to self-made billionaire is a journey full of twists and turns. Get ready as we unpack the fascinating life of this intriguing figure. #SamZell #retwit

👨💻Quick and easy Excel combo to auto-format your data: CTRL+A ALT+H+O+I ALT+H+O+A OR Code in: "Sub Autofit() Worksheets("Sheet1").Cells.EntireColumn.Autofit Worksheets("Sheet1").Cells.EntireRow.Autofit End Sub" into VBA and run it as a macro'🧠

Mezzanine loans carry higher risk, being repaid after primary lenders but before equity investors. Hence, the rewards are greater too, often yielding a combination of interest and equity upside. So, how do you manage and understand these risks and rewards?📉📈

Diving into the middle layer of #CRE financing, we find mezzanine loans - a vital tool for bridging the gap in your capital stack. Imagine you're buying a $10M property. You have $2M in equity and a $6M bank loan, leaving you short of $2M. This is where a mezzanine loan comes in.

Trust your instincts when it comes to #RealEstateInvesting. After all, your intuition is the culmination of all your experiences and knowledge. But remember, intuition isn't a replacement for due diligence. It's a tool to supplement it. So please use excel for the love of god.

Always important to have well organized excel models that provide you the most important metrics immediately. Toss away the napkins. Please.

How to quickly check a model - Stabilized yield 200bps+ above market cap rate - Stabilized price per key below market price per key - NOI margin at/below market - DSCR above 1.25x If all 4 check out, you probably have a very good deal

Ever heard of the 1% Rule in real estate investing? This quick check helps determine if a rental property's monthly rent will cover its mortgage. Use #Excel or #GoogleSheets to calculate it easily! #RealEstateInvesting

Rent roll management in #Excel can streamline your cash flow tracking as a #RealEstateInvestor. Automate due dates, late fees, and more with simple formulas!

Ever thought about visualizing your #RealEstateInvesting data? Use Excel's charting tools to spot trends in rental yields, appreciation rates, and more. A picture is worth a thousand words! #ExcelTips

Investors, are you making the most of depreciation? With #Excel or #GoogleSheets, you can easily track depreciation schedules for your rental properties. An essential for optimizing tax benefits! #RealEstate

What if we fell in love with Excel? That must be a saving grace right?

Hot take: Don’t fall in love from 22-29, there’s to much to lose. Your career will thank you.

New to #CRE? Consider bridge loans, a short-term financing tool designed to 'bridge' gaps between your immediate cash needs and long-term loans. It's like a stepping stone to help you secure that dream property while you arrange for traditional financing. #BridgeLoans #retwit

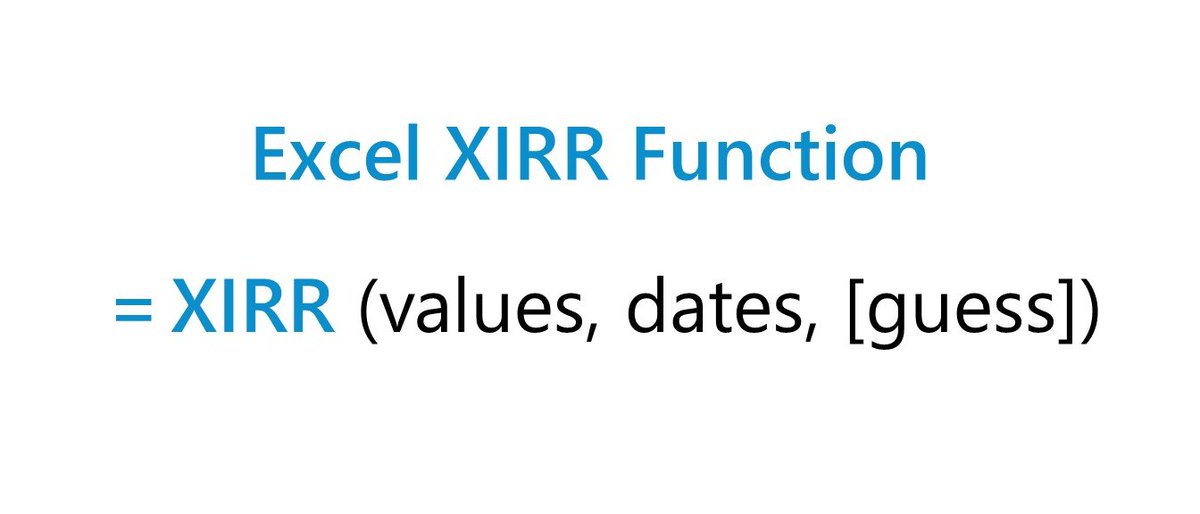

Still using IRR for evaluating real estate investments?🤔 Time to level up!📷 IRR assumes equal time intervals & same cash flows - not realistic at all. Enter #XIRR: it accurately calculates returns, accommodating varying cash flows and dates! #RealEstate

Some believe #AI will automate #CRE valuation and underwriting, eliminating the need for complex Excel models. Do you agree, or do you think the human touch will always be needed? #Retwit

When deciding on a commercial real estate investment, which metric should carry more weight - DSCR or Yield? Make your choice and let us know why! #CRE

صوت 1 · النتائج النهائية

Forecast with finesse📈, not just guesswork! Have you used the FORECAST.ETS function in Excel to predict rental revenue in your #CRE models. Comment "me" if would you find a step-by-step guide helpful!👇

United States الاتجاهات

- 1. Cheney 73.9K posts

- 2. Sedition 142K posts

- 3. Treason 84.9K posts

- 4. Mark Walter 1,169 posts

- 5. First Take 45.7K posts

- 6. Jeanie 1,532 posts

- 7. Cam Newton 3,927 posts

- 8. Seditious 75.4K posts

- 9. Trump and Vance 35.5K posts

- 10. Elon Musk 287K posts

- 11. Constitution 103K posts

- 12. #WeekndTourLeaks 1,445 posts

- 13. Commander in Chief 46.1K posts

- 14. Shayy 11.8K posts

- 15. Nano Banana Pro 21.8K posts

- 16. Coast Guard 18.1K posts

- 17. Seager N/A

- 18. #Geeksgiving25 N/A

- 19. Dameon Pierce N/A

- 20. #ExpediaChat 1,210 posts

قد يعجبك

-

Daniel Aviles (Apartment Brokerage Expert)

Daniel Aviles (Apartment Brokerage Expert)

@multifamilydan -

CRE8 Advisors

CRE8 Advisors

@CRE8Advisors -

Reid Lanigan

Reid Lanigan

@RetailReid -

The Criterion Fund🎙️

The Criterion Fund🎙️

@CriterionFundOK -

Jordon

Jordon

@jordonriver47 -

Camella Homes Real Estate Agent

Camella Homes Real Estate Agent

@Camellaagent20 -

Michael

Michael

@MichaelBrett79 -

Jacob P. Quinn

Jacob P. Quinn

@JPQRisk -

Porter Anderson | BirdHouse CRE

Porter Anderson | BirdHouse CRE

@BirdHouseCRE -

Genessy Jaramillo

Genessy Jaramillo

@GenessyCRE -

Matthew Francis

Matthew Francis

@mattfranciz -

Anton Mattli - CRE Finance

Anton Mattli - CRE Finance

@AntonMattli -

Best Corporate Real Estate

Best Corporate Real Estate

@BestCorpRealtor -

T

T

@T4242033532960

Something went wrong.

Something went wrong.