Gerobos

@Gerobos

Authorised Financial Services Provider. Integrity, consistency and quality underpin the Gerobos strategy. (Retweets are not endorsements)

You might like

Why aren't you tagging your fellow comrades 🤷🏽♂️ Let's help you @Lesufi @LebogangMaile1 @DadaMorero

Investing in times of war.

Well, I've been doing my best to prepare people for this bloody awful war, as well as for its financial consequences: bloomberg.com/opinion/articl… and bloomberg.com/opinion/articl…

@Naspers @Prosusgroup Has the time not come to change tack on your strategy? What are you going to do to urgently unlock the R422bn of value being denied to the South African savings industry? To all the SA Fund managers youtu.be/r6ngLaD4J6E

youtube.com

YouTube

Sean Peche slams Naspers/Prosus management, a voice for South African...

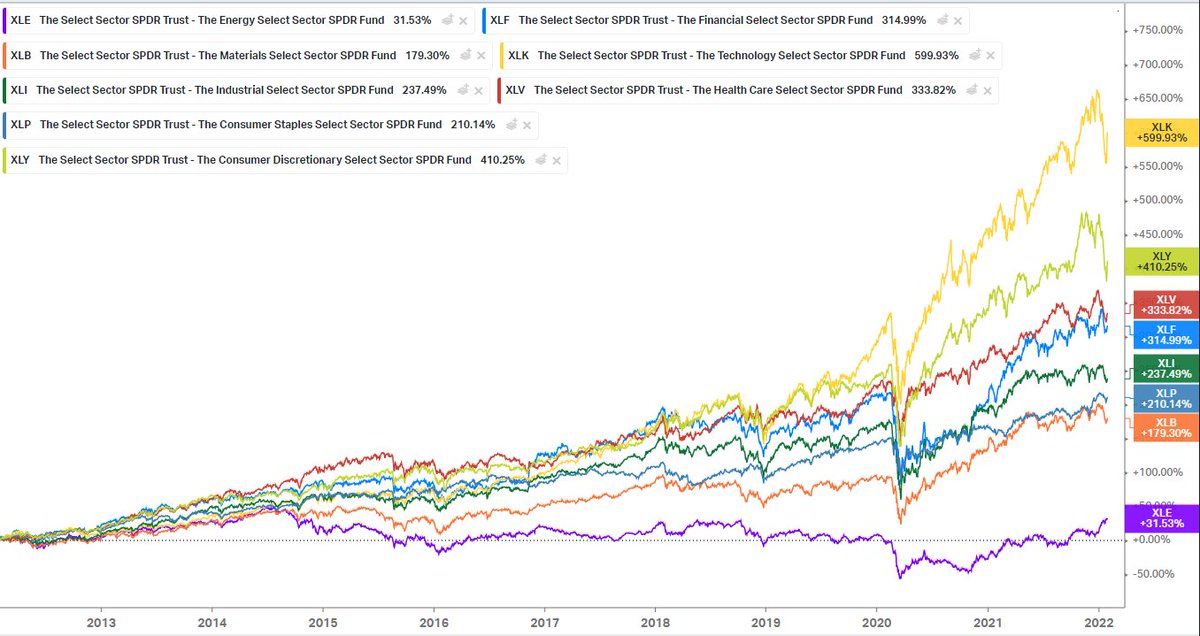

U.S. Sector Total Return Comparison (10-yr): $XLK (Technology) +599.93% $XLY (Cons. Discre.) +410.25% $XLV (Healthcare) +333.82% $XLF (Financials) +314.99% $XLI (Industrials) +237.49% $XLP (Cons. Staples) +210.14% $XLB (Materials) +179.30% $XLE (Energy) +31.53%

What an incredible stat. Shows the collapse in market breadth.

In 2021 the the median US stock was down 20% and yet the S&P 500 ended the year up 27%.

$PTON $ARKK

I bought a Peloton bike 6 months ago and have used it 0 times If I had just bought $PTON stock instead, at least I'd still have 25% of my money left

Franklin Templeton says that foreign interest in SA stocks is growing, but reforms are needed. The asset manager views SA market valuations as attractive, including sectors trading at levels that price in an excessively gloomy economic picture. @FTI_Global citywire.co.za/news/foreign-i…

Top story | UK minister throws tourism a lifeline with signal SA will be off ‘red list’ bit.ly/3Bd6ZMs 🔒

New report raises significant doubts on the sustainability of a basic income grant for South Africa businesstech.co.za/news/finance/5…

CPIJSE - Viceroy appealing fine

WORLD BANK REITERATES THAT IT CANNOT GIVE EL SALVADOR ASSISTANCE ON BITCOIN GIVEN ENVIRONMENTAL AND TRANSPARENCY SHORTCOMINGS

#Evergrande - China’s and world’s largest RE developer, with $ 15-16bn in offshore debt and more than $300bn in total liability - is on the verge of default and it’s bonds trading at 27c on the dollar. This is not making enough headlines given the systemic risk involved here imho

Very excited to let you know that the #IfIMust-braai range is here! As many of you know, I’m not a huge fan of sauces, but if you must use them, try using these. I’m doing 40 boxes which will include 1 marinade and 1 basting sauce. Pre-orders are open: forms.gle/wffxsqYEu3PFRg…

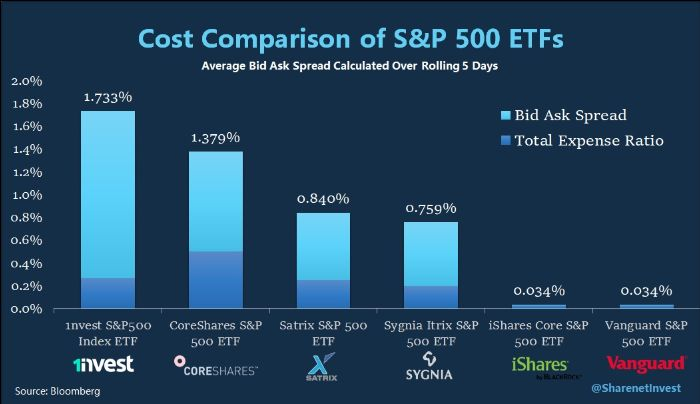

SP500 ETF cost comparison.

Looking to invest in #ETFs to gain access to Offshore Markets? We did a cost comparison investing in the S&P500, using a SA listed Rand #ETF versus investing direct (Offshore using a USD Share Portfolio acc) More insight in our EASY INVESTING Newsletter: mailchi.mp/2317cdb130e1/e…

PIC selling their MUR stake in the open market. Only 50 mil odd shares to go...

How The Holy Spirit Moved Cathie Wood To Become The Pied Piper Of Robinhood Traders zerohedge.com/markets/how-ho…

Naspers/Prosus: South African SoftBank divides and hopes to conquer ft.com/content/c49269…

United States Trends

- 1. Alcaraz N/A

- 2. Shakur N/A

- 3. Djokovic N/A

- 4. Happy Black History Month N/A

- 5. #AustralianOpen2026 N/A

- 6. Good Sunday N/A

- 7. Career Grand Slam N/A

- 8. Muhammad Qasim N/A

- 9. #AO26 N/A

- 10. #AusOpen N/A

- 11. #LingOrmTaipeiFanmeeting N/A

- 12. LINGORM TP FANMEET N/A

- 13. And Mary N/A

- 14. Career Slam N/A

- 15. Carlitos N/A

- 16. #LENAMIUBorn2Shine N/A

- 17. Tank N/A

- 18. LENAMIU 1ST FAN MEETING N/A

- 19. Happy New Month N/A

- 20. Taylor Rehmet N/A

Something went wrong.

Something went wrong.

![hilary_katz's profile picture. Active trader for 54 years. Technical chartist. News synthesizer. Passionate mentor - here to help, just ask! Timing is everything. [Comments are not advice]](https://pbs.twimg.com/profile_images/781765563043438592/kSHrbtTk.jpg)