Time isn't money, its much more valuable than that

🦔HSBC built a model to figure out if OpenAI can actually pay for all the compute it's contracted. The answer is no. OpenAI has committed to $250 billion in cloud compute from Microsoft and $38 billion from Amazon, bringing contracted compute to 36 gigawatts. Based on total deal…

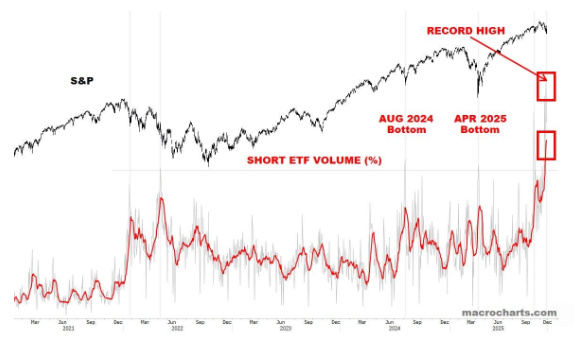

Traders are now shorting ETFs at the fastest pace in history 🚨🤯👀

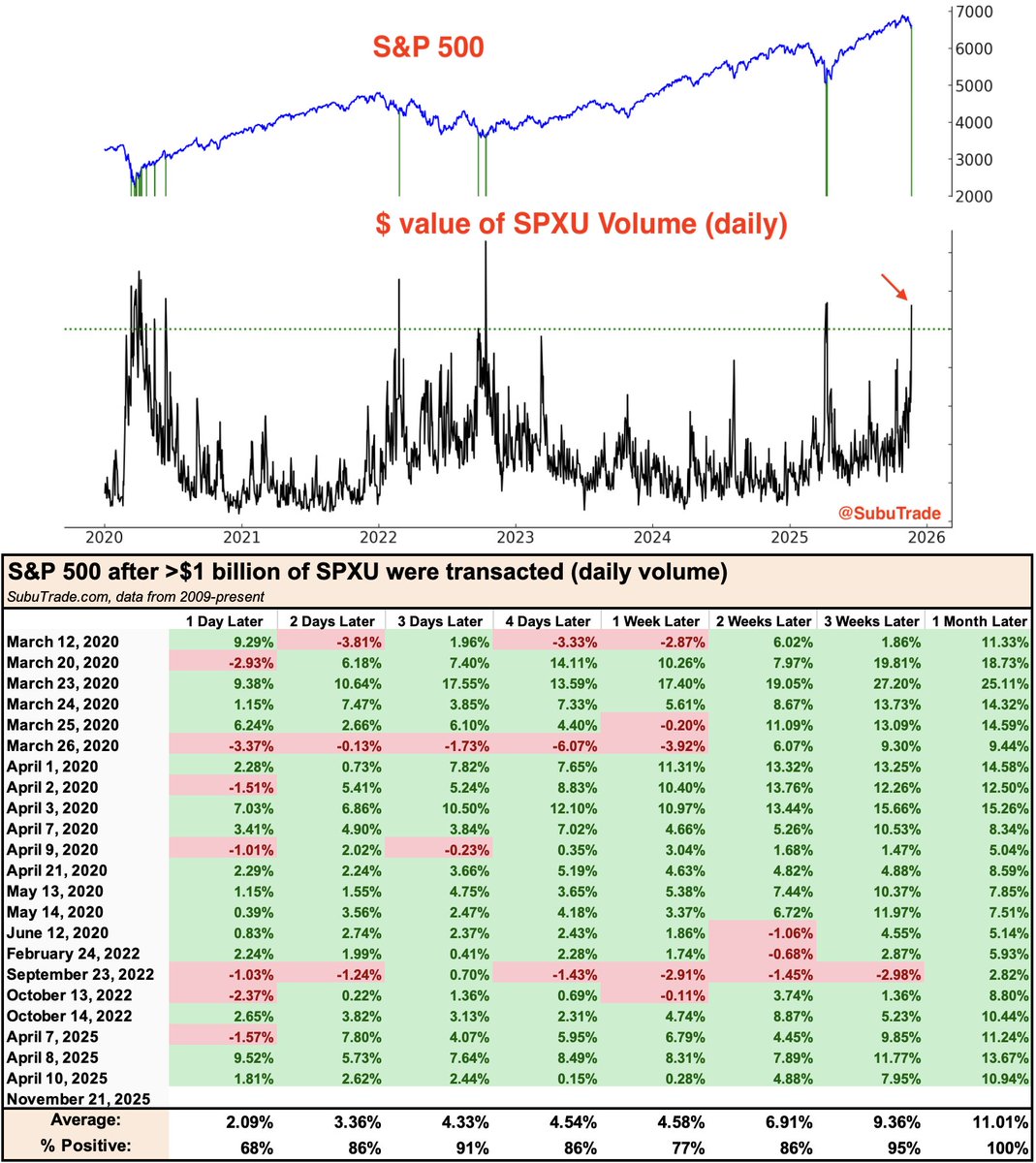

Huge bets against $SPX? On Friday, more than $1 billion of $SPXU were transacted. (SPXU is -3x short S&P 500 ETF) Past spikes marked major bottoms: 1. COVID bottom 2. 2022 bear market's first wave bottom 3. October 2022 (bear market bottom) 4. April 2025 (Liberation Day…

Insider selling is mostly noise. Insider buying is mostly signal.

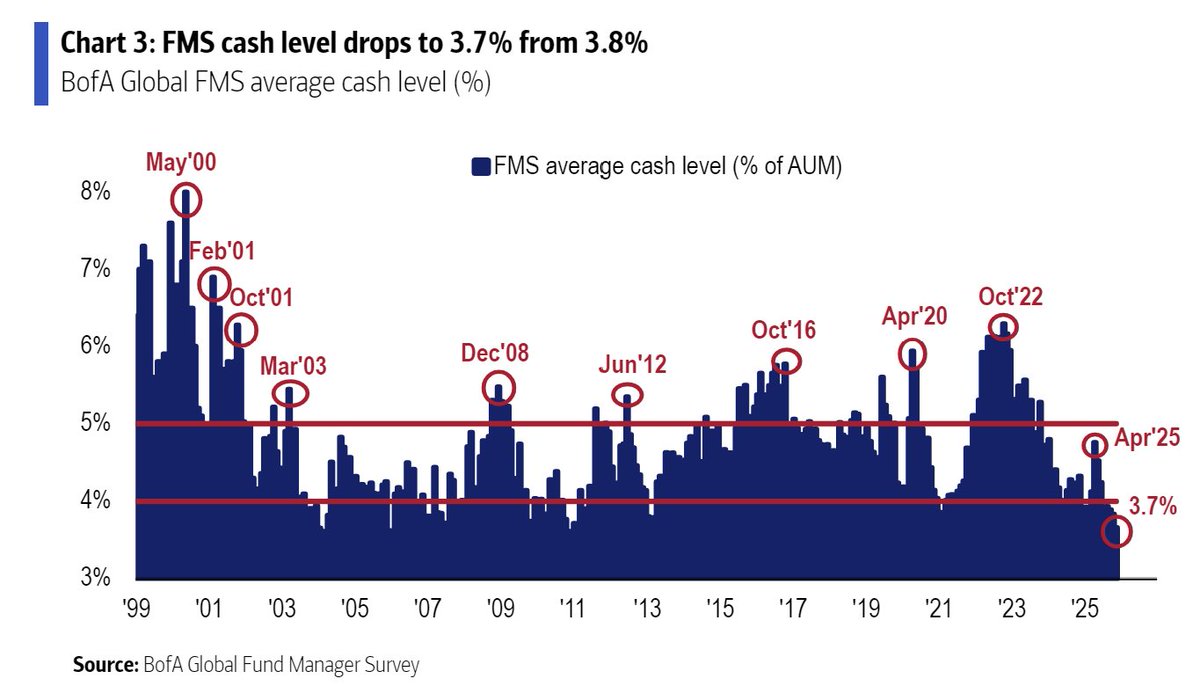

Fund Manager cash allocations reach warning levels (contrarian bearish signal) "cash levels of 3.7% or lower has occurred 20 times since 2002, and on every occasion stocks fell and Treasuries outperformed in the following 1-3 months"

🇯🇵 #JAPAN 10-YEAR GOVERNMENT BOND YIELD RISES TO HIGHEST SINCE 2008 - BBG

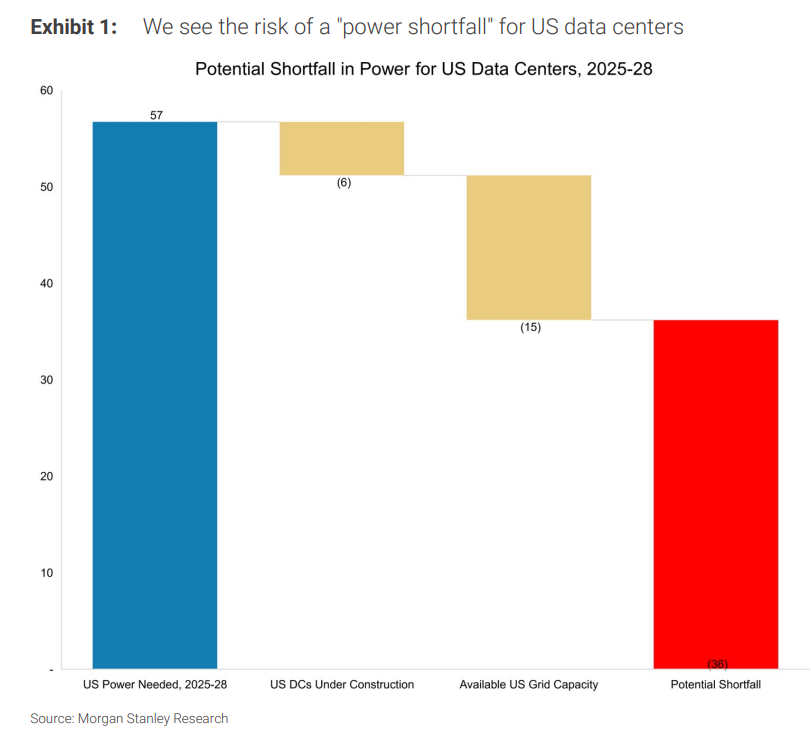

One year later, the staggering energy shortfall to power the AI revolution rises from 36GW to 44GW. At $60BN per GW, this is $2.5 Trillion in grid funding needed and EXCLUDES the $2 Trillion needed to build the actual data centers (source Morgan Stanley).

Wow: "In 2025-28, we project ~57 gigawatts (GW) of US data center power demand, and we quantify available power capacity to serve this demand as: near-term grid access of ~12-15 GW, plus ~6 GW of data centers under construction, resulting in a ~36 GW shortfall of US power…

Citi opens a 30-day upside catalyst on $NVDA and lifts its PT to $220 (from $210), keeping a Buy. The firm expects a “beat and raise” on Nov 19, modeling Oct-Q revenue of ~$57B (vs Street ~$55B) and Jan-Q guide of ~$62B (vs ~$61B). “Supply is the bottleneck, not AI demand.” The…

UBS SAYS S&P 500 COULD HIT 7,500 IN 2026 UBS is forecasting the S&P 500 to reach 7,500 next year, driven by ~14% earnings growth, with nearly half of that coming from tech. They see a “soft patch” in the near term as tariffs work through the economy, but expect growth to pick…

Silver is reclaiming the all-time high anchored VWAP 👀

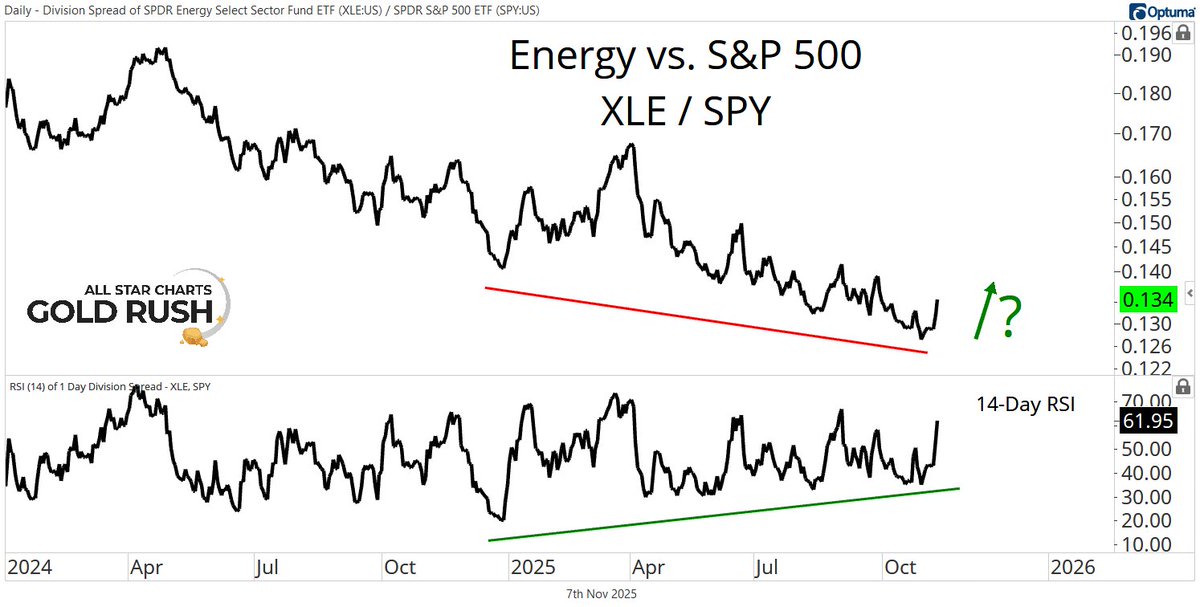

ARE YOU WATCHING THE OIL SECTOR ?!?!

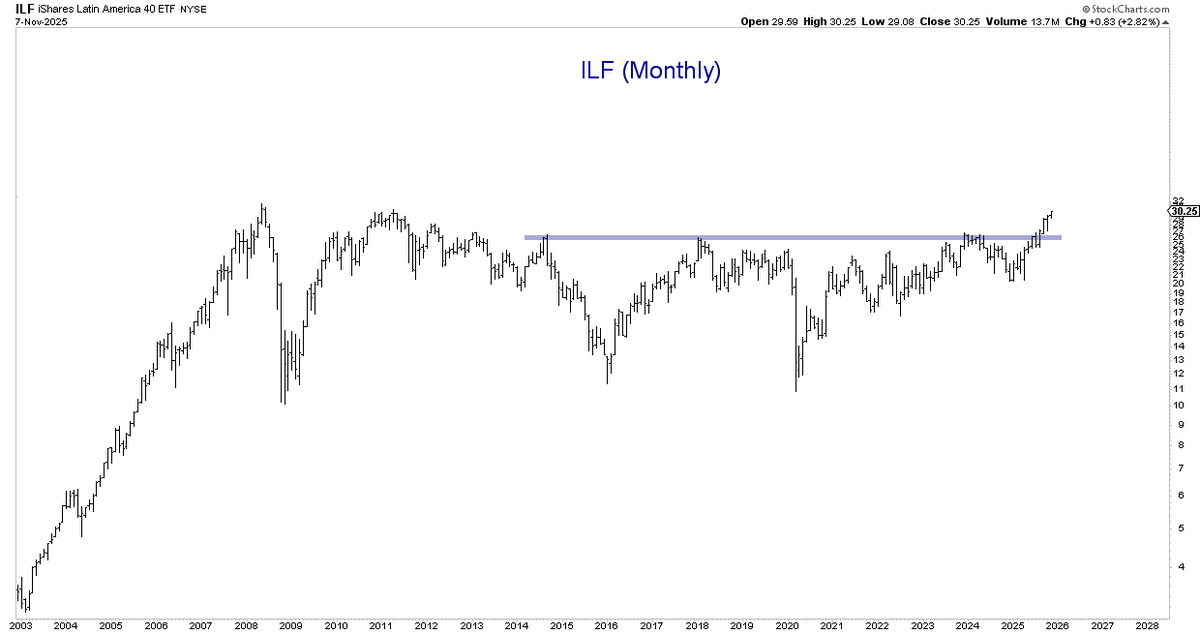

Meanwhile, LATAM is firing on all cylinders. $ILF $EWZ $EWW $ECH $COLO

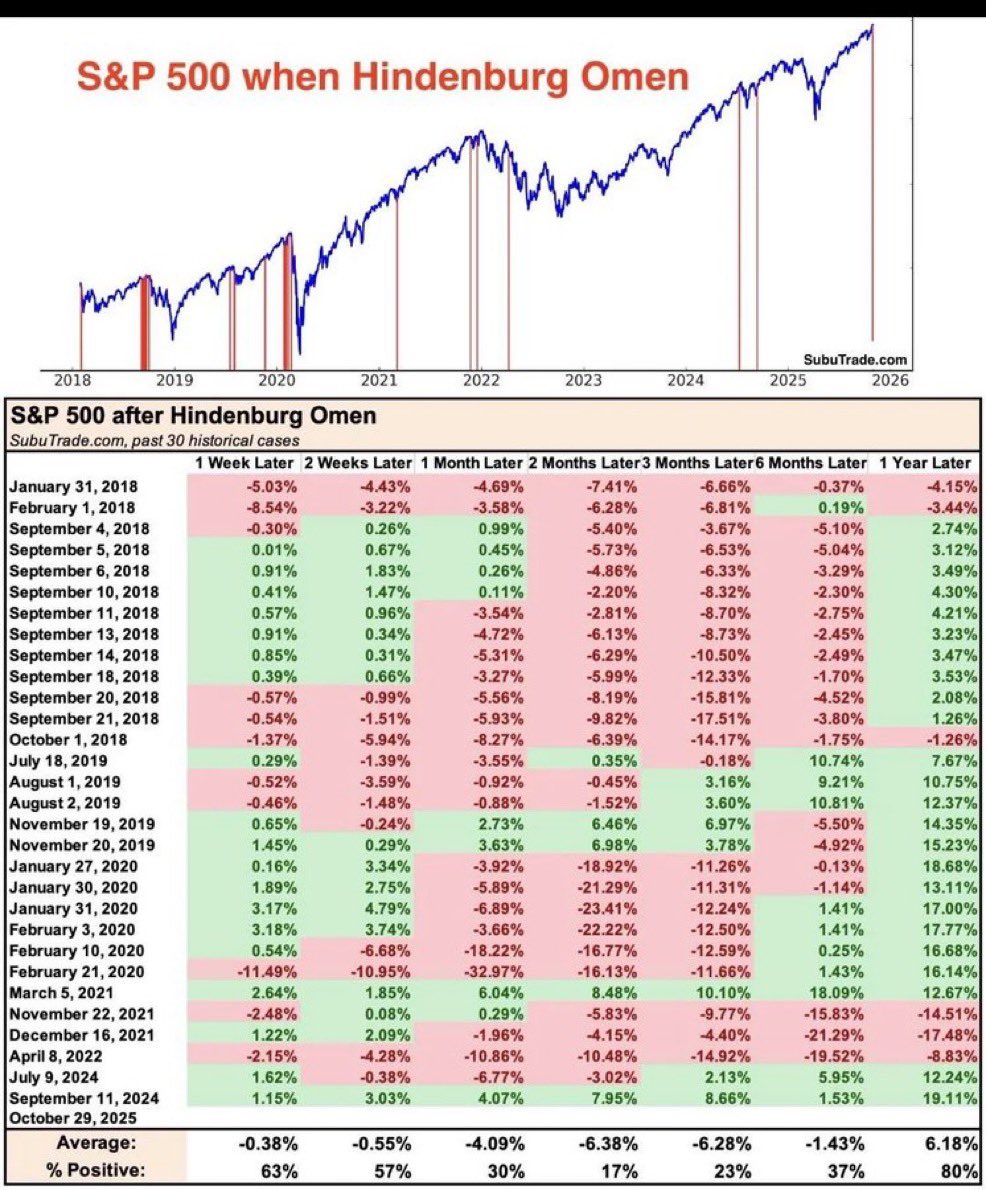

I'll be honest, I don't pay much attention to Hindenburg Omen's, and I wasn't even aware there was a "Titanic Syndrome" (which apparently is when w/in 7 days of a new high the number of new 52-week lows exceeds highs), given how infrequently it seems these things pan out, but…

I look at hundreds of charts a day. 📈📊📉 After the bell, I curate the best ones and send them to investors. Subscribe to be one of them 👇 dailychartbook.com

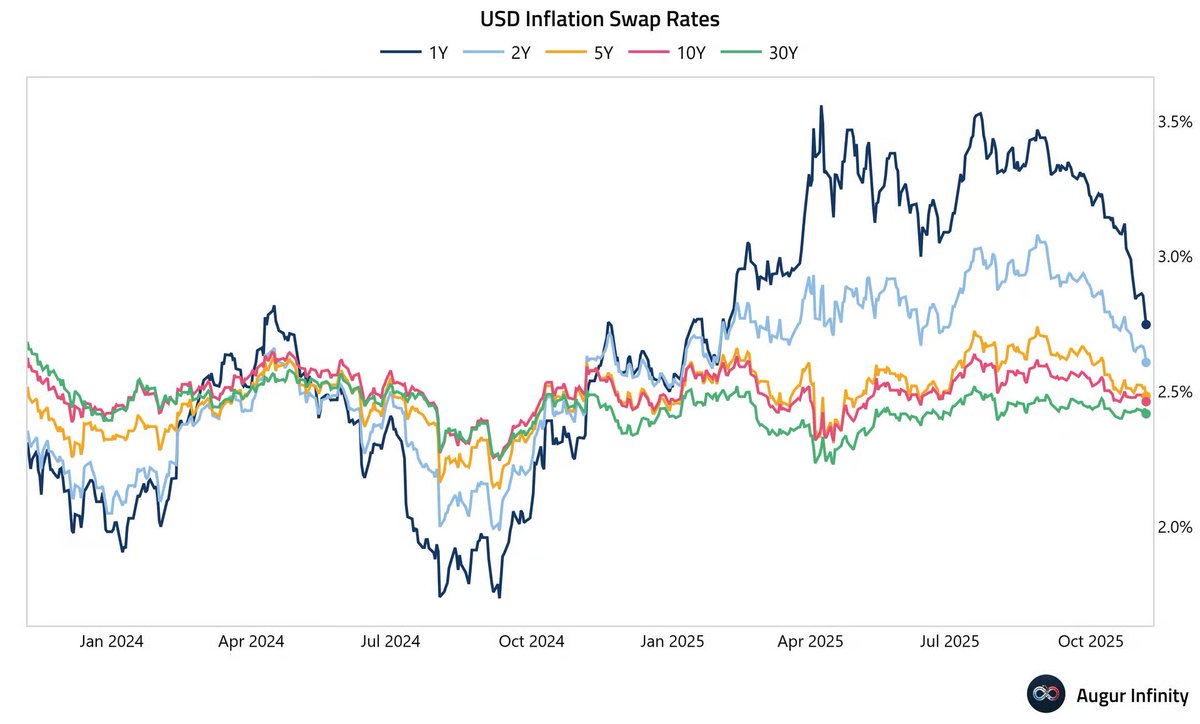

"Market-based inflation expectations falling like a rock: 1yr inflation swap now under 2.75% for the first time since early February." @MikeZaccardi @AugurInfinity

Exxon Mobil is a nose hair away from triggering a fresh buy signal on the long-term momentum indicator. The last time this happened? The stock doubled. Wen moon, @exxonmobil?

This is what a sold-out downtrend looks like 👇🏼 allstarcharts.com/all-star-chart…

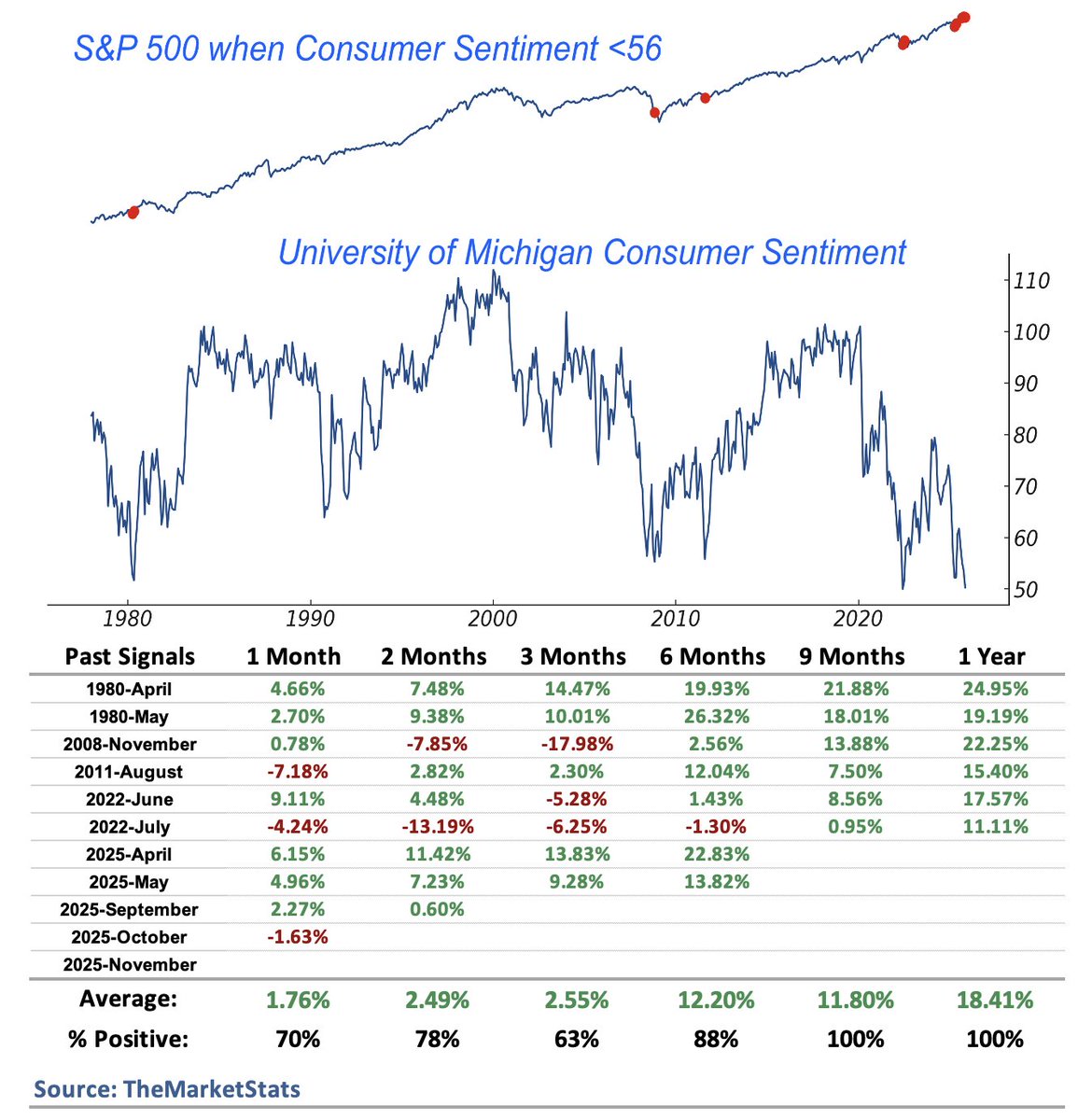

Consumer sentiment collapse?? University of Michigan's Consumer Sentiment index just fell to the 2nd lowest reading ever! This is BULLISH for $SPX

When you add in the fact 3 have occurred in quick succession that’s a whole new ball game. January - February of 2026 isn’t looking too good. Data from @SubuTrade.

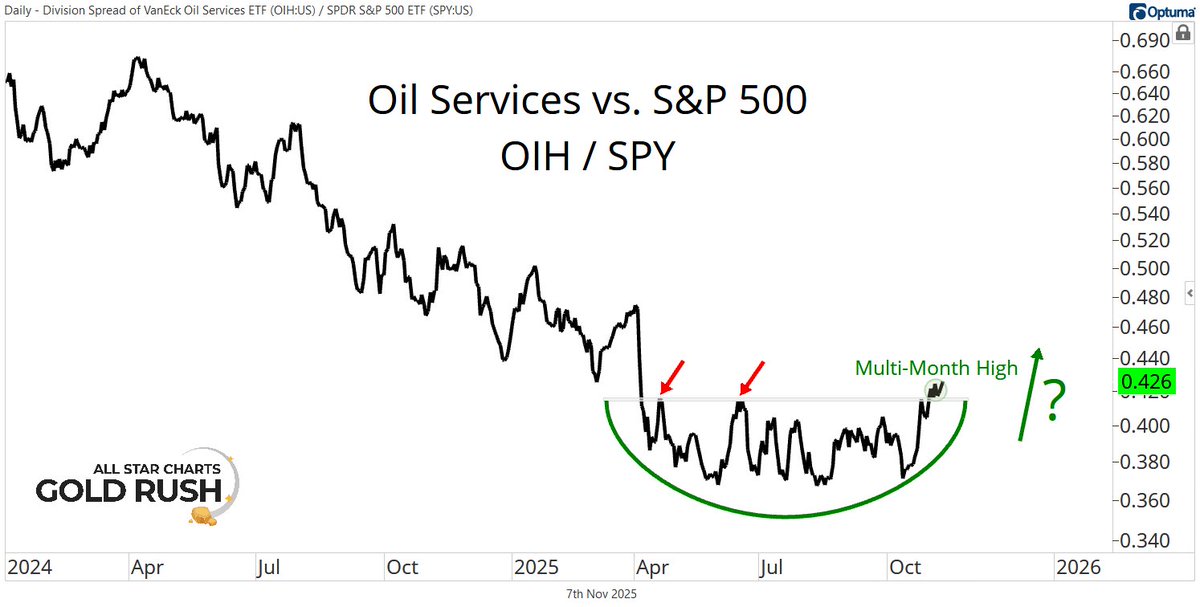

Oil Services are making new multi-month highs, too. These are some of the wildest and most offensive stocks in the energy sector.

United States 趨勢

- 1. Eagles 117K posts

- 2. Jalen 25.7K posts

- 3. Ben Johnson 11K posts

- 4. Caleb 45.9K posts

- 5. AJ Brown 4,955 posts

- 6. #BearDown 2,084 posts

- 7. Philly 24K posts

- 8. Patullo 10.9K posts

- 9. Sirianni 6,450 posts

- 10. Black Friday 511K posts

- 11. Swift 57.2K posts

- 12. Swift 57.2K posts

- 13. Lane 53.6K posts

- 14. #CHIvsPHI 2,394 posts

- 15. Saquon 7,507 posts

- 16. NFC East 1,585 posts

- 17. Gunner 5,191 posts

- 18. Nebraska 14.3K posts

- 19. Howie 2,242 posts

- 20. Tush Push 6,124 posts

Something went wrong.

Something went wrong.