Order Flow Adventures

@OrderFlowAdv

ES / NQ Futures trading ideas, edutainment and journal using charts, order flow tools, MGI + "back of napkin math." For entertainment. NOT FINANCIAL ADVICE.

你可能會喜歡

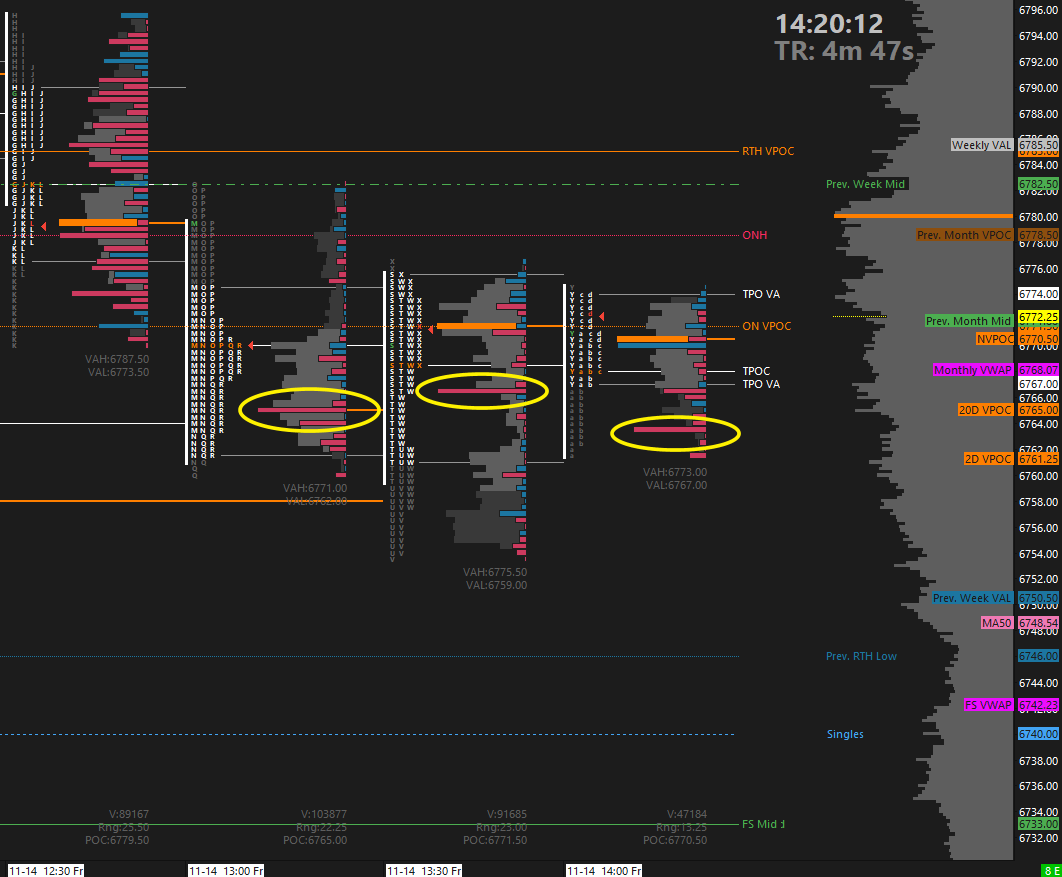

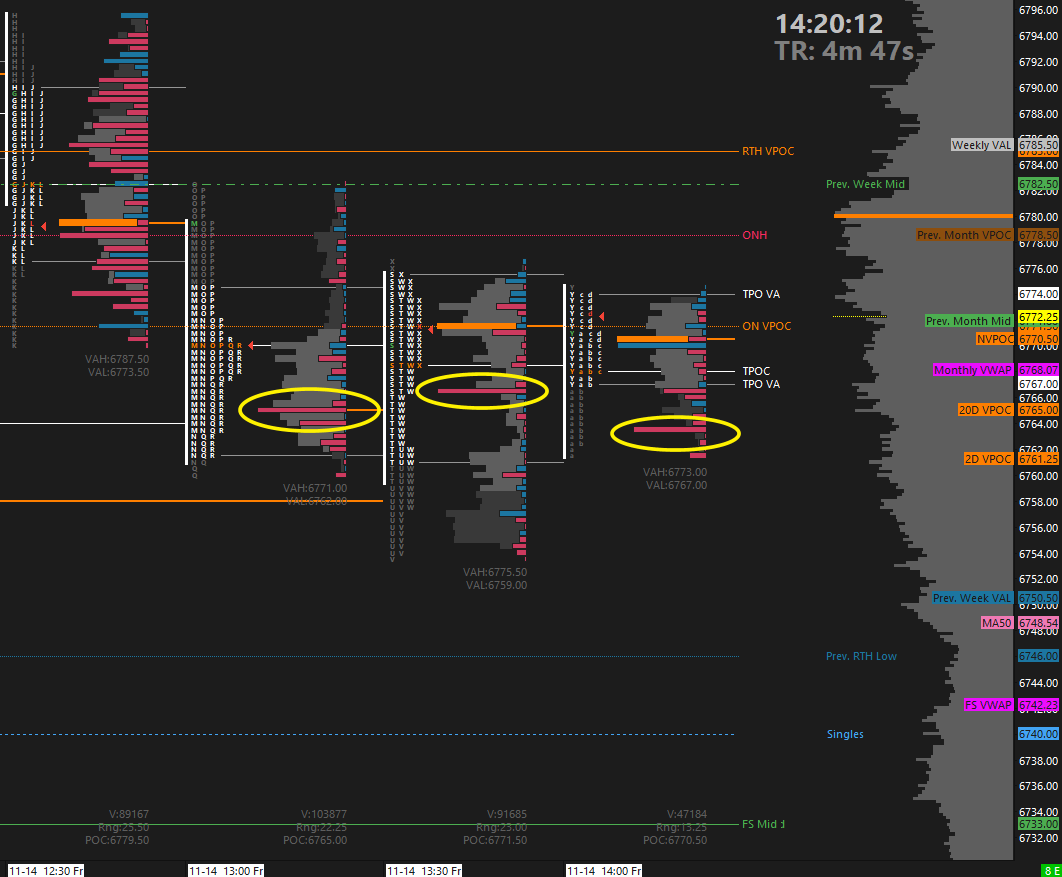

Been watching absorption around 6763 - 6766 in ES. Took a few small XSP scalps on the idea they were going to hold above ES 6750 (near prior day lows). No position currently, but was expecting a possible move back up toward HOD. Happening now.

Been watching absorption around 6763 - 6766 in ES. Took a few small XSP scalps on the idea they were going to hold above ES 6750 (near prior day lows). No position currently, but was expecting a possible move back up toward HOD. Happening now.

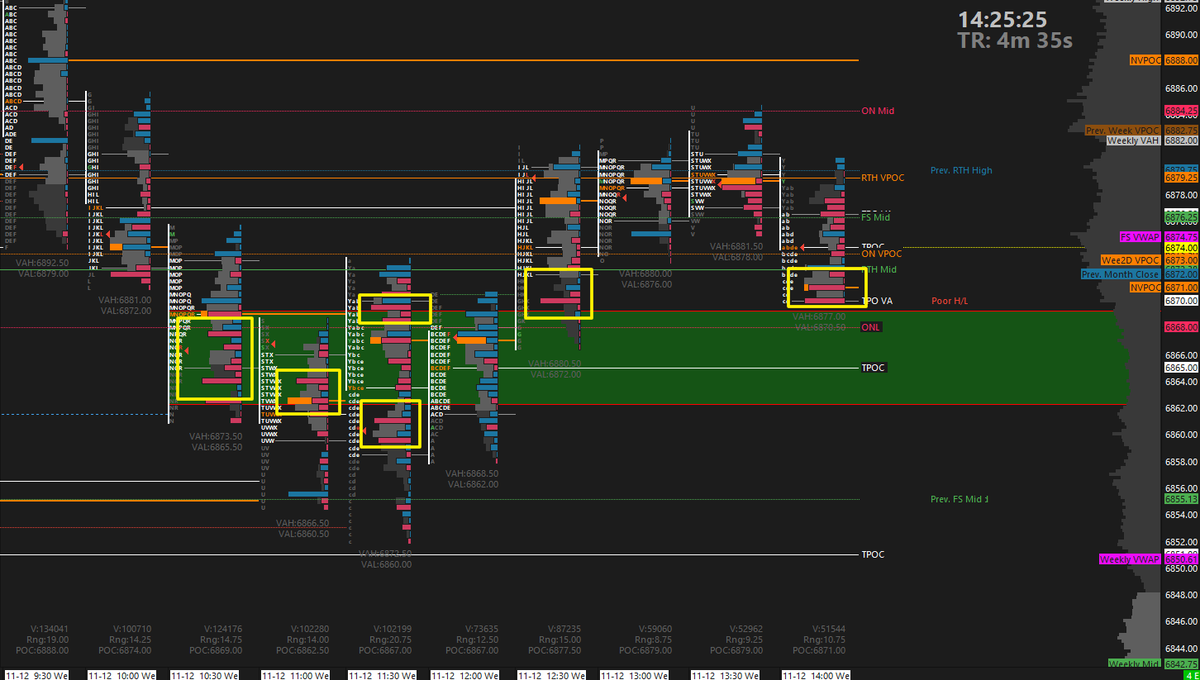

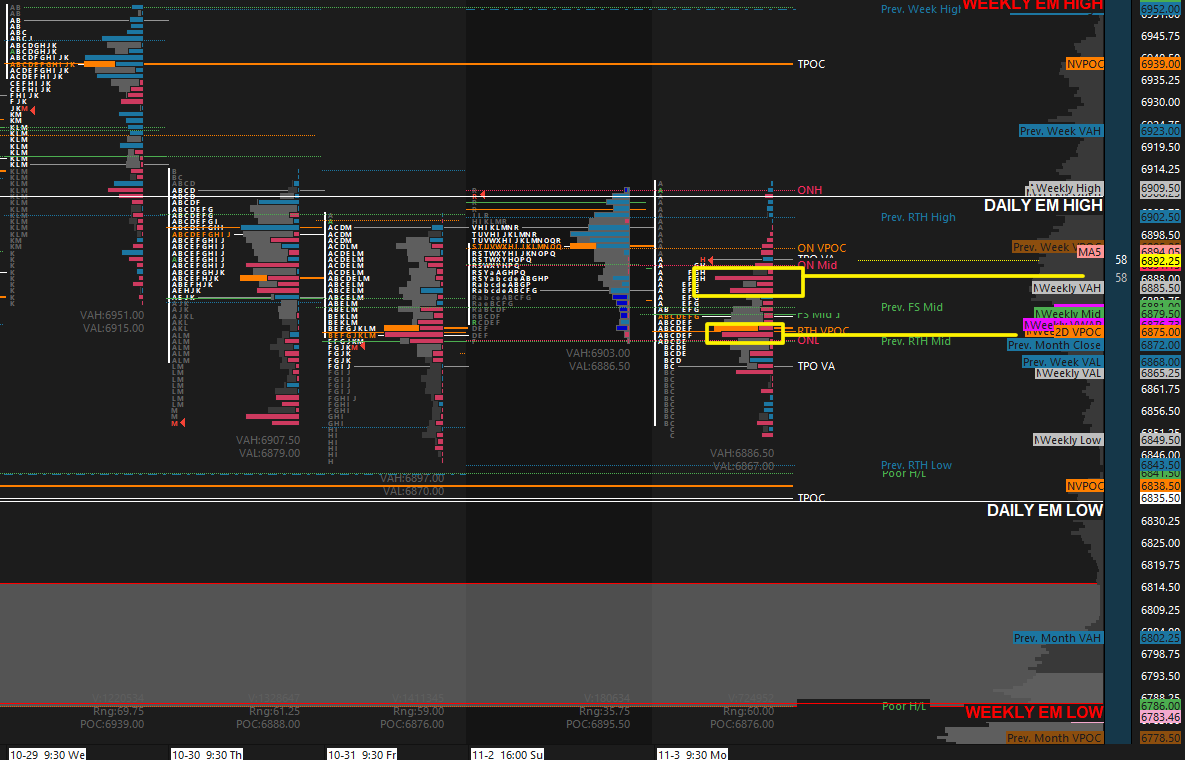

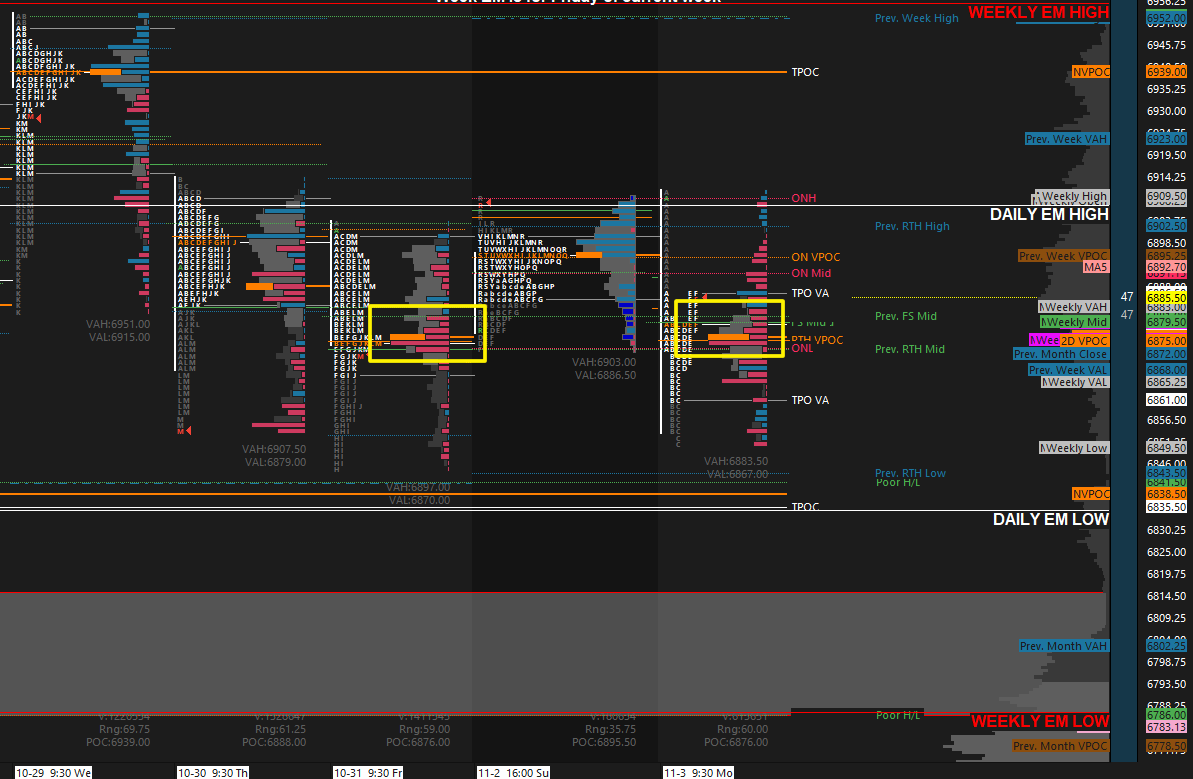

Lots of absorption under $ES 6870. Lean into EOD is bullish with SPX having largest call volume at 6870, but dependent on SPX 6850 holding.

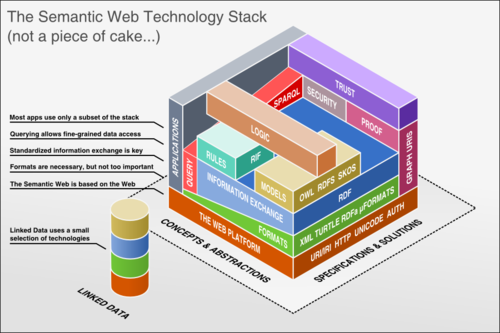

Trading tools should have accurate data. Often enough I find bugs in software that is costing $50-100/month for a subscription. People make trading decisions off of data they think is accurate. Your job as a service provider is to try to keep the bugs minimal and the data as…

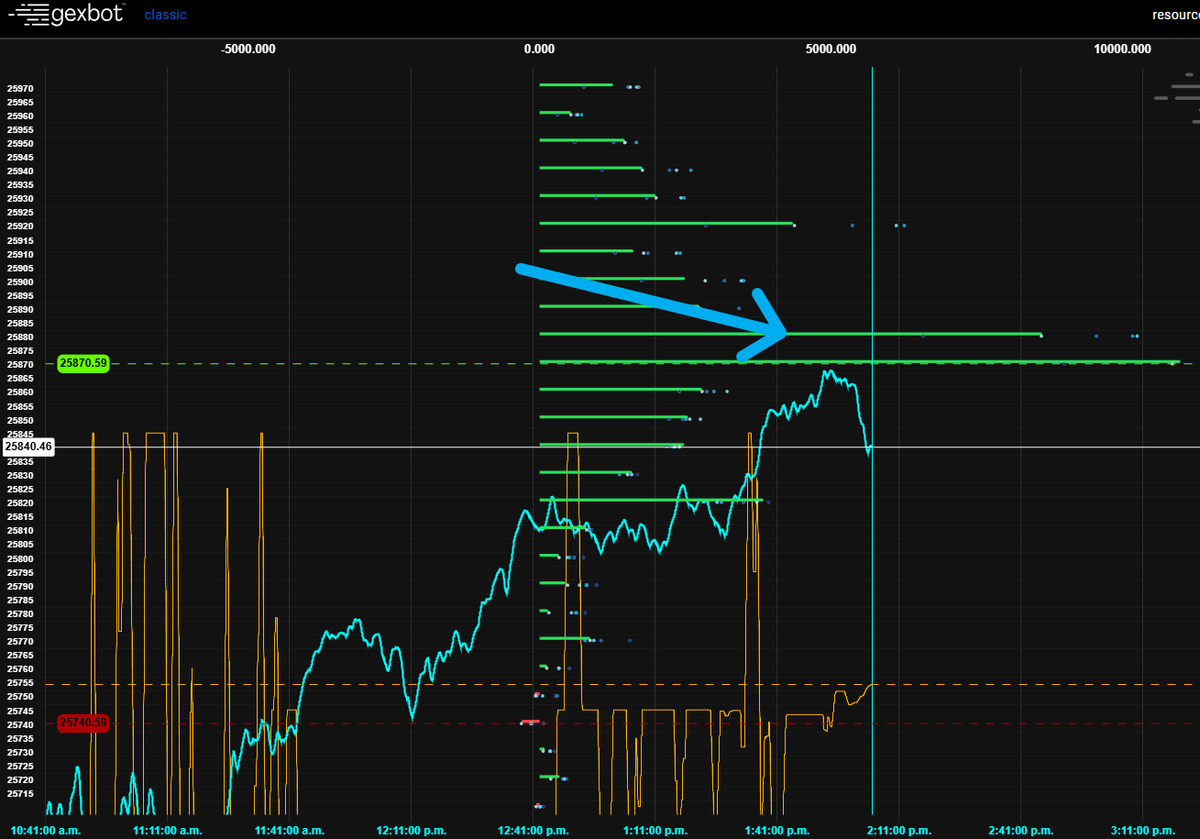

11/5/25 @ 2:00pm - $NQ tagged largest GEX level on the day (25870). Saw that a bit ago and seemed like that might happen before a larger pull-back. Finally getting a pull-back.

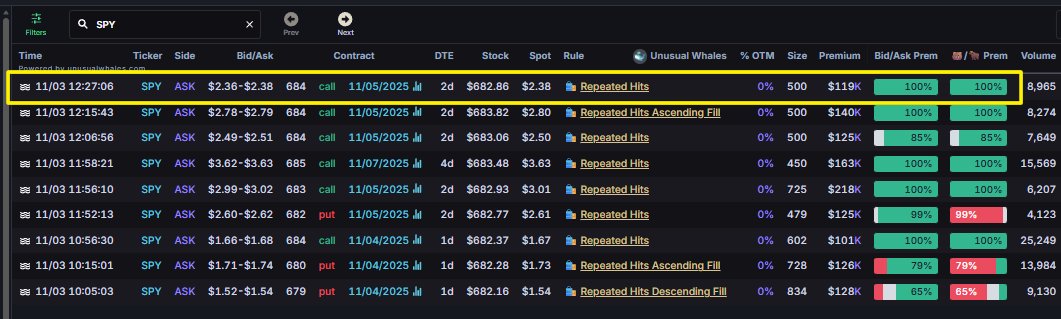

11/5/25 @ 12:15pm - Larger $SPY calls keep coming in, some for next few days, some a bit further out.

Negative delta at $ES 6885 & 6888 now the area to hold above. Otherwise back toward 6875, possibly 6865.

Someone still buying SPY 684c that expire 11/5 at 12:27pm.

Right after that post, big candle down lol. I got in an XSP 684p when I saw large volume candles in recent trading. Took very quick profits (small). Will see what happens if price trades back toward 685.50-686.00 in XSP.

11/3/25 @ 12:24pm - More negative delta put in today around the 6875 level in $ES. With price above now, will again use 6875 as bearish/bullish sentiment on the day in the afternoon session. Expected potential of balance in Thu/Fri ranges, which has happened thus far. Flush…

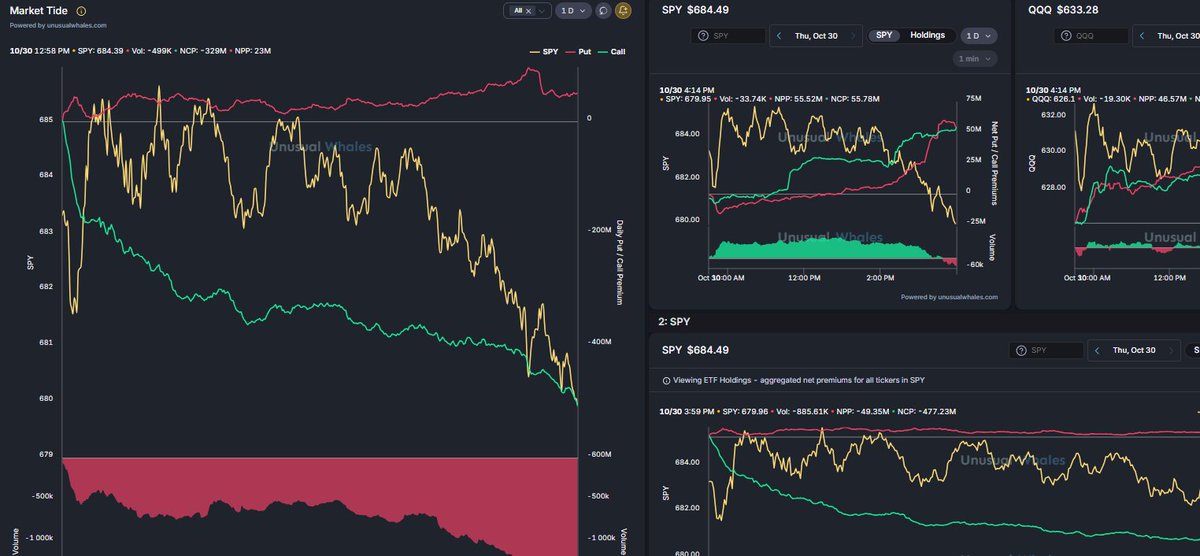

10/30/25 EOD - $SPY Market Tide (left), $SPY Holdings Premium (bottom right) on the day, SPY & $QQQ Premiums (top right).

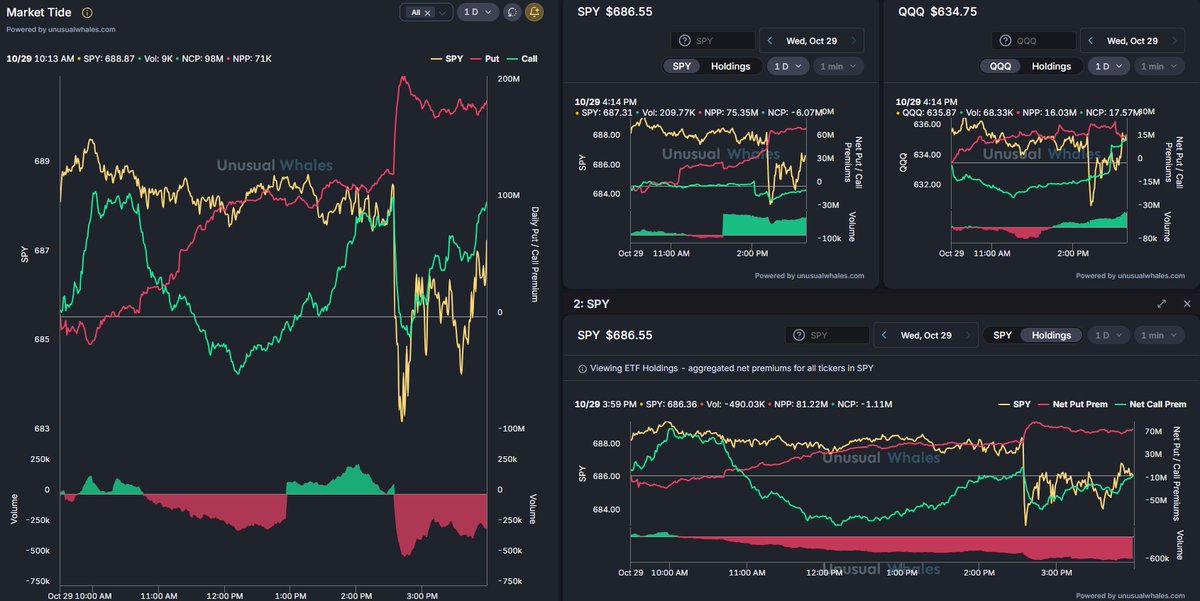

10/29/25 EOD - $SPY Market Tide (left), $SPY Holdings Premium (bottom right) on the day, SPY & $QQQ Premiums (top right).

DOW finally hit close to morning lows. Saw this earlier, with ES/NQ already below those lows.

Recent small put premium drop on SPY, rise in call premiums in QQQ / SPY Holdings causing call premiums to rise on Market Tide. So, some bullish developments on these charts that coincides with recent bounce higher.

United States 趨勢

- 1. Ukraine 447K posts

- 2. #FanCashDropPromotion 3,236 posts

- 3. Le Cowboy N/A

- 4. #FursuitFriday 12.4K posts

- 5. Putin 147K posts

- 6. #pilotstwtselfieday N/A

- 7. #FridayVibes 6,462 posts

- 8. Dave Aranda N/A

- 9. #TrumpCrushesYourDreams 2,340 posts

- 10. Kenyon 1,663 posts

- 11. ON SALE NOW 12.9K posts

- 12. Sam LaPorta N/A

- 13. Good Friday 70.1K posts

- 14. SINGSA LATAI EP4 165K posts

- 15. October CPI 1,414 posts

- 16. Fang Fang 13.4K posts

- 17. Eric Swalwell 5,822 posts

- 18. John Wall N/A

- 19. UNLAWFUL 150K posts

- 20. Ja Rule 1,837 posts

你可能會喜歡

-

Tom Baiz

Tom Baiz

@baiz_tom -

Ralph Blicker, CPA

Ralph Blicker, CPA

@ralph_b63 -

Ad F

Ad F

@AdamFuz -

Erik

Erik

@meechisdeadd -

techSavvy

techSavvy

@tradifySavvy -

miro

miro

@stokesjmike1 -

Scott Lindberg

Scott Lindberg

@ScottLindberg -

vlex103

vlex103

@vlex103 -

TrainWreck79

TrainWreck79

@TrainWreck_79 -

Raj

Raj

@rajboshmahal -

HolderBaggins

HolderBaggins

@HolderBaggins -

B from NC

B from NC

@NCRiverGuy -

loopy

loopy

@sunnyd5118 -

Moshii

Moshii

@krillionairess -

Daniel Criminger

Daniel Criminger

@Dantheman1250

Something went wrong.

Something went wrong.