Market Color

@TheMarketColor

Lifting the hood on messy financial markets. Market briefs | Macro insights | Trade ideas

I started The Market Color with the purpose of writing market briefs, sharing macro thesis, and introducing trade ideas-from easy to more complex ones. All feedback is welcome, and I'm always happy to discuss topics and opinions.

Yesterday was a risk-on fever dream. Europe’s Banks and Autos finally remembered how to move. Defense is tanking on "peace" rumors. Buy the dip, or just the delusion? The pivot is always noisy.

Goldman lifts its EoY $Gold target to $5,400 as the smart money finally panics. With central banks hoarding and the private sector using ETFs to hedge the inevitable policy dumpster fire, the floor just moved up. Turns out, uncertainty is the only growth industry left.

Everybody's getting excited about TACO Wednesday. I believe there's still room for a reversal, Nowadays, old deals are easily broken, not to mention supposed ones.

At a Davos dinner, ECB boss Lagarde bailed after US Commerce Secretary Lutnick roasted Europe’s economy. His “America’s winning” speech prompting Lagarde to later call for a “new world order” where Europe only dines with rule-abiding friends.

I'll add that with rates held below inflation for debt-sustainability reasons, the opportunity cost of holding gold collapses and systematically pushes capital into non-yielding hard assets. Inflation or financial repression become the de facto adjustment mechanism.

Everyone is missing what’s actually happening here. Gold isn’t surging because of one thing. Three simultaneous forces are converging for the first time in history, and none of them are stopping. Force 1: The Greenland Tariff War Trump just announced 10% tariffs on eight NATO…

Today the US Supreme Court might rule on the legality of IEEPA tariffs. If they rule against. It likely takes pressure off the Greenland affair as tariffs will not be able to be enacted from Feb 1st.

Trump's tariff threats over Greenland get people talk of weaponizing capital. With +$10tn in US assets, the EU could trigger a Sell America trade. The only problem is that most of it is held by private funds, making it difficult to force a selloff.

You won't need as much wealth as you think. But only if you understand this one idea: Tech deflation is coming in hard and fast. - Robots will be farming, manufacturing, etc. - There are massive economic incentives to make energy abundant - Super smart AIs will work around…

FRENCH PM TO USE ARTICLE 49.3 TOOL TO PASS BUDGET. Here we go again.

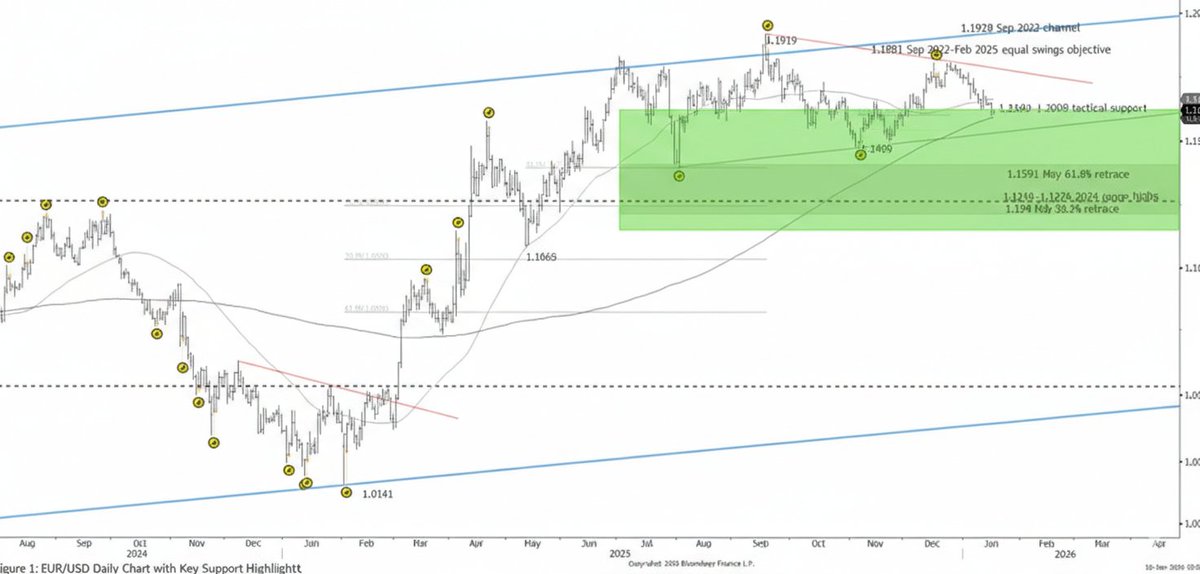

EURUSD tested critical 1.1589-1.1669 support after 4Q25 pullback. Breaking the 200DMA & 61.8% retrace risks a slide to 1.1391, confirming a long-term trend reversal. Near-term, we expect support to hold. Upside capped at 1.1919 & 1.2020. Key pivot zone ahead.

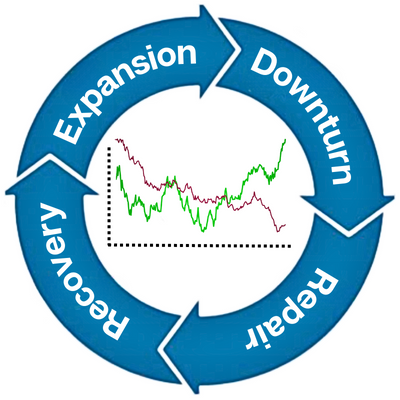

How to Hedge: $VIX $QQQ $SPY I often recommend not using the $VIX to hedge a portfolio. There’s really only one situation where it makes sense: a macro event or a structural breakdown. If you simply think the market is overpriced, or that some economic data is going to…

JPY under pressure as snap election risks fiscal expansion. US/Taiwan chip deal irks China. Tensions over Greenland. French PM trying to pass '26 budget.

Mild risk-on mode holds as tech tailwinds balance macro data. FED: January pause likely, strong jobs data caps rate cut bets. Polymarket has Warsh odds at 44% and Hassett at 37% for Chair. Market positioning is heavy.

Today: US monthly industrial production, NAHB housing market index. Bowman speaks. German Consumer price index.

Doing the best he can before midterms.

Today: US cross-border investment data, jobless claims, Eurozone industrial production and trade figures. France consumer price index. UK industrial production and trade balance. Major earnings: Morgan Stanley, Goldman Sachs.

Could the Venezuela + potential Iran intervention be the disinflationary cover Trump's administration needs to make the FED slash interest rates?

United States Trends

- 1. Good Saturday N/A

- 2. Gigi N/A

- 3. LINGORM HK ONLY YOU MEET N/A

- 4. #LingOrmHongKongFMD1 N/A

- 5. #WilliamEst1stFMinSingapore N/A

- 6. WILLIAMEST ECHO IN SG N/A

- 7. Giannis N/A

- 8. #PersonaLive N/A

- 9. Trans N/A

- 10. Jim Jones N/A

- 11. Sinner N/A

- 12. Adam 22 N/A

- 13. #SmackDown N/A

- 14. Jason Luv N/A

- 15. Djokovic N/A

- 16. #River N/A

- 17. Novak N/A

- 18. Jen Z N/A

- 19. Wawrinka N/A

- 20. Antarctica N/A

Something went wrong.

Something went wrong.