You might like

What’s the point of TSM guiding Q2 significantly above consensus when we all know demand is weakening and most likely the beat is just pull in. LOL.

Steve cohen was spot on how this significant market correction would play out. Impressive!

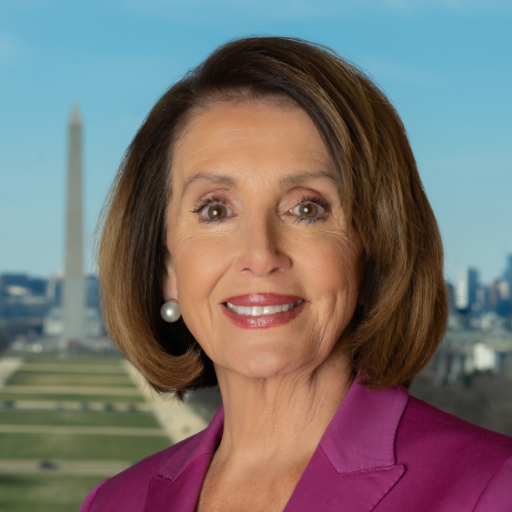

Hedge Fund Titan and Mets owner Steve Cohen is bearish for the first time in years.

don’t know how SMCI outlook math can be achieved without share gain. think top 2 customers (xai/tsla, coreweave) doubles in 25 at best barring any supply issues. they are 1/3 of SMCI rev. can rest of the biz double as well? They likely keep missing guidance

rewatched $TKO COO interview with CNBC, an interesting point brought up is that sports media rights ($FWONK, etc.) are hot because that’s the last thing legacy TV is holding onto, and streaming media(Netflix, Amazon) wants to take new subscribers.

Larry Ellison is the craziest CEO alive: • Hired investigators to spy on Microsoft • Waged a decade-long war against Google • Plotted to buy Apple and make Steve Jobs the CEO At 80, he looks younger than most 50-year-olds. How he managed to do this is insane 🧵

incredible the Intel in Asia - Samsung underperformed Hynix if you beta adj during the latest memory sell-off. LOL.

GS conference thoughts - think sox continues to range bound. Hyperscalers are not slowing down AI investment so nvidia demand is still holding up, but clearly AI applications are yet to take off = AI capex sustainability issue continues to be a debate.

memory semicap in free fall. interestingly still hearing a lot bullishness on the whole semicap space. they trade at 10x fwd PE in last down cycle fwiw. #LRCX #6146

why can’t MI300 rev go to zero when nvidia demand slows? think AMD should consistently trade at lower multiple than nvidia.

Amazing that Jensen had this clarity of thought and conviction 15 years ago. What's also impressive is the raw humility. Worth spending the 4 min to watch.

Jensen’s clarity of thought and soothing, patient speech can only be described as the Alan Watts of engineering 😁

Long NVDA short SMCI pair is still so attractive. remember SMCI is a 10-15x P/E stock while NVDA is a 30-40x P/E stock.

Scratching my head on Mongo’s comment of Q3 consumption better than Q2, given atlas decel’ed in Q3 even accounting for diff in days in Q.

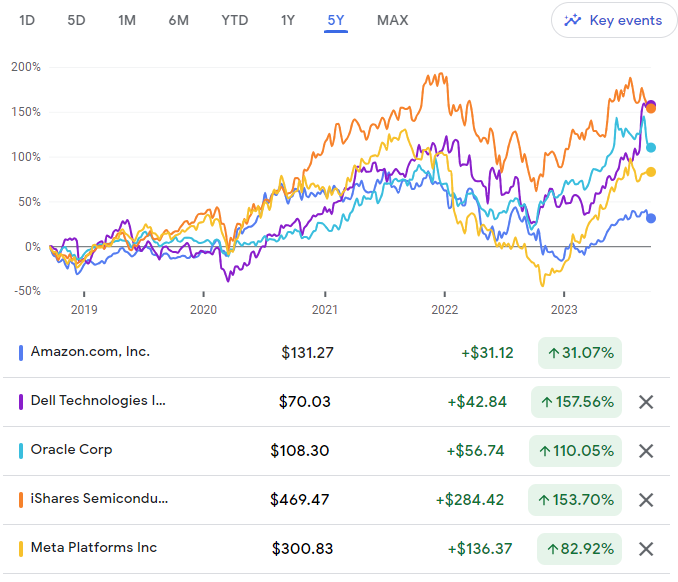

takeaways from this chart: 1)entry valuation matters a lot for IRR 2)hardware is not boring 3)find self-help story 4)or just buy and hold SOX?

NVDA now trading at similar fwd PE multiple as MSFT. Historically thats when NVDA starts outperforming significantly. Is this time different?

TLDR: trading dynamics and valuation regime for semiconductor stocks may be changing from historic, high vol “peak on peak/trough on trough” regime to a lower vol “trough multiple on peak fundamentals/peak multiple on trough fundamentals” regime that reflects inherent cyclicality

so Instacart's spending on SNOW is not falling off a cliff. 28m in CY21, 28m in CY22, 11m in H1 CY23. Snowflake and Instacart: The Facts snowflake.com/blog/snowflake…

How an $NVDA HGX H100 computing platform is manufactured:

United States Trends

- 1. Notre Dame N/A

- 2. Jassi N/A

- 3. Rivers N/A

- 4. Wendy N/A

- 5. Dabo N/A

- 6. Lobo N/A

- 7. Stacey N/A

- 8. Blades Brown N/A

- 9. March for Life N/A

- 10. Ryan Wedding N/A

- 11. #FursuitFriday N/A

- 12. Deion N/A

- 13. #TALON N/A

- 14. Jemele N/A

- 15. Bad Bunny N/A

- 16. Nate Oats N/A

- 17. OpTic N/A

- 18. #RepublicanHealthcareDisaster N/A

- 19. Marc Anthony N/A

- 20. Bricillo N/A

Something went wrong.

Something went wrong.