Kev

@kev_inverse

Diversification for the long run📈 Remember the Cant

You might like

This guy is in my DMs sending me shirtless pics and telling me to "GET STACKED BRO" @choffstein

Really enjoying this series

Join the #GetStacked crew as they delve into the intricacies of Return Stacking, market Trends, and the impact of taxes on investment strategies. Their insights provide a comprehensive look into the implications of their research for the investment landscape.

Those two problems are probably related; newer managers who have small AUM will also have a smaller sample of trailing data with which to evaluate performance. IMO, that means performance needs to be evaluated based on strategy type and factor exposures, *not* trailing returns.

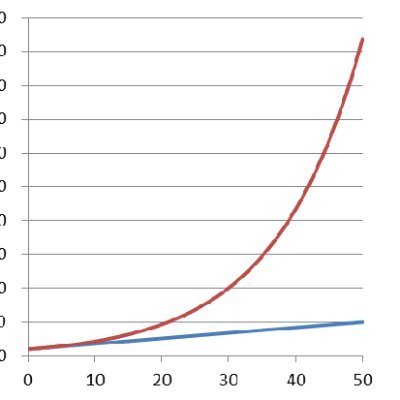

There are two types of people. Some will look at this and say, "why bother?" Others will say, "in sample, the more diversified thing ended up at the same place as the more concentrated thing? Great. I'll take more diversification for the out of sample period."

2022 was a homerun year for trend following strategies, but from nearly the start of century through 2021 they showed almost zero benefit as a diversifier to a traditional stock-bond portfolio.

This may shed some light on the discussion: Analysis Details: * Daily bootstrap: 10,000 iterations with replacement Period: 2000-01-31 to 2023-01-31 * Based on SIMULATED trend replication returns from whitepaper (investresolve.com/lp/peering-aro…) * Includes slippage, commissions, 2%…

Most investors (ie 60/40) should expect a pre-tax annualized Sharpe ratio of ~0.4. Stacking alternative betas (diversified trend + carry + merger arb + multi-strat equity mkt neutral) might approach an expected Sharpe of 1 pre-tax. Lesson being that unless you’re a top decile…

One of my favorite writings from @CliffordAsness "Risk Parity: Why We Lever" aqr.com/Insights/Persp… Everyone talks about the risks of leverage but few consider the risks of concentration

Thanks for posting. Found a backgrounder for those curious. PORTFOLIO OPTIMIZATION AND THE SHARPE MULTIPLIER: investresolve.com/portfolio-opti…

investresolve.com

Portfolio Optimization and the Sharpe Multiplier: A Case Study on Managed Futures - ReSolve Asset...

For a managed futures universe, we show mathematically and empirically that portfolio optimization maximizes expected performance by maximizing breadth.

Thanks @choffstein🙏 Now we just need the integrated combo😉

Must say I am a bit surprised there isn't a public trend+carry or even pure carry managed futures fund yet. Seems like the low hanging fruit if a manager wanted to differentiate from the dozen or so funds that are just pure trend. Though I guess differentiation = career risk.

The good news is there’s this cool thing you can do move up and to the left on the chart without being misleading

The volatilities used below are a joke and a manager or allocator showing them without a huge disclaimer that they calculated on crap data and therefore gibberish is just a scammer (including private credit where Meb needs an arrow).

United States Trends

- 1. #WWERaw 70.1K posts

- 2. Packers 47.9K posts

- 3. Packers 47.9K posts

- 4. John Cena 67.2K posts

- 5. Jalen 16.1K posts

- 6. #GoPackGo 4,989 posts

- 7. Jordan Love 4,195 posts

- 8. #RawOnNetflix 1,737 posts

- 9. Grand Slam Champion 20.2K posts

- 10. Matt LaFleur 1,174 posts

- 11. Lane Johnson N/A

- 12. Cam Whitmore 1,058 posts

- 13. Kevin Patullo N/A

- 14. Green Bay 11.6K posts

- 15. Mailata N/A

- 16. #MondayNightFootball N/A

- 17. Rusev 2,901 posts

- 18. Tush Push 10.9K posts

- 19. Cade Horton 1,245 posts

- 20. Shipley N/A

You might like

-

game-book-life

game-book-life

@game_book_life -

Eric McArdle

Eric McArdle

@EMcArdleInvest -

Art Johnson 🇨🇦

Art Johnson 🇨🇦

@ArtEddywealth -

Adam Goldstein

Adam Goldstein

@goldstein_aa -

Mount Lucas Mgmt

Mount Lucas Mgmt

@MountLucasMgmt -

metacognition_capital

metacognition_capital

@meta_cognitive -

Luke Swanson

Luke Swanson

@Luke_Swanson_ -

Ryan Gavin

Ryan Gavin

@RyanMGavin -

Scott Wimmer, CFA, CFP®, EA

Scott Wimmer, CFA, CFP®, EA

@wimms5987 -

BlankSlate

BlankSlate

@blank____slate -

Nick

Nick

@Nicholas_Meyers -

invertedfragility

invertedfragility

@invertedfragil1 -

Dr. Moritz "tl;dr" Lehmensiek-Starke

Dr. Moritz "tl;dr" Lehmensiek-Starke

@expectedrisk -

DB_Silver_Fox

DB_Silver_Fox

@DB_Silver_Fox -

Jonah Katsenelson

Jonah Katsenelson

@KatsenelsonJ

Something went wrong.

Something went wrong.