Jack Forehand

@practicalquant

Quant Investor - Validea Capital | Excess Returns: http://youtube.com/excessreturns

You might like

Cool milestone for us today. Thank you to everyone who has watched our shows and all the great guests who have taken the time to join us. Hopefully just the beginning. @JJCarbonneau @CultishCreative @DaveNadig @spotgamma

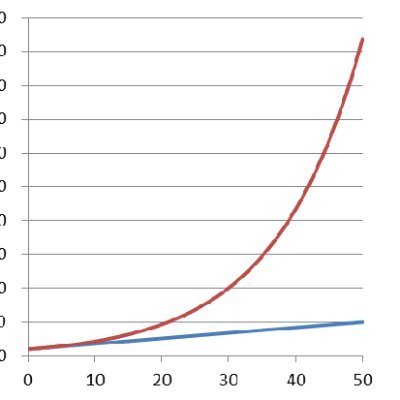

"You're fine!" say the poverty metrics. "But, we are not?!" say the people. @GestaltU essay on the poverty debate became a conversation worth capturing with @EpsilonTheory. Watch, share, discuss with us: youtu.be/eT8KGz2r8Ts

youtube.com

YouTube

The Bureau of Missing Children | Ben Hunt and Adam Butler on the...

Strong recommend! Learned a lot from listening. Very inspiring. Now have new ideas to test in my ML systems. Will redirect all ML newcomers with Q's to this H/t the @P123Finance AIFactor crowd @GfI_Himmelreich @Quant_Morales @Quant_Kurtis @Scifospace @InmanRoshi @VSai2314 ...

There has been a lot of talk about how to use AI in investing. This week, we sit down with someone who is actually using it to build real-world strategies. We talk to Pictet Head of Quantitative Investments David Wright about how he and his team do it. youtu.be/cpsI13lulQY

youtube.com

YouTube

The Alpha No Human Can Find | David Wright on Machine Learning's...

There has been a lot of talk about how to use AI in investing. This week, we sit down with someone who is actually using it to build real-world strategies. We talk to Pictet Head of Quantitative Investments David Wright about how he and his team do it. youtu.be/cpsI13lulQY

youtube.com

YouTube

The Alpha No Human Can Find | David Wright on Machine Learning's...

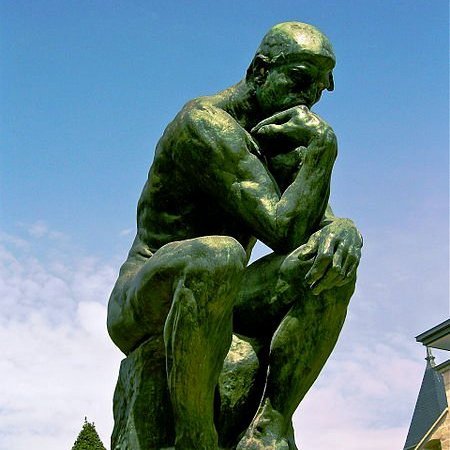

Most investing mistakes don’t start with bad math. They start with bad labels. We sat down with Chris Mayer and Robert Hagstrom this week for the latest episode of the 100 Year Thinkers. Here are five things we learned excessreturnspod.substack.com/p/the-labels-t…

What do you call looking for professional insights outside your profession? Few in investing tap the diversity @RobertGHagstrom and @chriswmayer do. @bogumil_nyc and I built our final 100 Year Thinkers on @excessreturnpod about it: youtu.be/L15V8PQClXM?si…

youtube.com

YouTube

The Wall Street Labels That Trap You: Chris Mayer & Robert Hagstrom...

“Inflation isn’t the problem. Growth is.” Five lessons we learned from our most recent interview with @jimwpaulsen excessreturnspod.substack.com/p/the-growth-p…

Come for our terrible takes on AI data centers in space and 25% GDP growth. Stay for @spotgamma breaking down what is going on behind the scenes as we head into what looks like the largest options expiration ever. The New Opex Effect is out. youtu.be/RFrZzi5I3DA

youtube.com

YouTube

Magnet Above. Trap Door Below | What the Options Market Tells Us...

“It worked too well” We sit down with @yardeni to discuss why he is downgrading the Mag Seven after having an overweight rating on Tech for 15 years. youtu.be/NKqXEsq3Flk

youtube.com

YouTube

He Was Overweight Tech for 15 Years. He Just Downgraded the Mag Seven...

“An investment environment can become so familiar as essentially to become invisible, and that's where the danger lies.” The five biggest lessons we learned from our interview with Graeme Forster excessreturnspod.substack.com/p/the-water-yo…

Any time I want to understand how a company works, I check for a @bizbreakdowns episode. With all @ReustleMatt has in his head from recording over 200 episodes, I wanted to see if we could do an ELI5 episode of @excessreturnpod on RESEARCH. We did(!): youtu.be/NzIajMzgpY0?si…

youtube.com

YouTube

The Single Most Important Metric | Matt Reustle on the Patterns That...

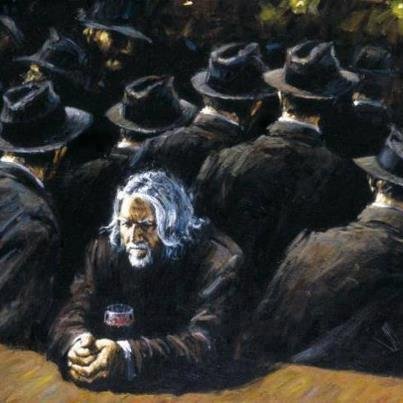

“It seems clear to me that what defines a major top or a major bottom is some particular absurdity that you can hardly imagine the human race is capable of inflicting on itself.” The five biggest lessons we learned from our interview with Jim Grant excessreturnspod.substack.com/p/a-century-of…

“An investment environment can become so familiar as essentially to become invisible, and that's where the danger lies.” I sit down with Graeme Forster to discuss six courageous questions investors should be asking heading into 2026. youtu.be/BgcW0W_jWcg

youtube.com

YouTube

The Risk is in the Water | Graeme Forster on Six Courageous Questions...

watch this @EpsilonTheory interview. youtu.be/T2hsjeCrRp0?si…

youtube.com

YouTube

The Job Loss is the Plan | Ben Hunt on the Risks of World War AI

Stop what you are doing and go listen to this 🔥 A lot of wisdom for free $SPY

We have now asked over 200 guests our standard closing question: If you could teach one lesson to the average investor, what would it be? In our latest episode, we bring the answers from our most popular guests together into one compilation. youtu.be/BBUjByklA7g

youtube.com

YouTube

You’re Missing the Most Important Lesson | 50 Great Investors Share...

Monday, I had the great pleasure of again joining @practicalquant and @jjcarbonneau from the Excess Return Podcast for a fourth monthly edition. Thanks for taking a watch & listen. PaulsenPerspectives.Substack.com youtube.com/watch?v=a030S6…

youtube.com

YouTube

The Growth Trap No One Sees | Jim Paulsen on the Real 20-Year Crisis...

We have now asked over 200 guests our standard closing question: If you could teach one lesson to the average investor, what would it be? In our latest episode, we bring the answers from our most popular guests together into one compilation. youtu.be/BBUjByklA7g

youtube.com

YouTube

You’re Missing the Most Important Lesson | 50 Great Investors Share...

The "AI will lead to a productivity boom" story requires about $4 trillion in capital. But sustaining that capital reallocation requires way bigger story. It will take a WWII-scale sacrifice. Which is why @EpsilonTheory is calling it WWAI. OUT NOW: youtu.be/T2hsjeCrRp0?si…

youtube.com

YouTube

The Job Loss is the Plan | Ben Hunt on the Risks of World War AI

You might think you know @DaveNadig. Fintech pioneer/ETF expert/music nerd/etc. But, how he got here matters - like when Cramer called him a criminal, or the climbing accident that completely changed his philosophy on winning... New Intentional Investor out now @EpsilonTheory

Our conversation with Louis-Vincent Gave was one of the most eye-opening we have had in a long time. Here are the five biggest lessons we learned. excessreturnspod.substack.com/p/what-investo…

Everyone thinks China's collapsing. Louis-Vincent Gave (@gave_vincent) says you're missing the brute force industrial strategy. More engineers than non-engineers Electric capacity > US + Europe combined The mispricing of the decade⁉️ @excessreturnpod youtu.be/OuJxZ67PwNk?si…

youtube.com

YouTube

The Real Estate Bust Was the Plan | Louis-Vincent Gave on China's...

United States Trends

- 1. Miami 83.4K posts

- 2. Miami 83.4K posts

- 3. Fletcher 7,651 posts

- 4. Marcel Reed 2,490 posts

- 5. Toney 4,915 posts

- 6. Carson Beck 3,315 posts

- 7. Michael Irvin 2,105 posts

- 8. Dawson 6,558 posts

- 9. Isak 32.8K posts

- 10. Aggies 4,126 posts

- 11. Lowe 9,618 posts

- 12. St. John 6,254 posts

- 13. Romero 19.5K posts

- 14. Clinton 474K posts

- 15. Liverpool 69.7K posts

- 16. #CFP2025 N/A

- 17. Jayden Quaintance 2,319 posts

- 18. Carter Davis N/A

- 19. Azzi 4,471 posts

- 20. #TOTLIV 20.3K posts

You might like

-

Dan Rasmussen

Dan Rasmussen

@verdadcap -

Ted Seides

Ted Seides

@tseides -

Research Affiliates

Research Affiliates

@RA_Insights -

Larry Swedroe

Larry Swedroe

@larryswedroe -

Pim van Vliet

Pim van Vliet

@paradoxinvestor -

Jack Vogel

Jack Vogel

@jvogs02 -

Acquirer’s Multiple®

Acquirer’s Multiple®

@acquirersx -

Wes Gray 🇺🇸

Wes Gray 🇺🇸

@alphaarchitect -

Nicolas Rabener

Nicolas Rabener

@Finominally -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

ReSolve Asset Mgmt

ReSolve Asset Mgmt

@InvestReSolve -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Ray Micaletti

Ray Micaletti

@RelSentTech -

Johnny Hopkins

Johnny Hopkins

@asxbites

Something went wrong.

Something went wrong.