Jack Forehand

@practicalquant

Quant Investor - Validea Capital | Excess Returns: http://youtube.com/excessreturns

คุณอาจชื่นชอบ

Cool milestone for us today. Thank you to everyone who has watched our shows and all the great guests who have taken the time to join us. Hopefully just the beginning. @JJCarbonneau @CultishCreative @DaveNadig @spotgamma

#🥐RUMBS 👇 ✅ it 🅾️

Full episode here! youtu.be/qBoeOAViXJI

youtube.com

YouTube

The Liquidity Trap Door | Cem Karsan on Why This Bubble Could Get...

Excess Returns Highlights: Risk The riskiest thing to me is that in three years you buy companies that don't grow and then you know you lose money you lose versus inflation. Highest Performing Companies The theory I kept coming back to was low marginal cost. The highest…

"We are in a bubble ... but you should probably be long said bubble." - @jam_croissant in conversation with me and @JJCarbonneau for @excessreturnpod. Also covered: why options are superior to stocks, and why it's ALWAYS about liquidty.

Thanks Aahan! @ckaiwu was on such a roll that all Justin and I had to do was get out of the way and let him talk. For anyone interested in what all this AI Capex spending means, this interview was really eye opening.

I operate in a different space mostly, but man is Kai good! @excessreturnpod kudos! open.spotify.com/episode/5xHiSu…

One French teacher changed everything for Adam Butler (@GestaltU). From D&D kid to CIO - this is about how mentors can redirect entire lives. Watch the full conversation: NEW Intentional Investor @EpsilonTheory

"The whole world is selling options." @nancy__davis on why investors are short volatility without knowing it, the hidden risk in bond indexing, and why the yield curve could steepen NEW @excessreturnpod youtu.be/5QDTc-IwnbU

youtube.com

YouTube

You're Short Volatility (And Don't Know It) | Nancy Davis on the Bond...

You get a hat! You get a hat! You get a hat! (Listen at least 1.5x) youtu.be/aZRyy4VfdRM?si…

youtube.com

YouTube

Zero Times in History | Meb Faber on What Happens After We Cross 40...

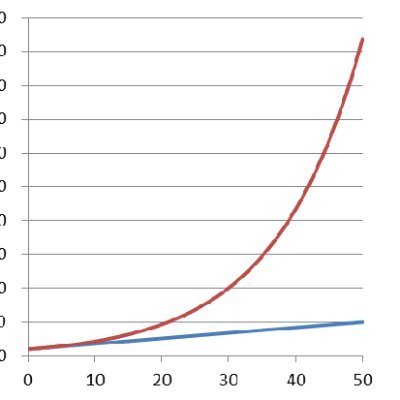

The market is very expensive. But Meb Faber explains why that doesn't mean what many investors think it does.

“This is as good as it gets.” @MebFaber on 15% return decades and what follows them, the impact of AI, why trend and value still matter and where you can get a sweet hat. NEW @excessreturnspod youtu.be/aZRyy4VfdRM

youtube.com

YouTube

Zero Times in History | Meb Faber on What Happens After We Cross 40...

“Just because Wall Street creates it, you don’t have to buy it.” @Rick_Ferri on the stages of an index investor, how complexity creeps into portfolios, and what it really takes to stay the course. NEW @excessreturnpod youtu.be/0-dUTwGcR50

Has liquidity replaced fundamentals? Remi Tetot (@TheKingCourt) thinks so. We trace what it's implications are across sectors, markets, and policy decisions in the latest @excessreturnpod - out now! youtu.be/ZuLH3wxZ17A?si…

youtube.com

YouTube

The $37 Trillion Trap | Remi Tetot on Why Liquidity Drives What's Next

Recorded this with @CultishCreative last week, it is funny because we happen to speak about Quantum Computing amongst many, many other things. 🫡 youtu.be/ZuLH3wxZ17A

youtube.com

YouTube

The $37 Trillion Trap | Remi Tetot on Why Liquidity Drives What's Next

👷Surviving the AI Capex Boom👷 Big Tech's AI buildout is transforming markets but history suggests caution. What should investors do? 🤖 AI Investment Boom 🚂 Echoes of Past Booms 📉 Rising Capex Firms Underperform 🏭 Magnificent 7: The New Utility? 🔎 Finding AI Early Adopters…

Here's link to podcast I did with Justin Carbonneau and Jack Forehand of Excess Returns in which we covered a whole lot of interesting topics youtube.com/watch?v=XwRHpE…

youtube.com

YouTube

The 4% That Drive All Returns | Larry Swedroe on What You're Getting...

“Markets trade on changes in growth and rates. Everything else is noise.” Adam Parker on why valuations have stopped working, what’s driving multiples higher, and how to navigate a new market regime. NEW @excessreturnpod youtu.be/zAvdPPRBJds

youtube.com

YouTube

You're Getting the Regime Wrong | Adam Parker on Growth, Rates, and...

Worth your time!

"In the financial world, you can be insolvent forever, but you can't be illiquid for a moment." Ben Hunt (@EpsilonTheory) breaks down why First Brands and Tricolor might be private credit's Bear Stearns moment. The trust is broken. What happens next? youtu.be/Tse3LRe3-3I?si…

youtube.com

YouTube

The Loans No One Can Exit | Ben Hunt on How Private Credit Unravels

"In the financial world, you can be insolvent forever, but you can't be illiquid for a moment." Ben Hunt (@EpsilonTheory) breaks down why First Brands and Tricolor might be private credit's Bear Stearns moment. The trust is broken. What happens next? youtu.be/Tse3LRe3-3I?si…

youtube.com

YouTube

The Loans No One Can Exit | Ben Hunt on How Private Credit Unravels

There have been a lot of weird things going on in the market. We got a big volatility spike on a small decline. We also broke the single day options volume record on that same day In the latest OPEX Effect, @spotgamma is back to break it all down. youtu.be/U2WKD2PPBSg

youtube.com

YouTube

The Volatility Trap No One Sees | What the Options Market Says About...

United States เทรนด์

- 1. Game 7 65.4K posts

- 2. Halloween 2M posts

- 3. Kawhi 4,358 posts

- 4. Glasnow 5,684 posts

- 5. Ja Morant 4,031 posts

- 6. Barger 5,458 posts

- 7. Bulls 30.2K posts

- 8. #LetsGoDodgers 10.7K posts

- 9. Sasaki 11K posts

- 10. Grizzlies 6,663 posts

- 11. Yamamoto 32.2K posts

- 12. #RipCity N/A

- 13. #BostonBlue 4,522 posts

- 14. Clement 5,060 posts

- 15. GAME SEVEN 6,724 posts

- 16. Rojas 10.6K posts

- 17. #SmackDown 25.9K posts

- 18. Mookie 14.3K posts

- 19. Justin Dean 1,632 posts

- 20. #DodgersWin 5,113 posts

คุณอาจชื่นชอบ

-

Dan Rasmussen

Dan Rasmussen

@verdadcap -

Ted Seides

Ted Seides

@tseides -

Research Affiliates

Research Affiliates

@RA_Insights -

Larry Swedroe

Larry Swedroe

@larryswedroe -

Pim van Vliet

Pim van Vliet

@paradoxinvestor -

Acquirer’s Multiple®

Acquirer’s Multiple®

@acquirersx -

Wes Gray 🇺🇸

Wes Gray 🇺🇸

@alphaarchitect -

Nicolas Rabener

Nicolas Rabener

@Finominally -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

ReSolve Asset Mgmt

ReSolve Asset Mgmt

@InvestReSolve -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Ray Micaletti

Ray Micaletti

@RelSentTech -

Drew Dickson

Drew Dickson

@AlbertBridgeCap -

Excess Returns Podcast

Excess Returns Podcast

@excessreturnpod

Something went wrong.

Something went wrong.