おすすめツイート

If I have one regret in my 57 yrs, I would have been more present to my kids when they were younger. I was so focused on building wealth & stressed about building my career I didn’t always savor & fully enjoy that time. Sure, I was at every dance recital or practice, I coaches…

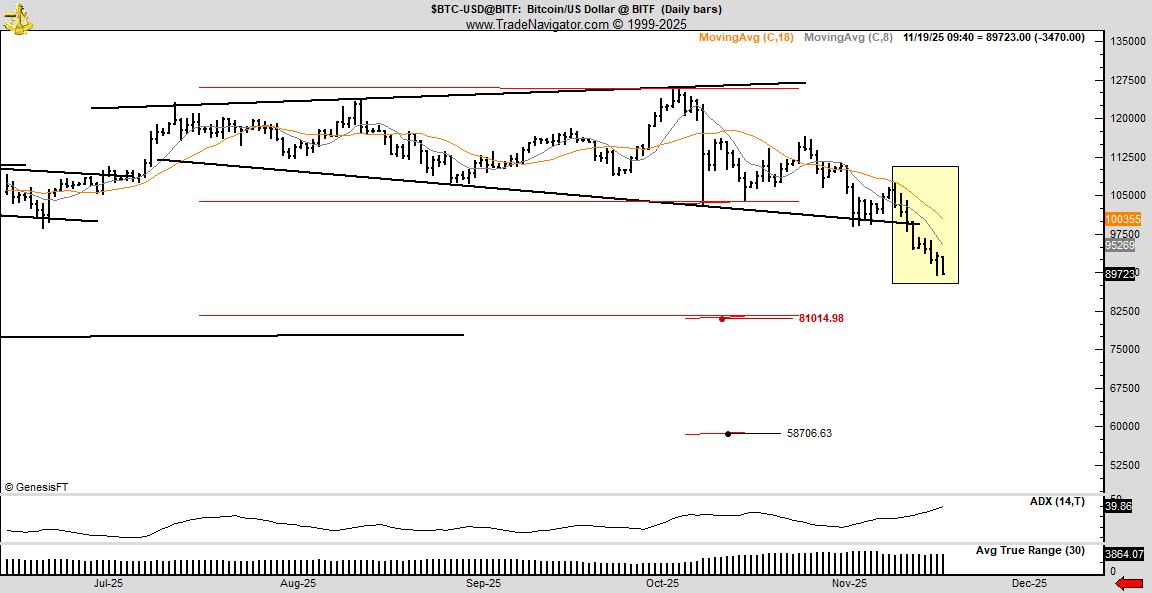

Does a sweeping reversal ((Nov 11) followed by 8 days of lower highs and the completion of a massive broadening top qualify as a bear market? Targets implied are 81k and 58k Those who now claim they will be big buyers at $58K will be pukers by the time BTC reaches $60k

You will blow up trading 0DTE. You will blow up buying short-dated earnings contracts. Anyone telling you otherwise is either inexperienced or selling a dream.

I have supported myself as a trader at CBOT and own prop firm for 50 years. I personally know and call as friends some of the world's best traders and Market Wizards None of them -- not one -- posts screen shots and displays their testosterone on Twitter X Take this as a hint

I am actually obsessed with probabilities, metrics, Bayesian thinking For the life of me I cannot figure out why people pursue day trading. It just does not make mathematical sense. People deserve to lose as day traders. The odds are just so stacked against them. It makes no…

Looking at a single options trade as "two-sided" misses the point. The aggressor is the one expressing intent, while the contra party is often a market maker providing liquidity and hedging off risk. The trade might have two sides mechanically, but only one side is showing…

There are two sides to all trades. This says “put selling,” which is bullish. Collecting premium.

Lack of information can be information in itself.

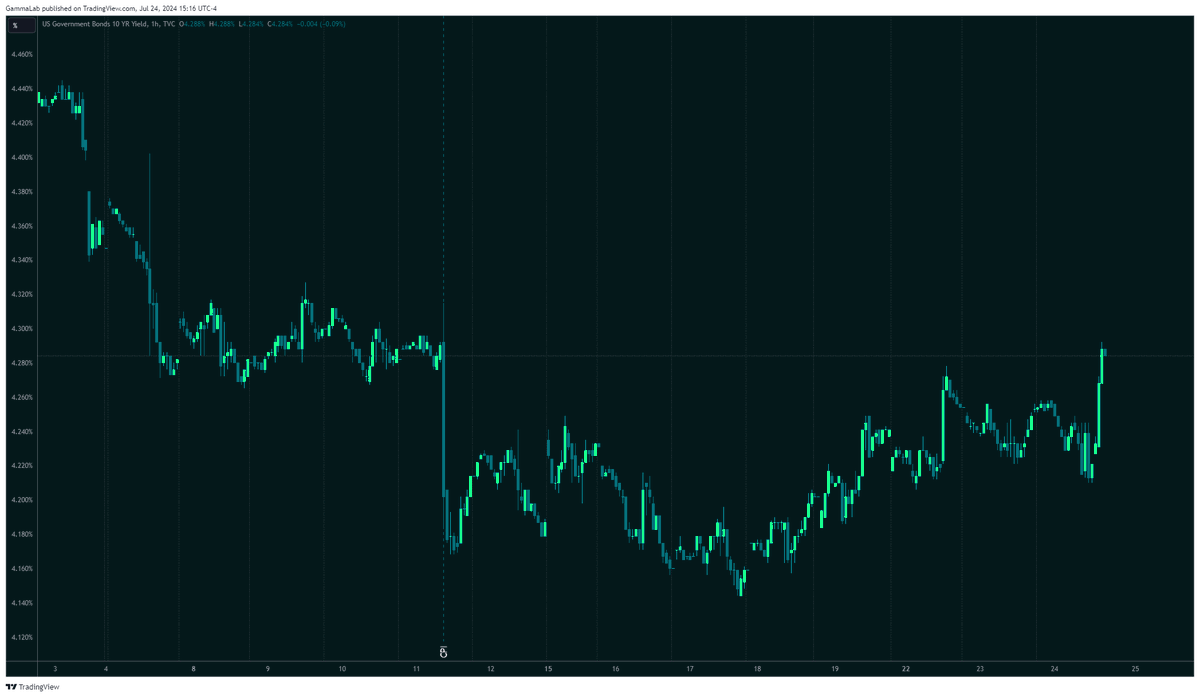

10-year note yield highest since CPI.

According to the Wall Street Journal, a secretive group of Trump advisors is quietly drafting proposals that would attempt to erode the Fed's independence. According to a 10-page paper the president himself should play a role in setting interest rates and also should have…

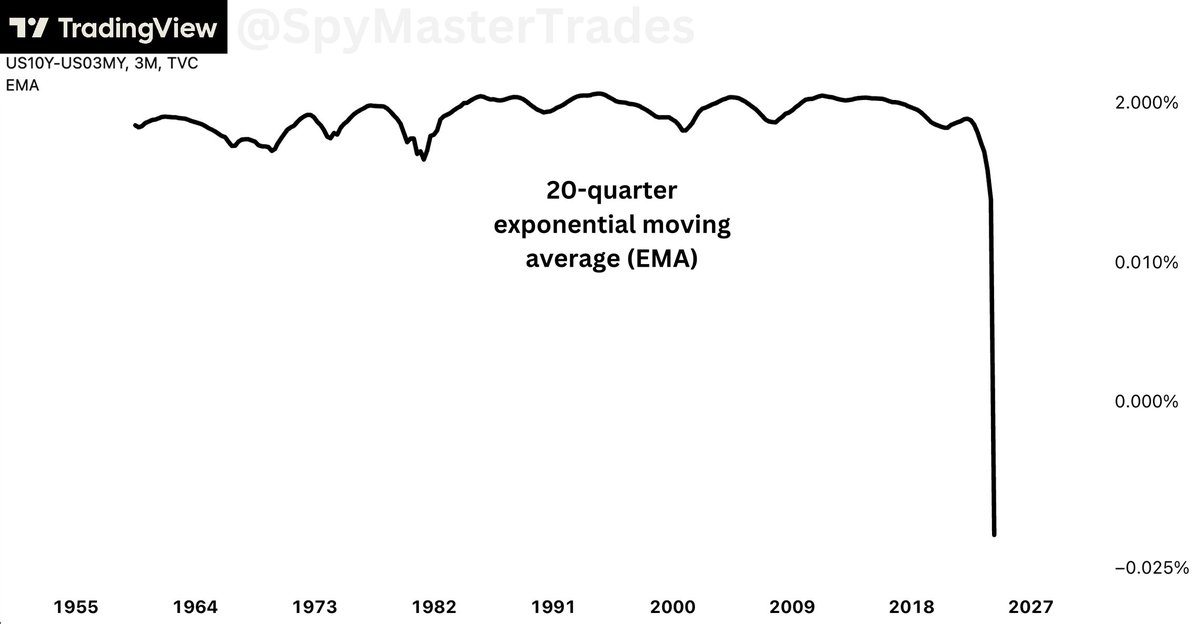

Reliable recession indicator continues to send unprecedented recession warning. The spread between the 10-year Treasury yield and the 3-month Treasury yield is a reliable recession indicator. Whenever these yields invert, a recession has always followed on a lagging basis.…

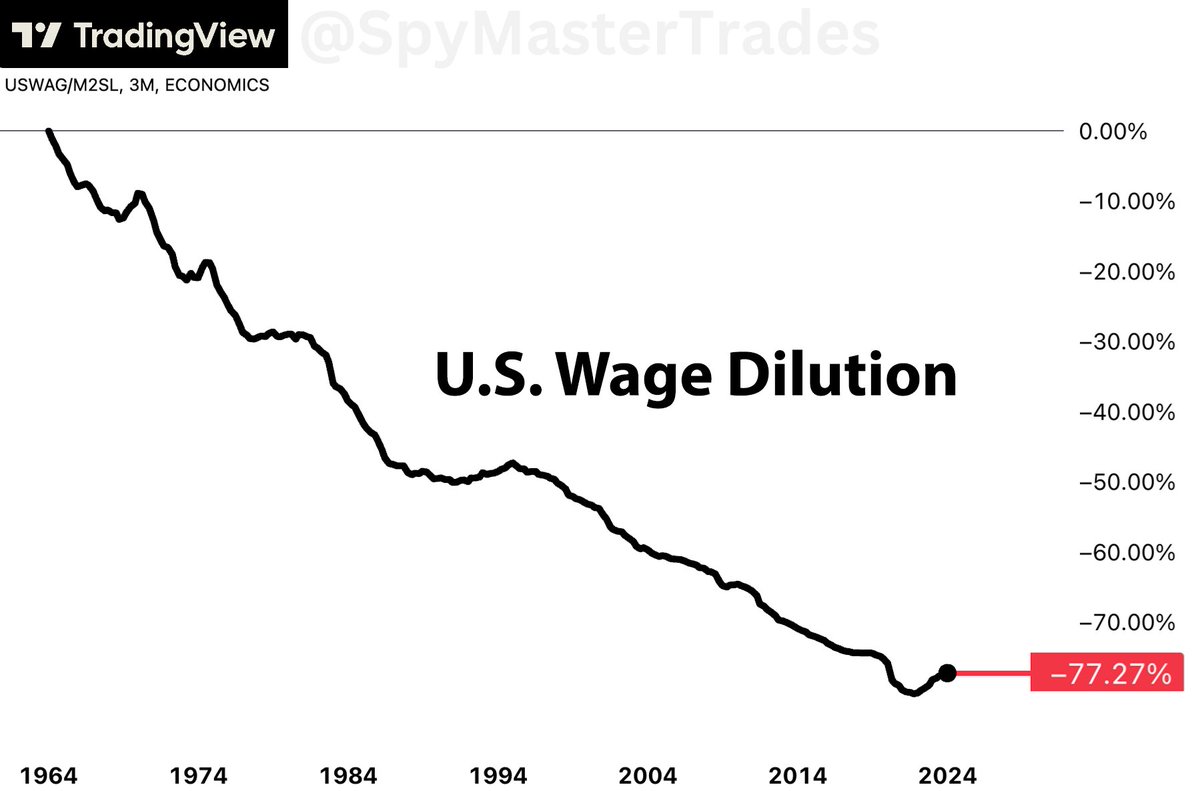

A must-read post discussing the failure of modern monetary systems and its alarming effect on wages

Over the past 60 years, monetary easing has diluted U.S. wages by 77%. By causing the broad money supply to increase much faster than wages, the central bank has caused a substantial dilution of wage earners' purchasing power. Another way of conceptualizing this is as a hidden…

''Is it fair to say you flooded the system with money?'' Powell: ''Yes, we did. As a Central Bank we have the ability to create money digitally'' Come on, be honest. You'll also miss JPOW when he retires :(

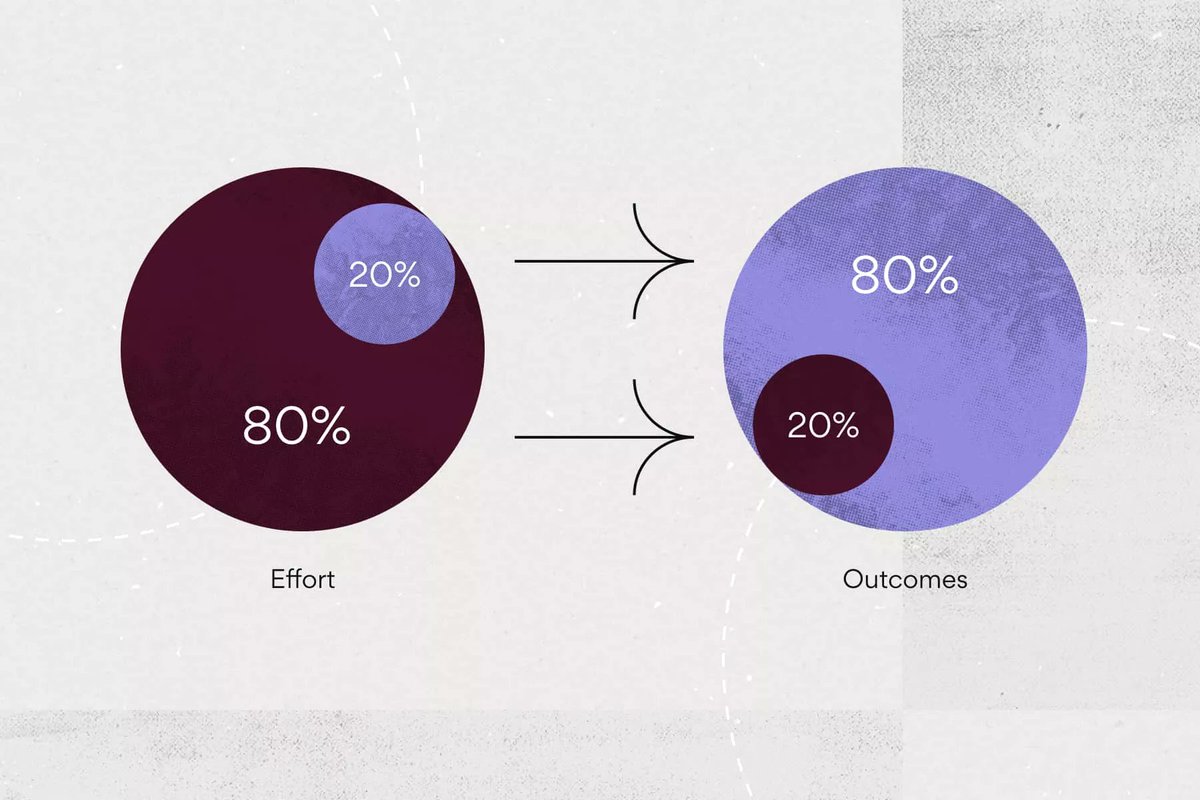

During my 48 years as a speculator, every professional flat price trader I've known has performance governed by the Pareto Principle whereby 10% to 20% of their trades account for 80% to 90% of their profits -- year after year. Only traders who understand this (whether they refer…

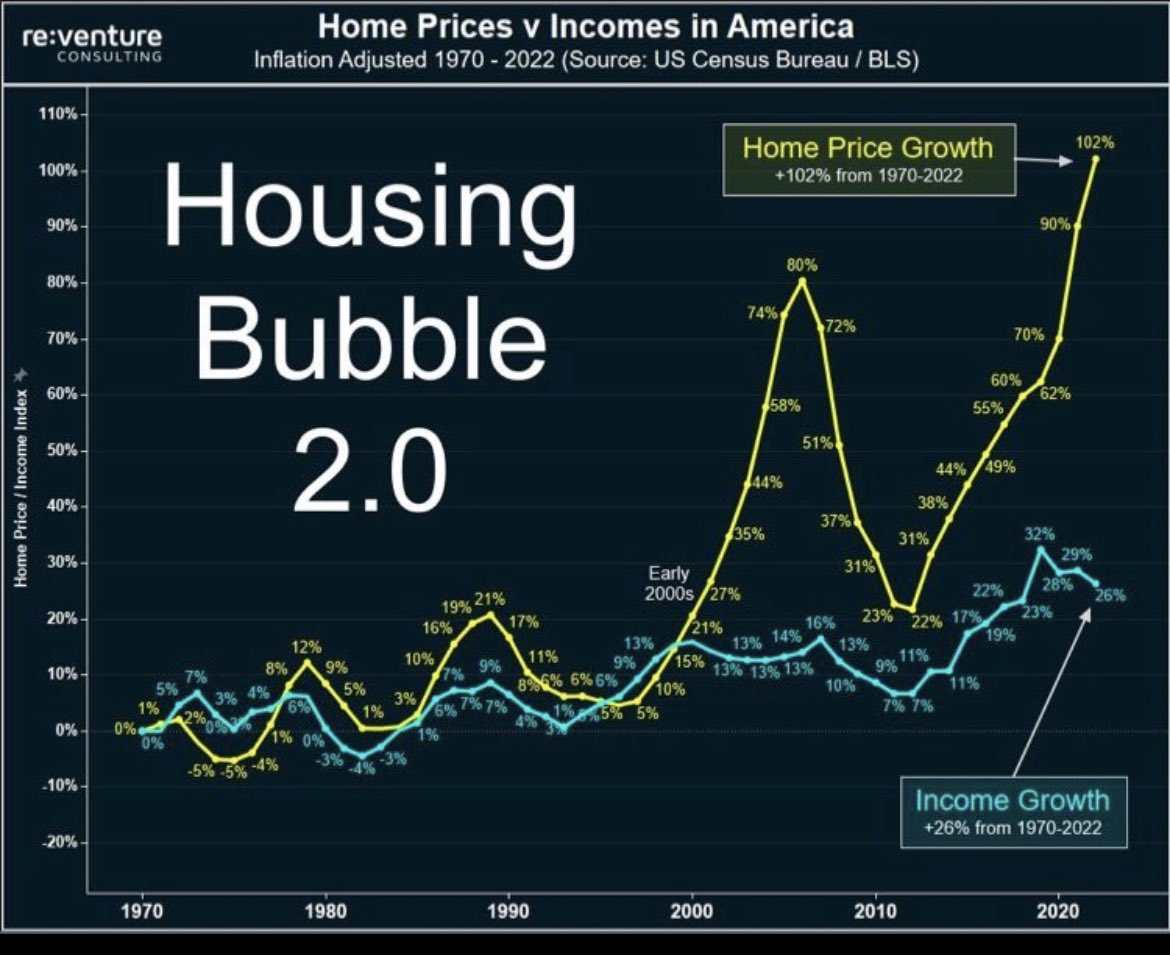

Housing has never been more unaffordable relative to income

This picture should be sobering to anyone convinced that we have reattained price stability.

United States トレンド

- 1. #NightOfTheSamurai 16.1K posts

- 2. Inoue 17K posts

- 3. Cherki 40.6K posts

- 4. Good Saturday 28.8K posts

- 5. Hernandez 17.4K posts

- 6. President Holland N/A

- 7. Minnesota 660K posts

- 8. Elder Holland N/A

- 9. #天音かなた卒業ライブ 252K posts

- 10. #MeAndTheeSeriesEP7 1.14M posts

- 11. #Caturday 2,415 posts

- 12. Kanata 42.7K posts

- 13. #TYPE_非 48.4K posts

- 14. Igor Jesus 2,397 posts

- 15. Bonded 4,533 posts

- 16. FDNY 19.8K posts

- 17. Somali 507K posts

- 18. Forest 88.6K posts

- 19. Scissors 8,102 posts

- 20. Adopt 30.2K posts

Something went wrong.

Something went wrong.