#optionsdata نتائج البحث

Navigate flat markets with a new AI trading strategy. See how past trades succeeded and learn about the Theta Data partnership for better options. Disclaimer: We are not financial advisors and this is not financial advice. #AItrading #optionsdata #ThetaData #tradingstrategy

ONLY OPTIONS TRADER CAN UNDERSTAND & FEEL THE SAME I feel exactly this same each time whenever I place my trades in options Thrill remains at the PEAK Analysis eyeing on TARGET Discipline keeps my SL intact #optionbuying #optiontrading #optionsdata #bullhearmindset

BotSpot unveils its latest features! Users can now import strategies and leverage options data through a new partnership with Theta Data. Disclaimer: We are not financial advisors, and this is not financial advice. #BotSpot #ThetaData #OptionsData #StrategyImport #TradingTools

Option trading is not magic… It’s data + discipline + track record ✅ We focus on levels, logic & risk control not gambling 🎯 Call or whatsapp us... 9081363090 #OptionTrading #TrackRecord #OptionsData #BankNiftyOptions Disclaimer: sairamstocks.com/stock/condition

SpiderRock’s Kasia Kobylarz shares a look into the evolution of SpiderRock Data & Analytics, how we built a high-quality options data business, and where we are headed in 2025. #SpiderRock #OptionsData Read more: rb.gy/601nb4

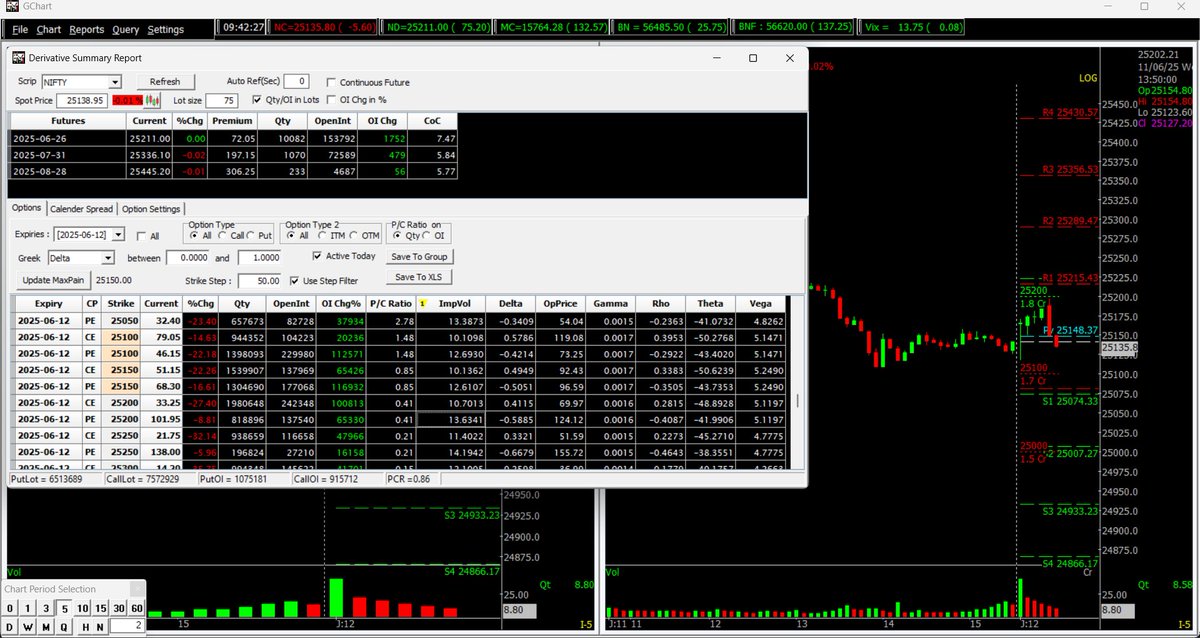

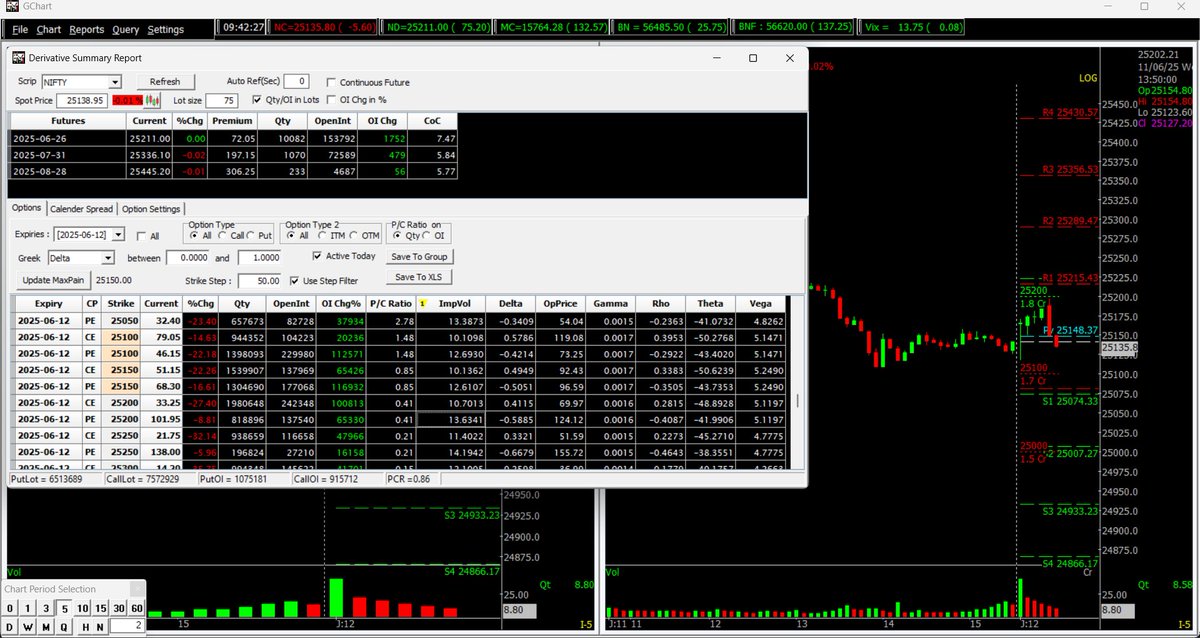

NIFTY📉 Spot 25138.95 🔻25000 PE OI +39.6K 🔻25100 PE OI +11.6K 💡Support: 25000 (1.5Cr OI) 📌Resistance: 25200 (1.8Cr OI) PCR: 0.86 Max Pain: 25150 #NIFTY #OptionsData

$AMZN If you would have taken $131p odte at the put volume spike near HOD at 10:44 they ran from $0.64 to $1.20 #OptionsFlow #OptionsData #OptionsTrading #OptionsTools Tool: quantdata.us/?referredBy=co…

#Nifty #BankNifty #OptionsData #Stocks #StockMarket Quant data indicates strength and more upside, after many days. 19340 can be seen in next few sessions.

Nifty 30-Sept-25 Outlook #Nifty #StockMarketIndia #OptionsData #TechnicalAnalysis #TradingSetup #NSE #MarketOutlook #IntradayTrading

NIFTY & BANK NIFTY OI Data (9th Mar Exp) as on 8th Mar 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

#BankNifty Hourly charts update, loss of momentum can be seen in price action too, quants data indicates consolidation and loss of up ward momentum. #BankNiftyOptions #OptionsData #StocksToBuy

"#OptionsData suggests bullish call option writer & bearish put option writer, but more analysis needed to determine strength #OptionsTrading". Please follow @hackveda #ITC #BreakoutStocks #StocksToBuy #stocksinfocus #stockstowatch

#optionsdata suggests equal fight between #bulls and #bears. #PCR at 19500 strike is almost 1 suggests fight is equal. #PCR at 19450 is in favour of bulls so its a support for now. So the range for now is 19450 to 19500

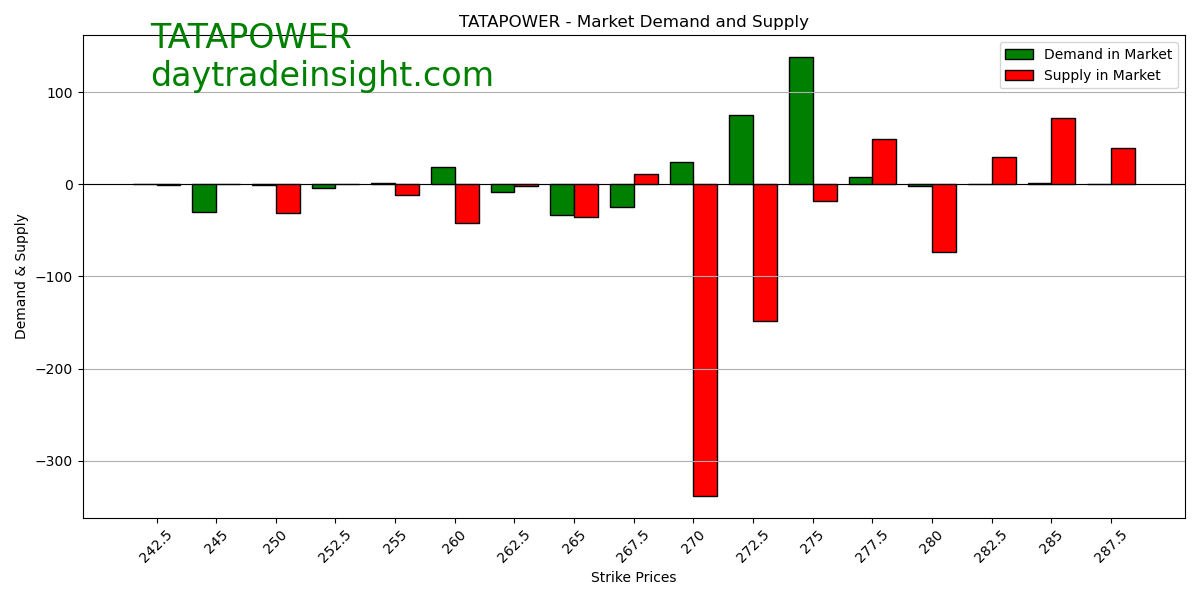

"#OptionsData reveals call option writers are more bullish on stock price target, seen in higher open interest, percentage change, and volume. #Bull. Please follow @hackveda #TATAPOWER #BreakoutStocks #StocksToBuy #stocksinfocus #stockstowatch

We did see a large put premium come in (on $12.50 08/04) at the end of the day. It was a multileg order so we'll have to wait to see tomorrows OI. Where do you think $LYFT will go next? #OptionsFlow #OptionsData #PutPremium #CallPremium #StockTrading #OptionsTrading

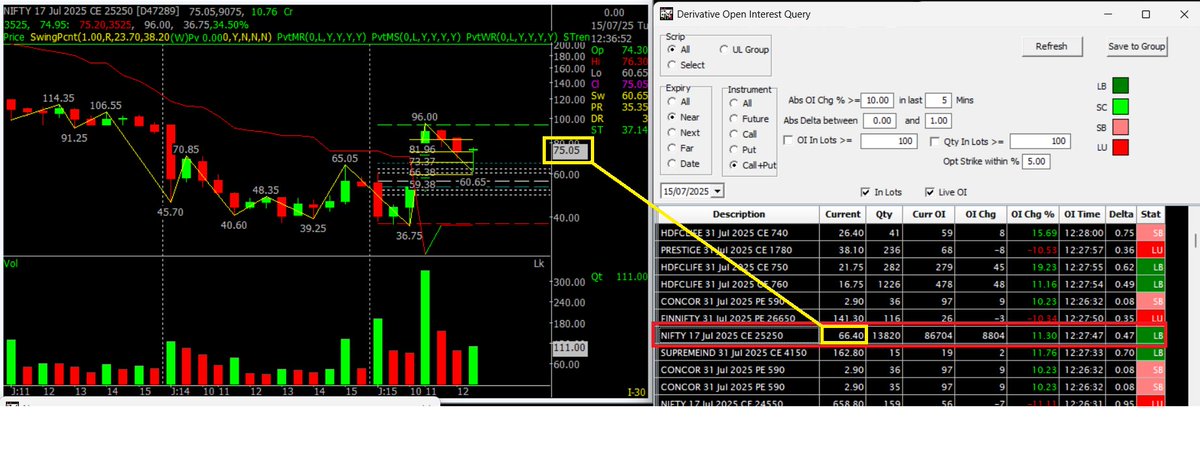

Tracking NIFTY 17 Jul 2025 CE 25250 — Price: 67 | OI: +11.3% | Delta: 0.47 Clear long build-up with rising volume. Watching resistances: 73 / 81 / 96. Data + Price Action = 🔑 for momentum trading! #Nifty #OptionsData #MomentumTrading #optionbuying @SpiderSoftIn @Mayank0620

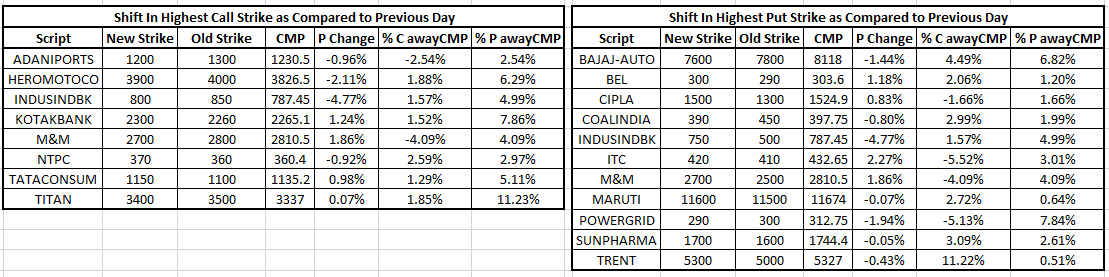

Shift in Highest Strike_ Call & Put Strike(Nifty 50 Stocks) "From Resistance to Support: A Comprehensive Analysis of Strike Changes Utilising Price Action" #Nifty50 #OptionsData #PriceAction #StrikeShift #MarketSentiment #EducationalContent

#Nifty50 #OptionsData #OpenInterest #WeeklyExpiry #OIAnalysis #VIXAnalysis #NiftySetup #DerivativesTrading #ScalpingLevels #GammaExposure #SmartMoneyMoves #MarketFlow #IntradayTrading #TradingStrategy #MetaverseTradingAcademy

NIFTY📉 Spot 25138.95 🔻25000 PE OI +39.6K 🔻25100 PE OI +11.6K 💡Support: 25000 (1.5Cr OI) 📌Resistance: 25200 (1.8Cr OI) PCR: 0.86 Max Pain: 25150 #NIFTY #OptionsData

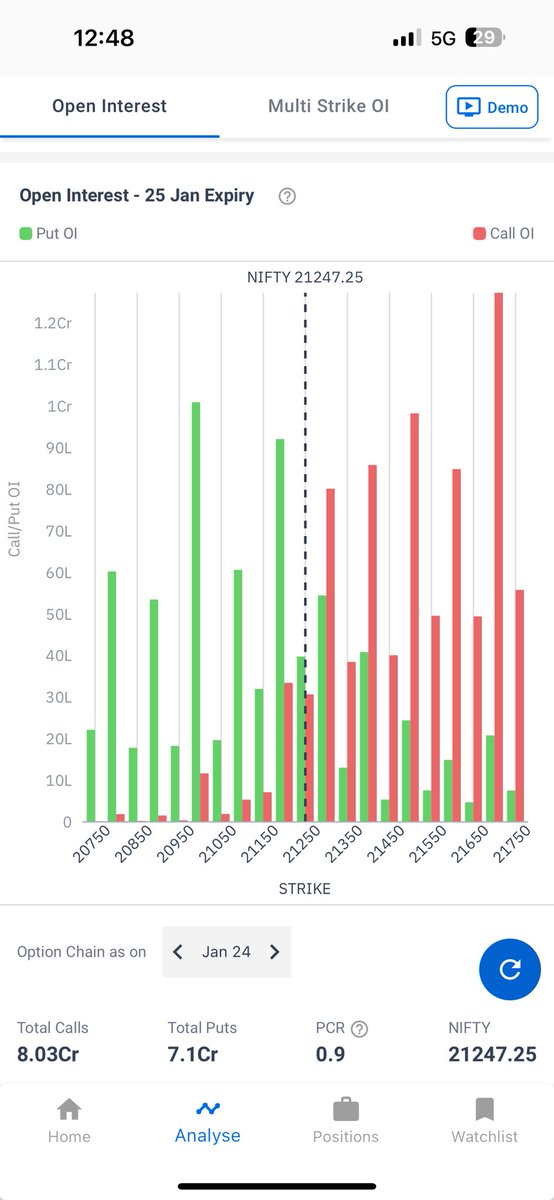

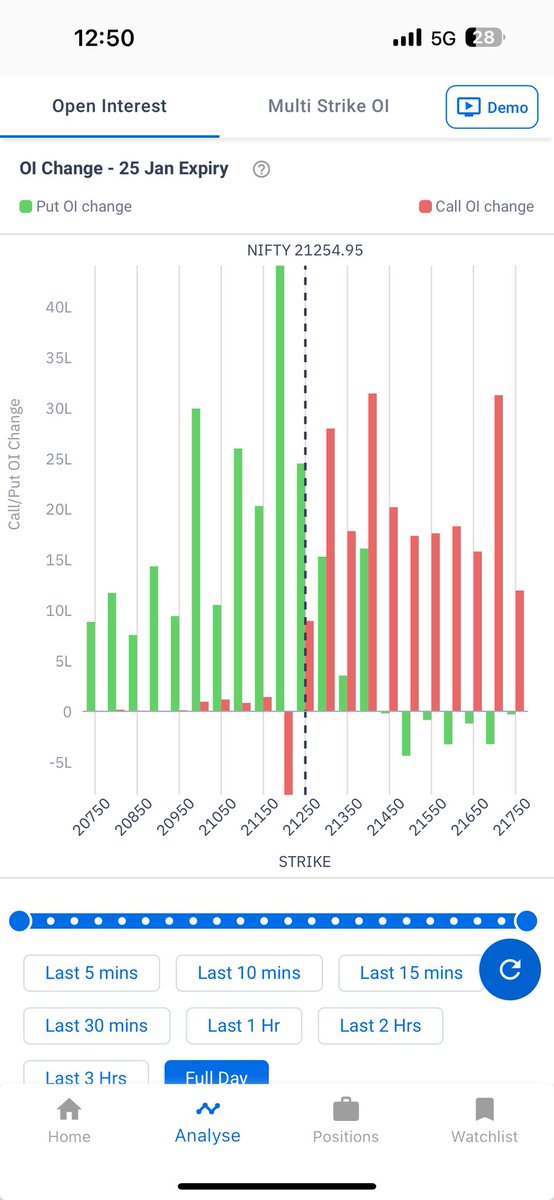

#Nifty Let's look at #Optionsdata Change in OI - 2.39 Cr puts vs 1.6 Cr calls, indicating bullishness Overall Open Interest - 6.85 Cr puts vs 6.64 Cr calls - neutral However 21300 has Max put writing indicating stronger support. Summary - don't short the market 😉

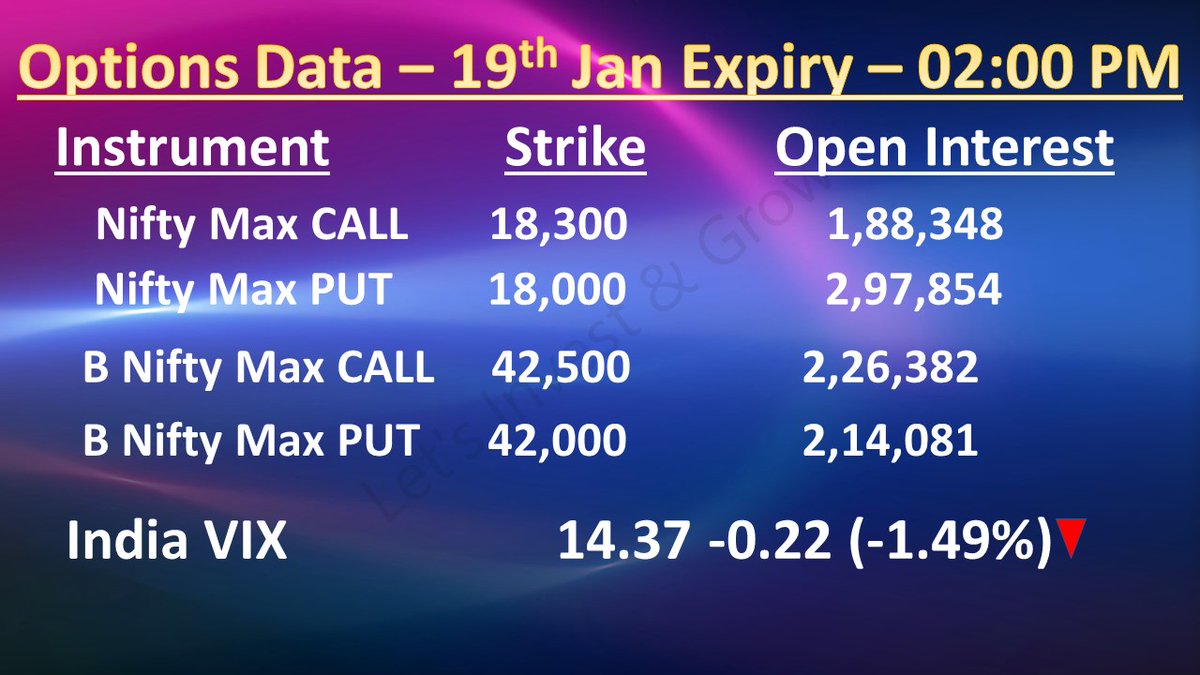

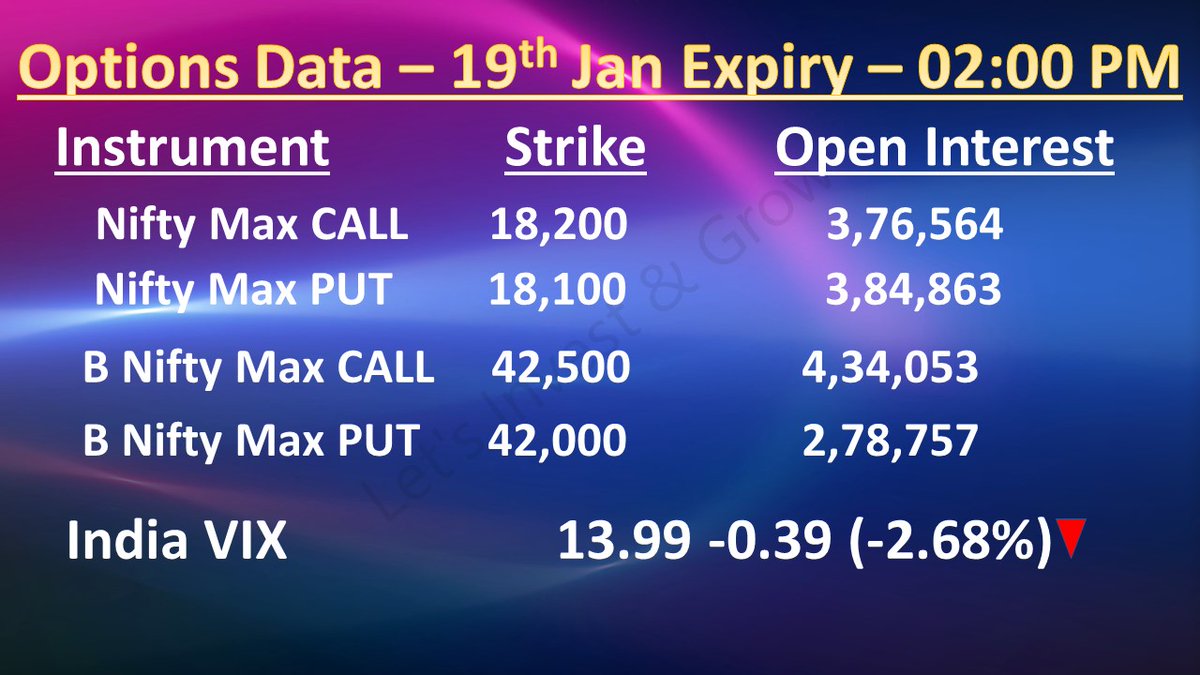

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 18th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

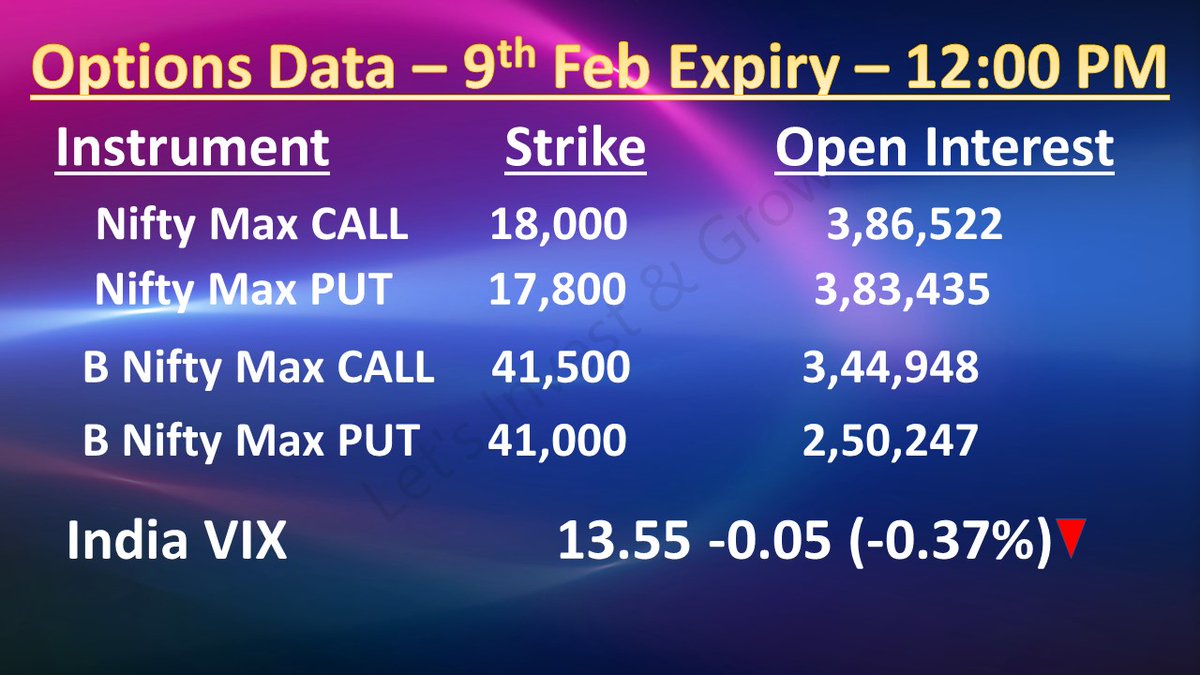

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 9th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Mar Exp) as on 8th Mar 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

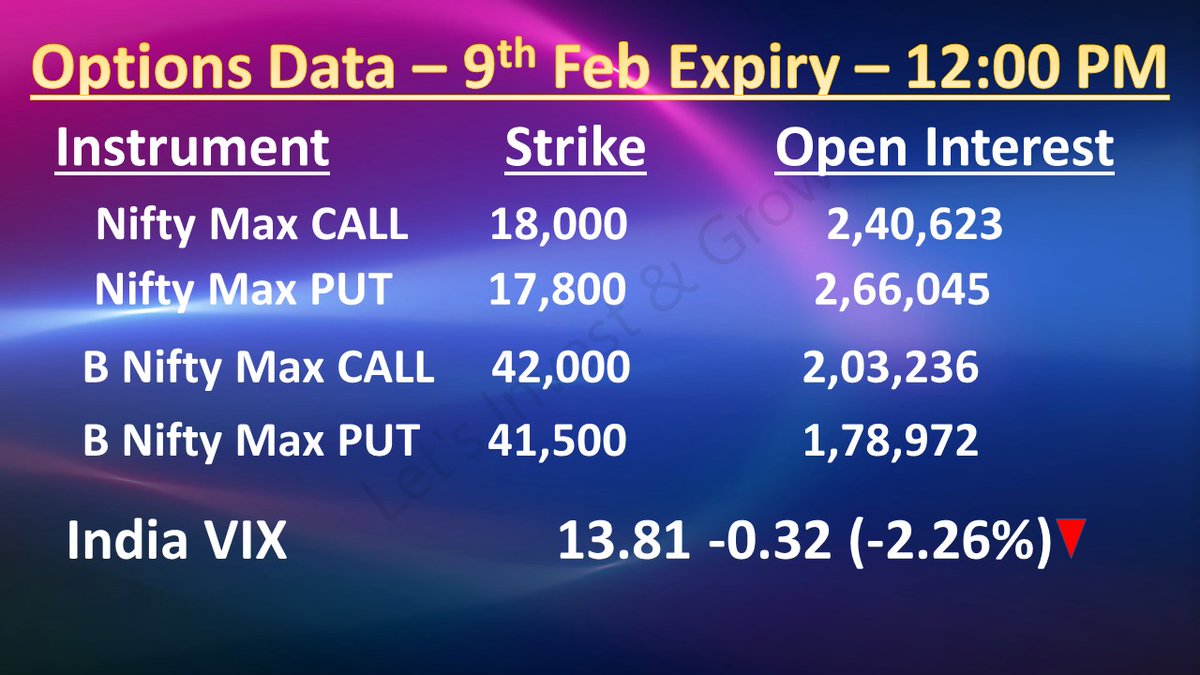

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 8th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

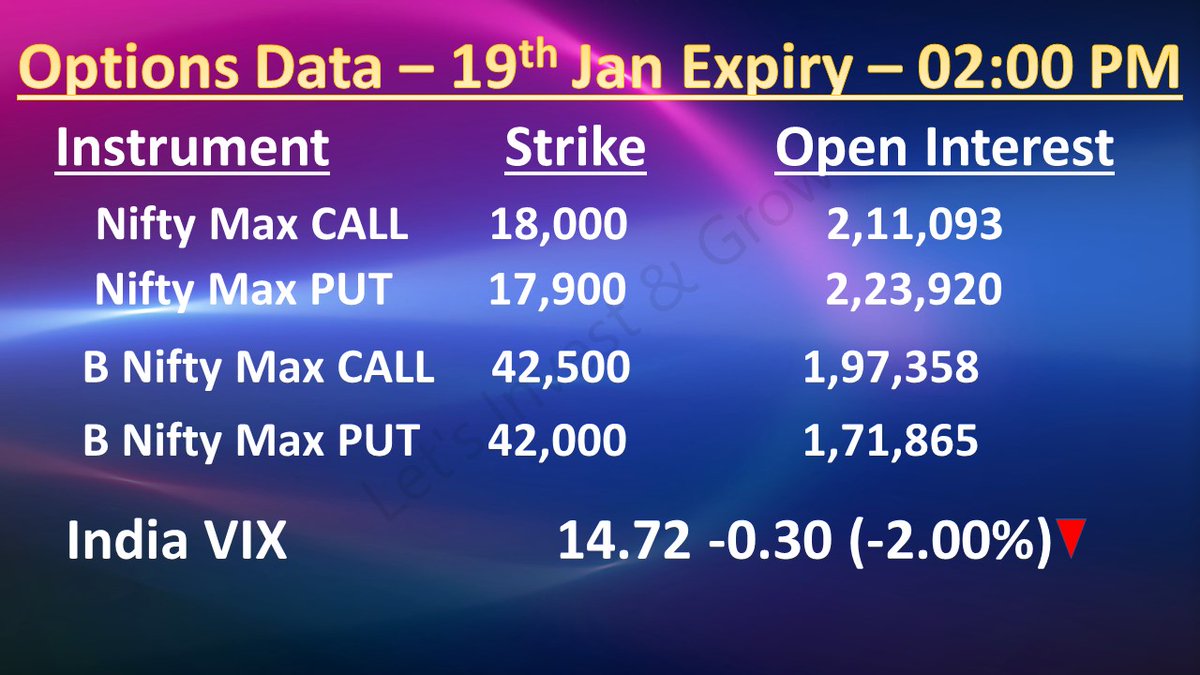

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 19th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 17th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 6th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 10:00 AM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 8th Feb 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

Did puts get trapped this morning (rising OI this AM) at the 24,685 support? Sharp reversal right off the level—solid defense ahead of RBI decision. #Nifty #OptionsData

Participant Wise OI data. Explains lack of volume - weak selling primarily driven by the Pro's. #Options #Optionsdata #Nifty #ICICIBank #IRFC #IRCON

Let’s look at options data Overall Open OI- 8 Cr calls vs 7 Cr puts - mildly bearish/ neutral. 21200 is working as interim support. Oi change - mildly bullish. 2.3 Cr puts vs 2.15 Cr calls. Overall the data is indicating a sideways market so far. #Nifty #Optionsdata

Something went wrong.

Something went wrong.

United States Trends

- 1. Black Friday 409K posts

- 2. Egg Bowl 6,177 posts

- 3. Mississippi State 3,513 posts

- 4. Emmett Johnson N/A

- 5. Sumrall 1,803 posts

- 6. Black Ops 7 Blueprint 2,283 posts

- 7. Black Ops 7 XP 3,538 posts

- 8. Stricklin 1,517 posts

- 9. #releafcannabis N/A

- 10. NextNRG Inc 1,803 posts

- 11. Kamario Taylor N/A

- 12. #Huskers N/A

- 13. Chambliss 1,414 posts

- 14. #SkylineSweeps N/A

- 15. #Illini N/A

- 16. #HMxCODSweepstakes N/A

- 17. Porsha N/A

- 18. Carson Soucy N/A

- 19. Fisch 1,320 posts

- 20. Stribling N/A