#optionsdata نتائج البحث

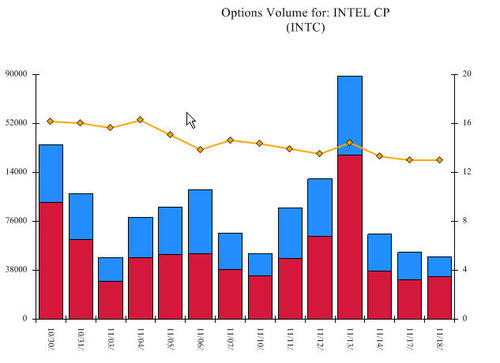

Navigate flat markets with a new AI trading strategy. See how past trades succeeded and learn about the Theta Data partnership for better options. Disclaimer: We are not financial advisors and this is not financial advice. #AItrading #optionsdata #ThetaData #tradingstrategy

ONLY OPTIONS TRADER CAN UNDERSTAND & FEEL THE SAME I feel exactly this same each time whenever I place my trades in options Thrill remains at the PEAK Analysis eyeing on TARGET Discipline keeps my SL intact #optionbuying #optiontrading #optionsdata #bullhearmindset

Option trading is not magic… It’s data + discipline + track record ✅ We focus on levels, logic & risk control not gambling 🎯 Call or whatsapp us... 9081363090 #OptionTrading #TrackRecord #OptionsData #BankNiftyOptions Disclaimer: sairamstocks.com/stock/condition

BotSpot unveils its latest features! Users can now import strategies and leverage options data through a new partnership with Theta Data. Disclaimer: We are not financial advisors, and this is not financial advice. #BotSpot #ThetaData #OptionsData #StrategyImport #TradingTools

SpiderRock’s Kasia Kobylarz shares a look into the evolution of SpiderRock Data & Analytics, how we built a high-quality options data business, and where we are headed in 2025. #SpiderRock #OptionsData Read more: rb.gy/601nb4

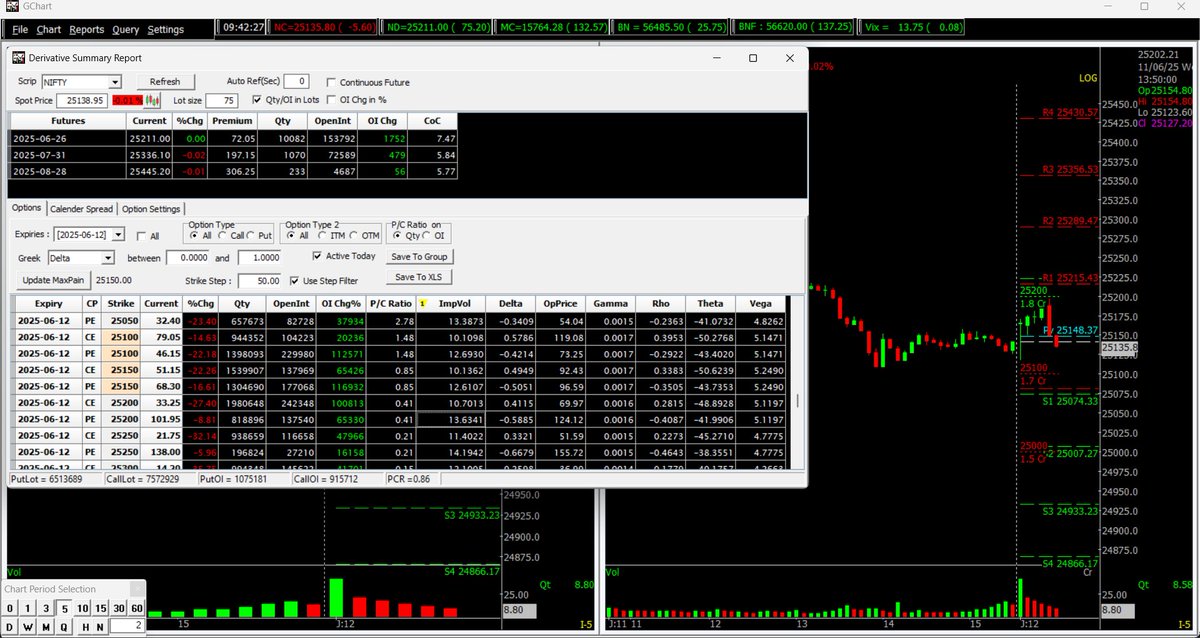

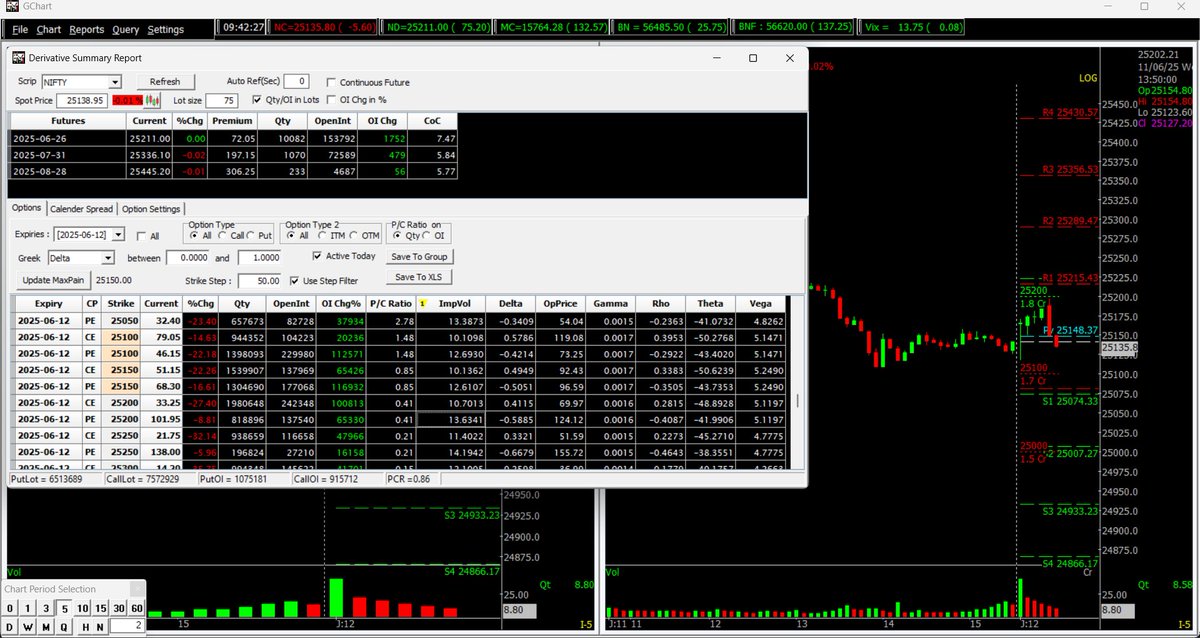

NIFTY📉 Spot 25138.95 🔻25000 PE OI +39.6K 🔻25100 PE OI +11.6K 💡Support: 25000 (1.5Cr OI) 📌Resistance: 25200 (1.8Cr OI) PCR: 0.86 Max Pain: 25150 #NIFTY #OptionsData

$AMZN If you would have taken $131p odte at the put volume spike near HOD at 10:44 they ran from $0.64 to $1.20 #OptionsFlow #OptionsData #OptionsTrading #OptionsTools Tool: quantdata.us/?referredBy=co…

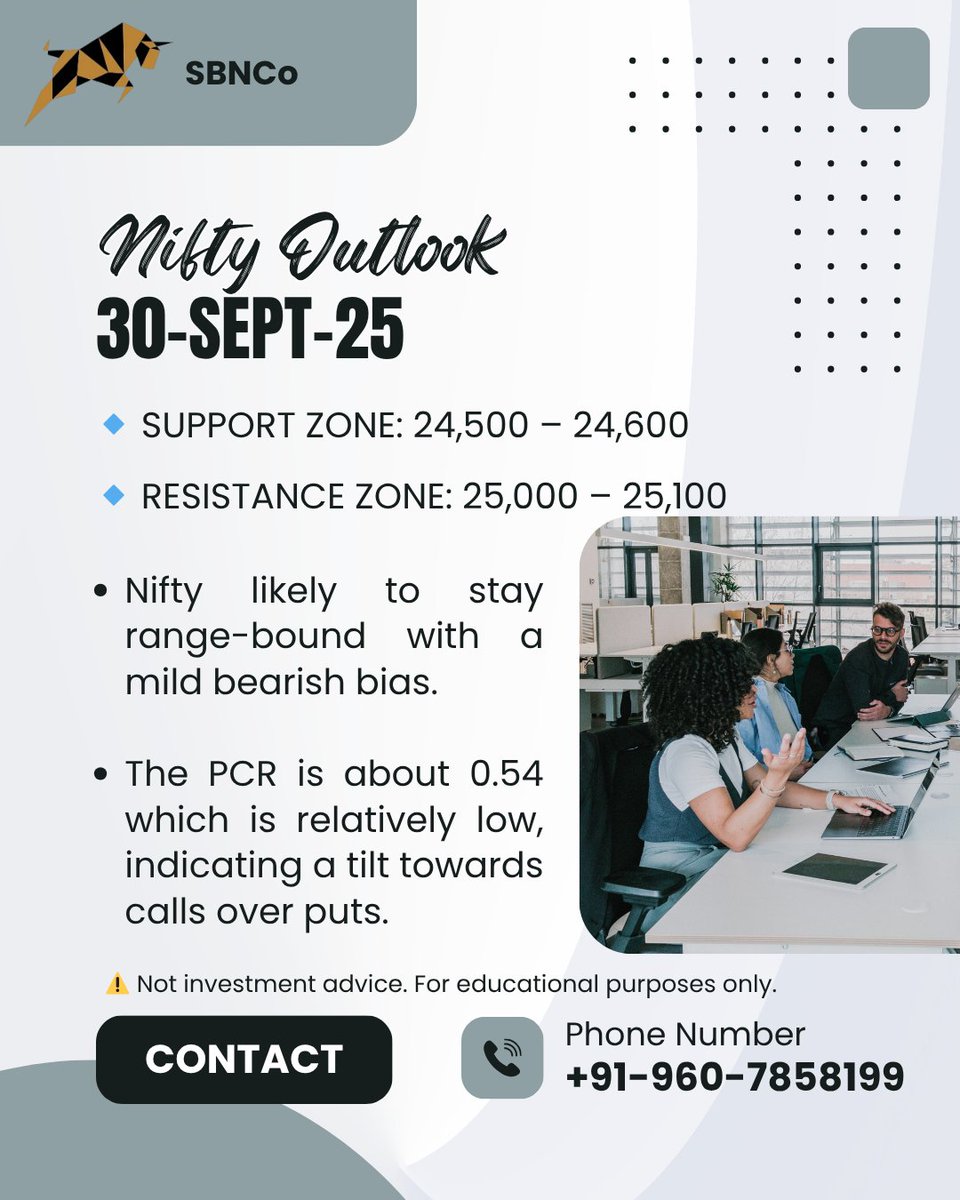

Nifty 30-Sept-25 Outlook #Nifty #StockMarketIndia #OptionsData #TechnicalAnalysis #TradingSetup #NSE #MarketOutlook #IntradayTrading

#Nifty #BankNifty #OptionsData #Stocks #StockMarket Quant data indicates strength and more upside, after many days. 19340 can be seen in next few sessions.

NIFTY & BANK NIFTY OI Data (9th Mar Exp) as on 8th Mar 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

"#OptionsData suggests bullish call option writer & bearish put option writer, but more analysis needed to determine strength #OptionsTrading". Please follow @hackveda #ITC #BreakoutStocks #StocksToBuy #stocksinfocus #stockstowatch

#BankNifty Hourly charts update, loss of momentum can be seen in price action too, quants data indicates consolidation and loss of up ward momentum. #BankNiftyOptions #OptionsData #StocksToBuy

#optionsdata suggests equal fight between #bulls and #bears. #PCR at 19500 strike is almost 1 suggests fight is equal. #PCR at 19450 is in favour of bulls so its a support for now. So the range for now is 19450 to 19500

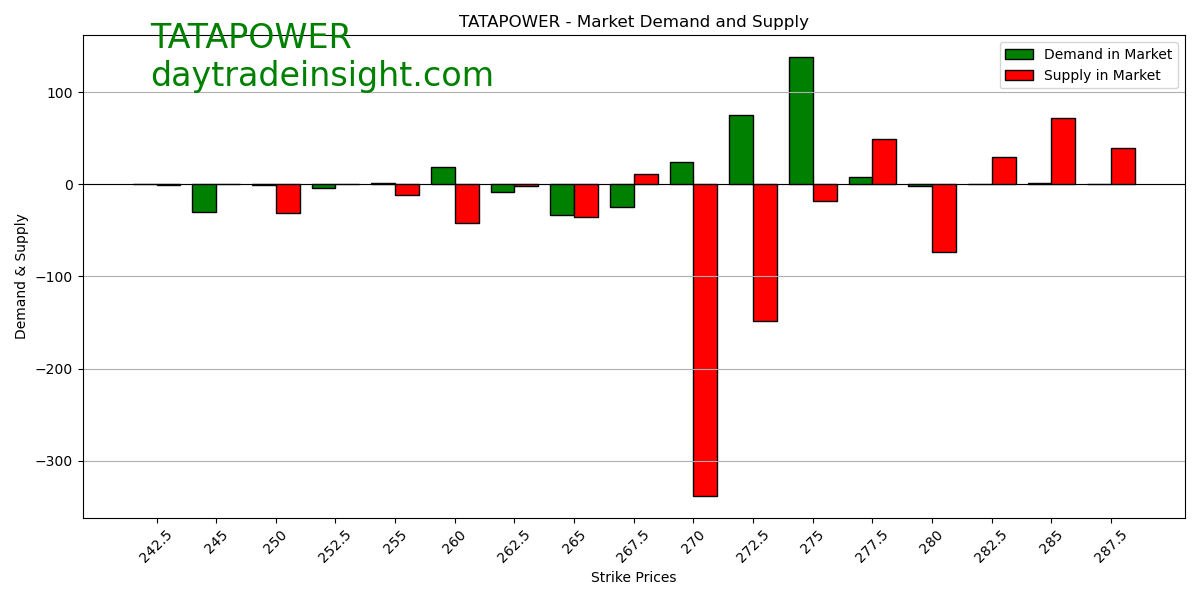

"#OptionsData reveals call option writers are more bullish on stock price target, seen in higher open interest, percentage change, and volume. #Bull. Please follow @hackveda #TATAPOWER #BreakoutStocks #StocksToBuy #stocksinfocus #stockstowatch

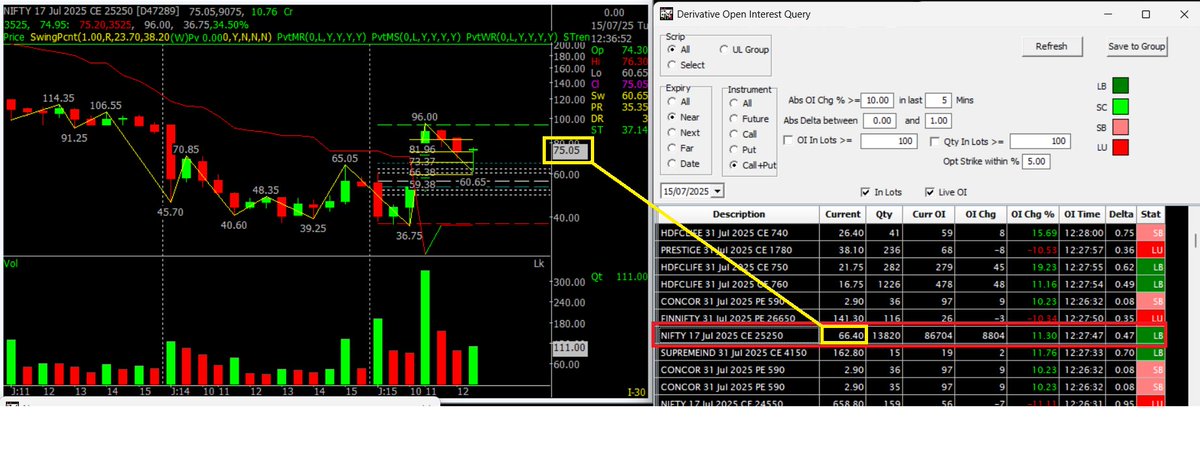

Tracking NIFTY 17 Jul 2025 CE 25250 — Price: 67 | OI: +11.3% | Delta: 0.47 Clear long build-up with rising volume. Watching resistances: 73 / 81 / 96. Data + Price Action = 🔑 for momentum trading! #Nifty #OptionsData #MomentumTrading #optionbuying @SpiderSoftIn @Mayank0620

Identify top market participants involved in options on any stock or ETF with our 13F data, compiled daily from the SEC. Offers enhanced data, percent of open interest by the filer and quarterly changes in positions. Now on Cboe DataShop. #DataAndAccess #OptionsData 🔗:…

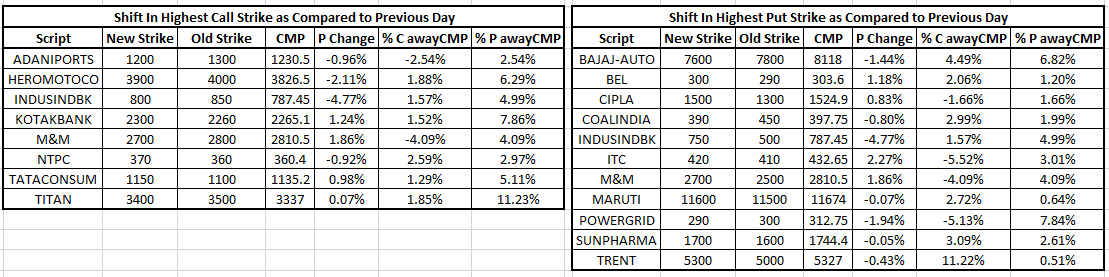

Shift in Highest Strike_ Call & Put Strike(Nifty 50 Stocks) "From Resistance to Support: A Comprehensive Analysis of Strike Changes Utilising Price Action" #Nifty50 #OptionsData #PriceAction #StrikeShift #MarketSentiment #EducationalContent

#Nifty50 #OptionsData #OpenInterest #WeeklyExpiry #OIAnalysis #VIXAnalysis #NiftySetup #DerivativesTrading #ScalpingLevels #GammaExposure #SmartMoneyMoves #MarketFlow #IntradayTrading #TradingStrategy #MetaverseTradingAcademy

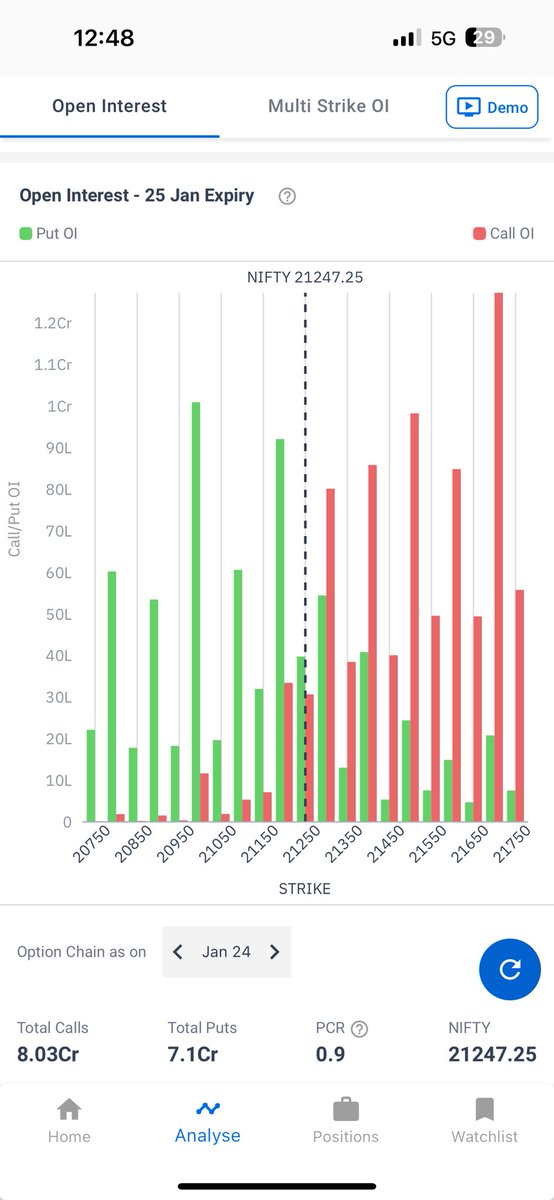

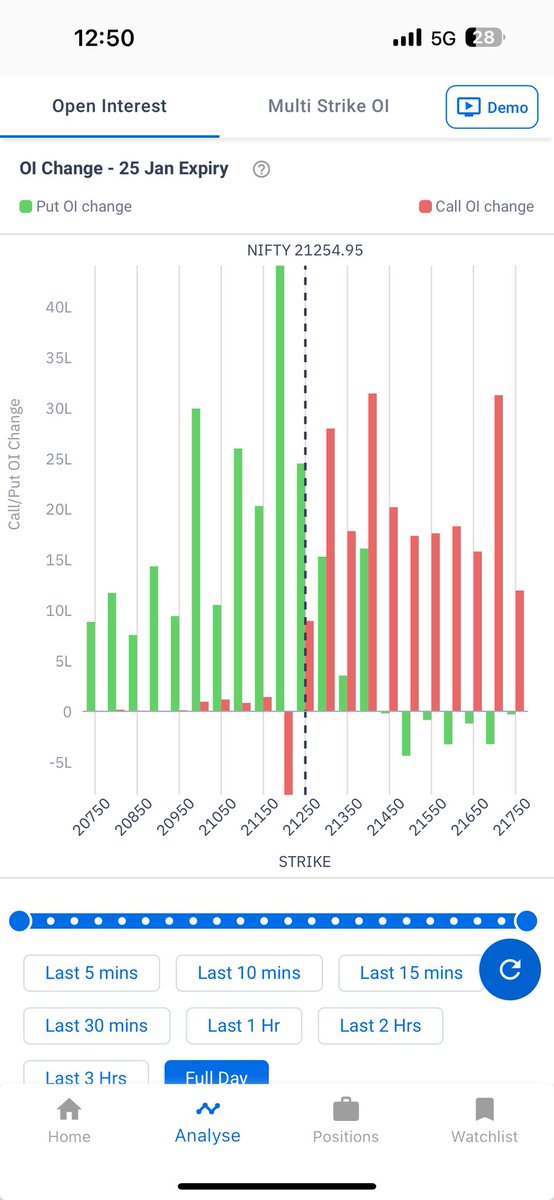

#Nifty Let's look at #Optionsdata Change in OI - 2.39 Cr puts vs 1.6 Cr calls, indicating bullishness Overall Open Interest - 6.85 Cr puts vs 6.64 Cr calls - neutral However 21300 has Max put writing indicating stronger support. Summary - don't short the market 😉

NIFTY📉 Spot 25138.95 🔻25000 PE OI +39.6K 🔻25100 PE OI +11.6K 💡Support: 25000 (1.5Cr OI) 📌Resistance: 25200 (1.8Cr OI) PCR: 0.86 Max Pain: 25150 #NIFTY #OptionsData

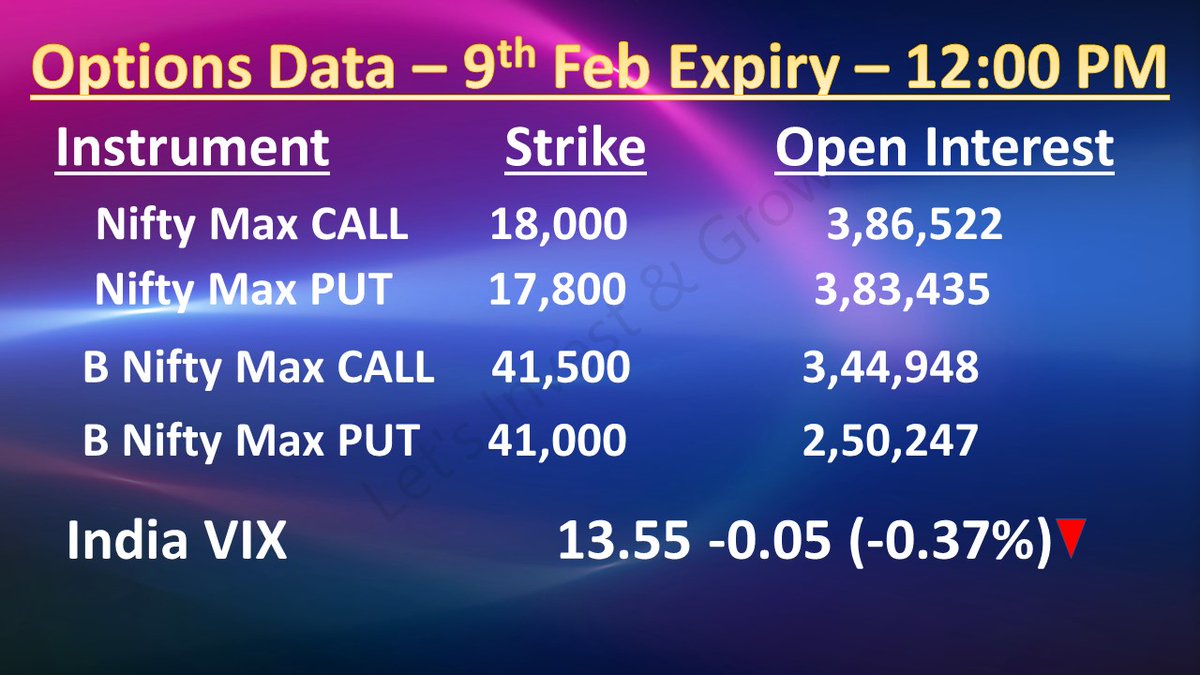

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 9th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

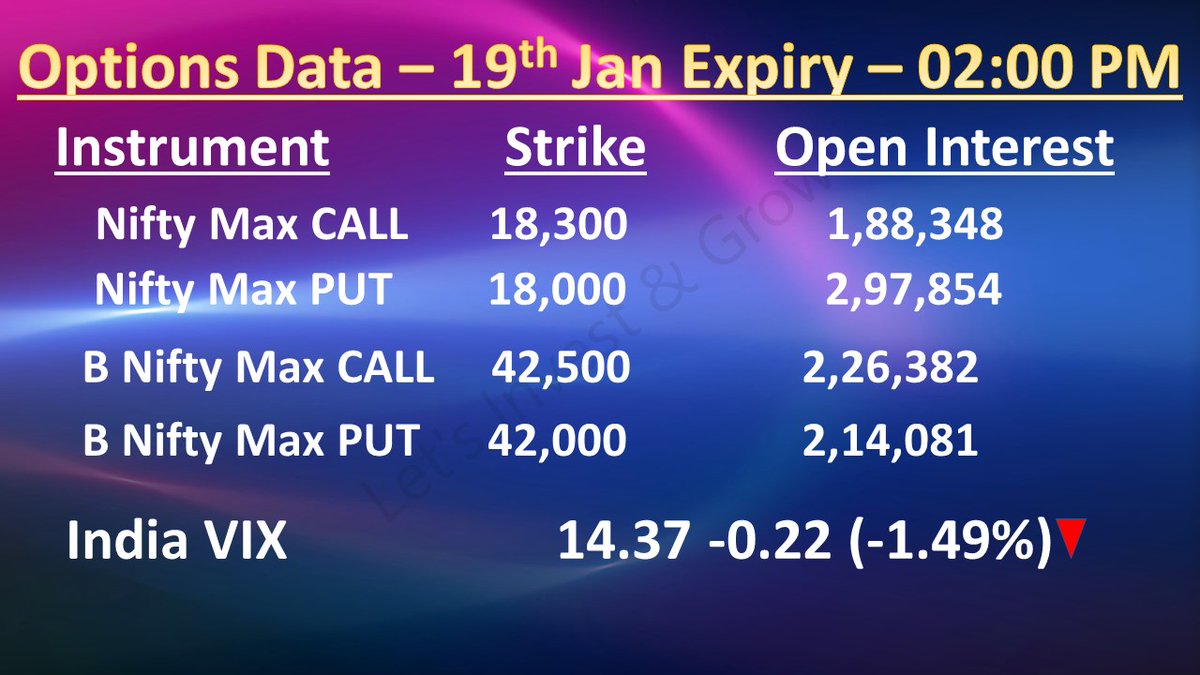

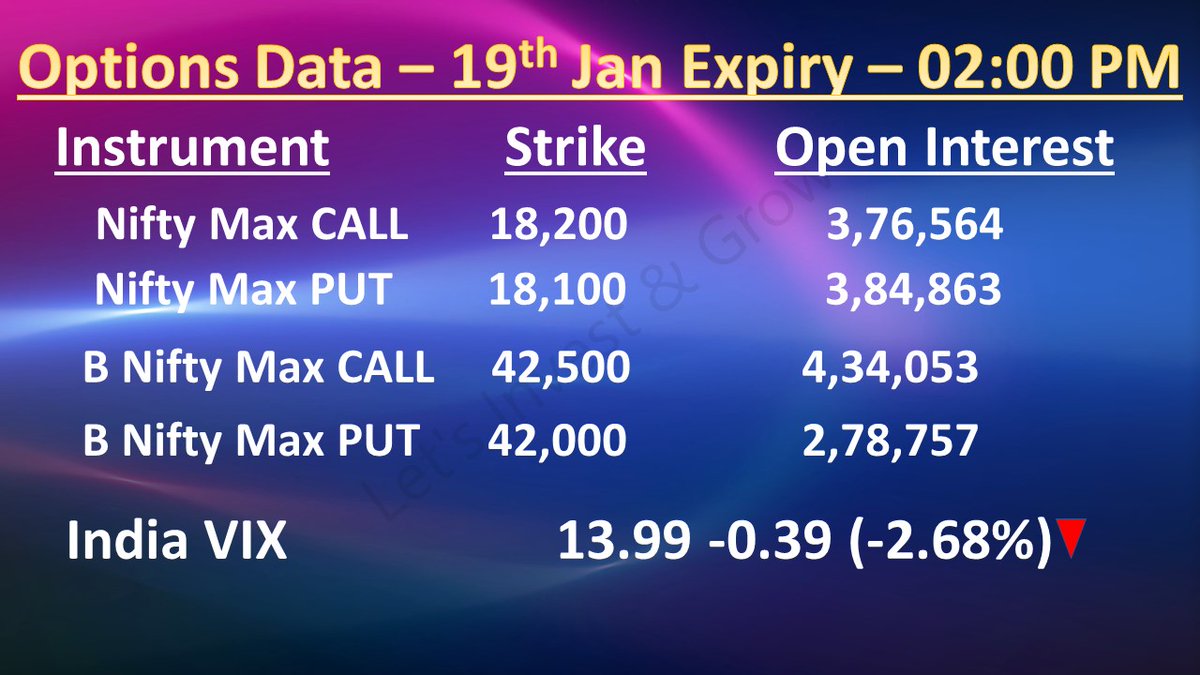

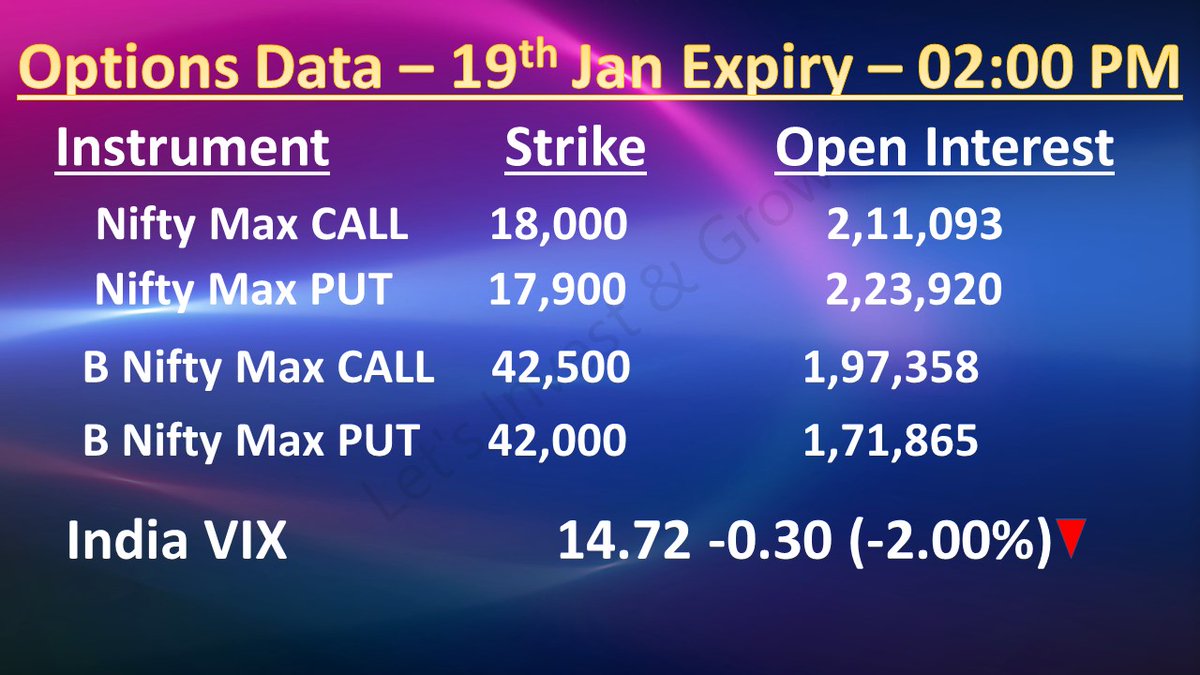

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 18th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Mar Exp) as on 8th Mar 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

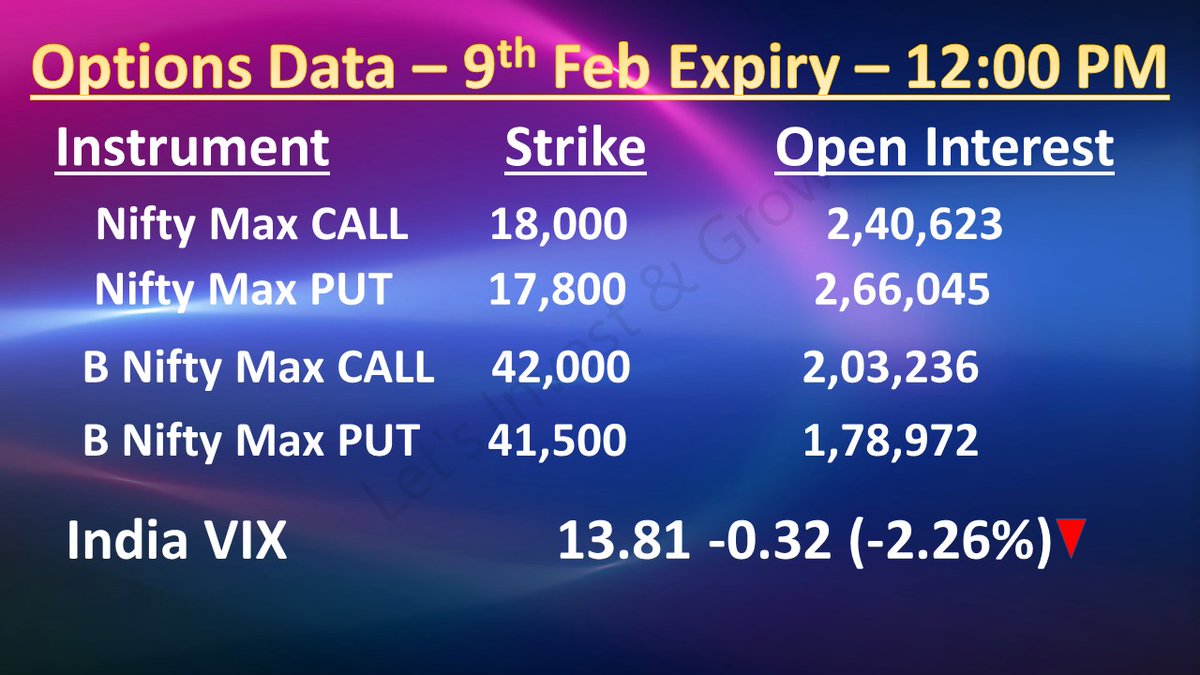

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 8th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 19th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (19th Jan Exp) as on 17th Jan 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 6th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 10:00 AM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 12:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 7th Feb 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

NIFTY & BANK NIFTY OI Data (9th Feb Exp) as on 8th Feb 23 02:00 PM #optionsdata #oidata #nifty50 #banknifty #bankniftyoptions #niftyoptions

Did puts get trapped this morning (rising OI this AM) at the 24,685 support? Sharp reversal right off the level—solid defense ahead of RBI decision. #Nifty #OptionsData

Let’s look at options data Overall Open OI- 8 Cr calls vs 7 Cr puts - mildly bearish/ neutral. 21200 is working as interim support. Oi change - mildly bullish. 2.3 Cr puts vs 2.15 Cr calls. Overall the data is indicating a sideways market so far. #Nifty #Optionsdata

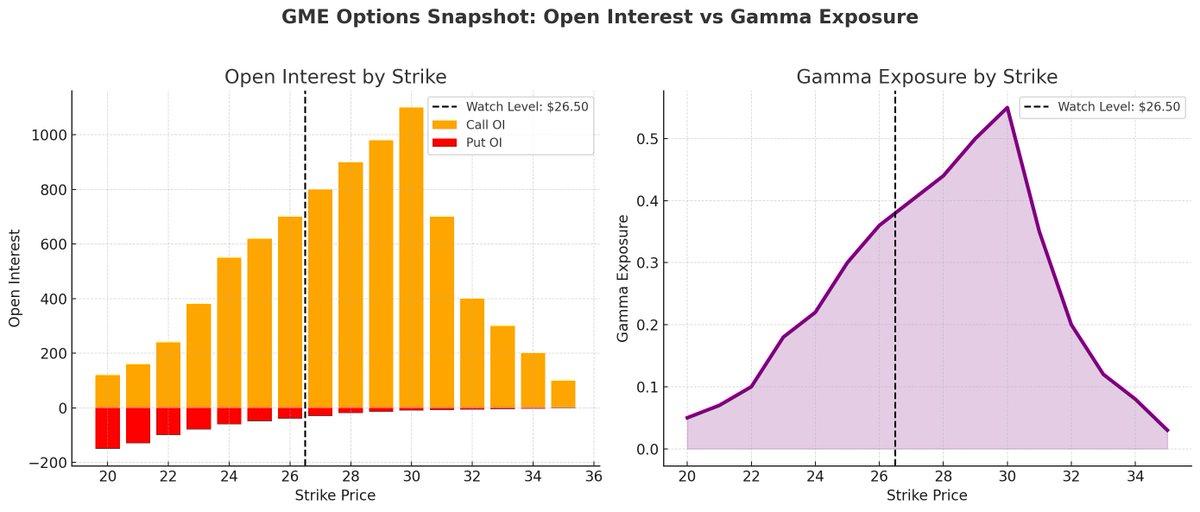

👐🏻 👀👀👀👐🏻 $GME pre-earnings structure (all real flow): ✅ Calls: $25–$28 = loaded ✅ PUTs: Deep OTM sold into 2027 ✅ Gamma: Dealers short > $26 ✅ IV: Expanding on upside only This is how squeezes start What do you think is behind the curtain? 👇 #GME #OptionsData…

Something went wrong.

Something went wrong.

United States Trends

- 1. Black Friday 439K posts

- 2. Nebraska 8,691 posts

- 3. Iowa 10.9K posts

- 4. Jalon Daniels N/A

- 5. Black Ops 7 Blueprint 6,791 posts

- 6. Egg Bowl 6,900 posts

- 7. Sumrall 2,513 posts

- 8. Go Birds 10.1K posts

- 9. #Huskers N/A

- 10. Mississippi State 4,249 posts

- 11. Black Ops 7 XP 5,680 posts

- 12. Stribling N/A

- 13. Matt Rhule N/A

- 14. #kufball N/A

- 15. Kiffin 9,974 posts

- 16. #Illini N/A

- 17. Kansas 16K posts

- 18. Emmett Johnson N/A

- 19. Chambliss 1,594 posts

- 20. Scott Stricklin 1,351 posts